Form 117

What is the Form 117

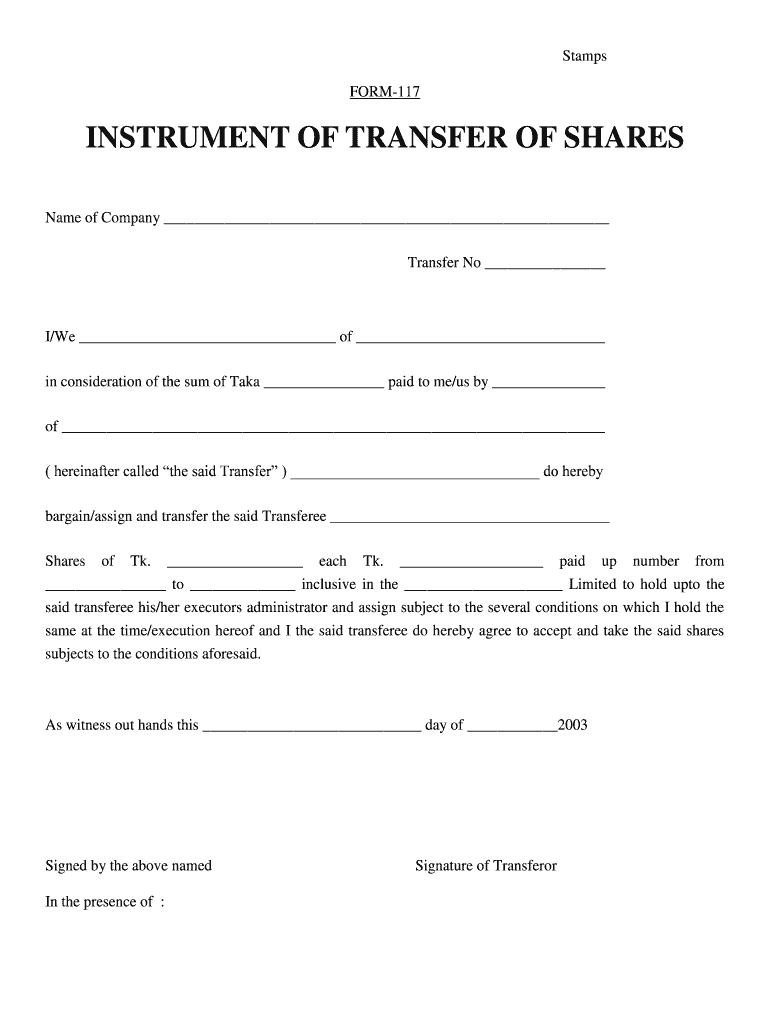

The Form 117, also known as the instrument of transfer sample, is a crucial document used in various legal and financial transactions. It serves as a formal declaration for transferring ownership of assets or property. This form is particularly significant in real estate transactions, where clear documentation of ownership transfer is essential for legal purposes. Understanding the nuances of Form 117 ensures that all parties involved in the transaction are protected and that the transfer complies with relevant laws.

How to use the Form 117

Using the Form 117 involves several key steps to ensure accuracy and compliance. Initially, the form should be obtained from an official source or authorized entity. Once acquired, it must be filled out with precise information regarding the parties involved, the asset being transferred, and any conditions related to the transfer. After completing the form, all relevant parties should review it for accuracy before signing. This careful approach helps prevent disputes and ensures that the transfer is recognized legally.

Steps to complete the Form 117

Completing the Form 117 requires attention to detail and adherence to specific guidelines. Follow these steps for a successful submission:

- Obtain the latest version of the Form 117 from a reliable source.

- Fill in the required fields, including the names and addresses of the transferor and transferee.

- Provide a detailed description of the asset being transferred, including any relevant identification numbers.

- Include any conditions or stipulations related to the transfer.

- Review the completed form for accuracy and completeness.

- Have all parties sign the form in the designated areas.

- Submit the form according to the specified submission methods.

Legal use of the Form 117

The legal use of the Form 117 is paramount for ensuring that the transfer of ownership is recognized by courts and other authorities. To be considered legally binding, the form must meet specific requirements, including proper signatures and compliance with state laws governing property transfers. Utilizing a trusted electronic signature solution can enhance the validity of the form, as it provides a secure method for signing and storing the document. Ensuring compliance with legal standards helps protect the interests of all parties involved.

Key elements of the Form 117

Understanding the key elements of the Form 117 is essential for its effective use. Important components include:

- Transferor Information: Details of the current owner of the asset.

- Transferee Information: Details of the individual or entity receiving the asset.

- Description of the Asset: A clear and concise description of what is being transferred.

- Conditions of Transfer: Any stipulations or requirements that must be met for the transfer to be valid.

- Signatures: Required signatures from all parties involved to validate the document.

How to obtain the Form 117

The Form 117 can be obtained through various channels. It is advisable to check with local government offices, such as the county clerk or recorder's office, which may provide the form. Additionally, legal professionals or real estate agents often have access to the most current version of the form. Online resources may also offer downloadable versions of the Form 117, ensuring that users can easily access and print the document as needed.

Quick guide on how to complete instrument of transfer sample

Complete instrument of transfer sample effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage form 117 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to edit and eSign instrument of transfer sample effortlessly

- Locate bc form 117 and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your selection. Edit and eSign form 117 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 117

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask bc form 117

-

What is form 117 and how can it be used with airSlate SignNow?

Form 117 is a legal document used for various business transactions. With airSlate SignNow, you can easily upload, edit, and eSign form 117 securely, ensuring that your documents are processed quickly and efficiently.

-

How does airSlate SignNow enhance the eSigning experience for form 117?

airSlate SignNow offers a streamlined interface that simplifies the eSigning process for form 117. Users can add signatures, initials, and other required fields seamlessly, allowing for a faster turnaround on essential documents.

-

What are the pricing options for using airSlate SignNow with form 117?

airSlate SignNow offers various pricing plans to fit different business needs regarding form 117. Plans range from basic options with essential features to advanced packages with extensive capabilities, ensuring affordability and scalability.

-

Can I integrate airSlate SignNow with other software to manage form 117?

Yes, airSlate SignNow integrates with numerous third-party applications, making it easy to manage form 117 alongside your existing workflows. Whether it’s CRM, project management, or document storage tools, integration is seamless.

-

What are the security features for handling form 117 in airSlate SignNow?

AirSlate SignNow prioritizes security, offering robust encryption and compliance measures for handling form 117. All documents are stored securely, ensuring that sensitive information remains protected throughout the signing process.

-

Is it possible to track the status of form 117 sent via airSlate SignNow?

Indeed, airSlate SignNow provides tracking features that allow you to monitor the status of form 117. You’ll receive real-time updates, ensuring you know when your document has been viewed and signed.

-

How can airSlate SignNow improve the speed of completing form 117?

By utilizing airSlate SignNow, businesses can signNowly reduce the time needed to complete form 117. Automated reminders and easy access to the signing interface mean you can finalize your documents much faster than traditional methods.

Get more for form 117

- Withdrawal notice of an assumed name form

- Medical necessity review form required form

- Ac 120 42c extended operations etops and polar operations faa form

- Form 8404 2016

- Ssa 1199 gr op1 application for payment of united states social security secure ssa form

- Falmouth citizens academy application falmouthmass form

- Form 541 2016

- The apple store invoice oocities form

Find out other instrument of transfer sample

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors