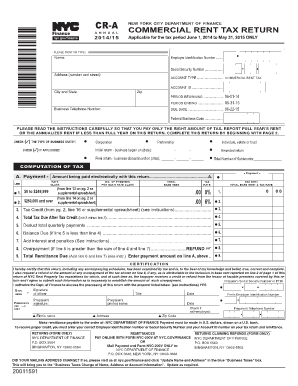

Applicable for the Tax Period June 1, to May 31, ONLY Form

What is the Applicable For The Tax Period June 1, To May 31, ONLY

The form applicable for the tax period June 1 to May 31 is a crucial document for individuals and businesses in the United States. It serves to report income, deductions, and credits relevant to that specific tax period. This form is particularly significant for those who may have unique income streams or deductions that apply only during this timeframe. Understanding its purpose is essential for accurate tax reporting and compliance with IRS regulations.

Steps to complete the Applicable For The Tax Period June 1, To May 31, ONLY

Completing the applicable for the tax period June 1 to May 31 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all sections are completed according to the instructions provided. After completing the form, review it for any errors or omissions. Finally, submit the form by the appropriate deadline to avoid penalties.

Legal use of the Applicable For The Tax Period June 1, To May 31, ONLY

The legal use of the applicable for the tax period June 1 to May 31 hinges on compliance with IRS guidelines and regulations. This form must be filled out accurately to reflect true income and allowable deductions. Failure to do so can result in penalties or audits. Utilizing a reliable eSignature platform can enhance the legal standing of the form by ensuring that all signatures are valid and compliant with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the applicable for the tax period June 1 to May 31 are critical for compliance. Typically, the form must be submitted by a specific date following the end of the tax period, often in June. It is essential to stay informed about these deadlines to avoid late filing penalties. Keeping a calendar with important dates can help ensure timely submission.

Required Documents

To complete the applicable for the tax period June 1 to May 31, several documents are required. These may include W-2 forms, 1099 forms for freelance income, receipts for deductible expenses, and any other relevant financial statements. Having these documents organized and readily available will streamline the completion process and improve accuracy.

Examples of using the Applicable For The Tax Period June 1, To May 31, ONLY

Examples of using the applicable for the tax period June 1 to May 31 can vary based on individual circumstances. For instance, a self-employed individual may report income from contracts completed during this period, while a business may claim deductions for operational expenses incurred. Each example highlights the importance of accurately reflecting financial activities relevant to this specific timeframe.

IRS Guidelines

IRS guidelines provide essential information regarding the completion and submission of the applicable for the tax period June 1 to May 31. These guidelines outline the necessary steps for filling out the form, the types of income and deductions that can be reported, and the legal implications of misreporting. Familiarizing oneself with these guidelines is crucial for compliance and to avoid potential issues with the IRS.

Quick guide on how to complete applicable for the tax period june 1 to may 31 only

Complete Applicable For The Tax Period June 1, To May 31, ONLY effortlessly on any device

Online document management has gained traction with companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Applicable For The Tax Period June 1, To May 31, ONLY on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to edit and eSign Applicable For The Tax Period June 1, To May 31, ONLY without any hassle

- Obtain Applicable For The Tax Period June 1, To May 31, ONLY and then click Get Form to initiate.

- Utilize the tools available to finalize your document.

- Select important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Applicable For The Tax Period June 1, To May 31, ONLY to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the applicable for the tax period june 1 to may 31 only

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the 'Applicable For The Tax Period June 1, To May 31, ONLY' feature in airSlate SignNow?

The 'Applicable For The Tax Period June 1, To May 31, ONLY' feature ensures that all documents signed within this timeframe meet specific compliance requirements. Businesses can easily manage their legal and tax documentation while using airSlate SignNow, enhancing accuracy and legal validity for that period.

-

How does airSlate SignNow handle documents related to the 'Applicable For The Tax Period June 1, To May 31, ONLY'?

airSlate SignNow provides a streamlined process to electronically sign and store documents applicable for the tax period June 1, To May 31, ONLY. This ensures all records are easily accessible and organized, allowing businesses to maintain compliance and enhance efficiency.

-

What pricing plans does airSlate SignNow offer for the 'Applicable For The Tax Period June 1, To May 31, ONLY' services?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes, ensuring that the services applicable for the tax period June 1, To May 31, ONLY are accessible at a competitive rate. Visit our website for detailed pricing options to find the best fit for your needs.

-

Can I integrate airSlate SignNow with other software for documents 'Applicable For The Tax Period June 1, To May 31, ONLY'?

Yes, airSlate SignNow offers various integrations with popular platforms to enhance your document workflow for those applicable for the tax period June 1, To May 31, ONLY. These integrations ensure seamless data transfer and process automation, improving overall efficiency.

-

What benefits does airSlate SignNow provide for documents that are 'Applicable For The Tax Period June 1, To May 31, ONLY'?

Using airSlate SignNow for documents 'Applicable For The Tax Period June 1, To May 31, ONLY' provides benefits such as time savings, legal compliance, and enhanced security. You can trust that your documents are managed properly while reducing administrative burdens.

-

How secure are the documents signed using airSlate SignNow, especially those 'Applicable For The Tax Period June 1, To May 31, ONLY'?

airSlate SignNow employs industry-leading security measures to ensure the safety of your documents, including those applicable for the tax period June 1, To May 31, ONLY. Our platform features end-to-end encryption, secure storage, and compliance with international regulations.

-

Is there customer support available for queries related to documents 'Applicable For The Tax Period June 1, To May 31, ONLY'?

Yes, airSlate SignNow provides dedicated customer support to assist with any questions or concerns regarding documents applicable for the tax period June 1, To May 31, ONLY. Our support team is available via various channels to ensure you have the assistance you need when you need it.

Get more for Applicable For The Tax Period June 1, To May 31, ONLY

Find out other Applicable For The Tax Period June 1, To May 31, ONLY

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors