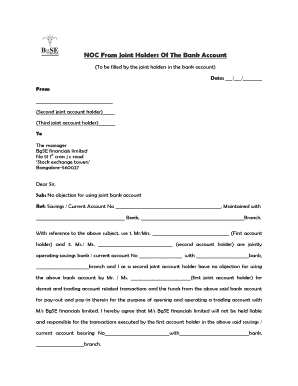

NOC from Joint Holders of the Bank Account Form

What is the NOC From Joint Holders Of The Bank Account

The No Objection Certificate (NOC) from joint holders of a bank account is a formal document that signifies the consent of all account holders regarding a specific action, such as transferring funds or changing account types. This certificate is essential when one or more joint account holders wish to proceed with a transaction that requires the approval of all parties involved. The NOC serves to protect the interests of all account holders and ensures that no party can claim ignorance of the transaction.

How to Obtain the NOC From Joint Holders Of The Bank Account

To obtain the NOC from joint holders of a bank account, all account holders must agree to the terms laid out in the document. The process typically involves the following steps:

- Gather all necessary information, including account details and the purpose of the NOC.

- Draft the NOC, ensuring it includes the names of all joint holders, the account number, and the specific request.

- Have all joint holders sign the document to validate their consent.

- Submit the signed NOC to the bank, along with any required identification or supporting documents.

Steps to Complete the NOC From Joint Holders Of The Bank Account

Completing the NOC from joint holders involves several key steps to ensure its validity and acceptance by the bank:

- Identify the purpose of the NOC, such as a transfer request or account modification.

- Draft the NOC, including all relevant details such as account information and the names of all joint holders.

- Ensure that each joint account holder reviews the document for accuracy.

- Collect signatures from all joint holders, confirming their agreement.

- Submit the completed NOC to the bank, keeping a copy for personal records.

Key Elements of the NOC From Joint Holders Of The Bank Account

When drafting the NOC, certain key elements must be included to ensure its effectiveness:

- Account Information: Clearly state the account number and type.

- Joint Holders' Names: List the names of all account holders involved.

- Purpose of the NOC: Specify the reason for the request, such as a transfer or closure.

- Signatures: Include the signatures of all joint holders to validate the document.

- Date: Indicate the date when the NOC is being issued.

Legal Use of the NOC From Joint Holders Of The Bank Account

The NOC from joint holders is legally binding, provided it meets specific criteria. It must be signed by all parties involved and clearly outline the consent for the requested action. This document can be used in various scenarios, such as transferring funds to another account or changing the account type from a single to a joint account. Banks typically require this document to protect against disputes that may arise from unilateral decisions made by one account holder.

Examples of Using the NOC From Joint Holders Of The Bank Account

The NOC can be utilized in several situations involving joint bank accounts:

- When one joint holder wishes to transfer funds to a different bank account.

- If the account type needs to be changed, such as converting a single account to a joint account.

- In cases where a joint account is being closed and all holders must agree.

Quick guide on how to complete noc from joint holders of the bank account

Manage NOC From Joint Holders Of The Bank Account effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing for easy access to the correct form and secure online storage. airSlate SignNow provides all the necessary tools to create, alter, and electronically sign your files swiftly without delays. Manage NOC From Joint Holders Of The Bank Account on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign NOC From Joint Holders Of The Bank Account with ease

- Find NOC From Joint Holders Of The Bank Account and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or redact sensitive details using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, inviting link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign NOC From Joint Holders Of The Bank Account and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the noc from joint holders of the bank account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for noc from bank?

The application for noc from bank is a formal request that customers submit to their financial institution to obtain a No Objection Certificate (NOC). This document verifies that the customer has settled all dues and that the bank has no objection to any further financial activities related to the account.

-

How can airSlate SignNow help with the application for noc from bank?

airSlate SignNow streamlines the process of submitting your application for noc from bank by allowing you to create, sign, and manage documents electronically. This not only saves time but also ensures that your application is sent securely and efficiently, reducing the likelihood of errors.

-

What features does airSlate SignNow offer for the application for noc from bank?

airSlate SignNow offers features such as customizable templates, legally binding eSignatures, and document tracking, all of which can enhance the application for noc from bank process. Additionally, users can automate reminders and notifications, ensuring timely submissions and follow-ups.

-

Is there a cost to using airSlate SignNow for the application for noc from bank?

Yes, there is a pricing structure for using airSlate SignNow, which is competitively priced to ensure it's cost-effective. Various plans are available to fit different business needs, and each plan offers features that can enhance your application for noc from bank experience.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for your application for noc from bank comes with numerous benefits, including increased efficiency, reduced paper usage, and enhanced compliance. The platform simplifies document workflows and provides a secure environment for managing sensitive information.

-

Can I integrate airSlate SignNow with other tools for the application for noc from bank?

Absolutely! airSlate SignNow offers integration capabilities with a wide range of tools, including CRM systems and cloud storage services. This means you can streamline your application for noc from bank by connecting with your existing business applications for seamless data flow.

-

How secure is the application for noc from bank process with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and security protocols to protect your application for noc from bank and other sensitive documents. This ensures that your data remains confidential and secure throughout the entire process.

Get more for NOC From Joint Holders Of The Bank Account

- Subcontractor warranty form

- Public works letterhead form dekalb county department of

- Lov fryer start up form frymaster

- York technical college transcript form

- Device tracking form allergan

- Degree form muhs

- How to fill up visa application form in algeria

- Final settlement agreement gloveralbrecht class action form

Find out other NOC From Joint Holders Of The Bank Account

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT