Nevada Tire Tax Form

What is the Nevada Tire Tax Form

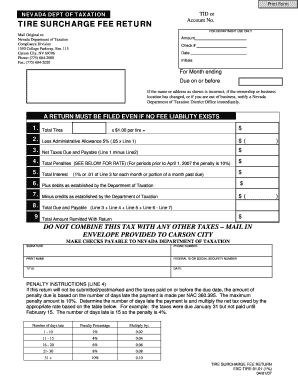

The Nevada tire tax form is a specific document used for reporting and remitting the tire tax imposed by the state of Nevada. This tax applies to the sale of new tires and is intended to fund waste tire management programs. Businesses that sell tires must complete this form to comply with state regulations and ensure that they are contributing to the proper disposal and recycling of used tires. Understanding the purpose and requirements of this form is crucial for businesses operating within the state.

How to use the Nevada Tire Tax Form

Using the Nevada tire tax form involves several steps to ensure accurate completion and compliance with state regulations. First, businesses must gather relevant sales data, including the number of tires sold and the applicable tax rate. Next, the form requires detailed information about the seller, including business name, address, and tax identification number. Once the form is filled out, it must be submitted along with the calculated tax payment to the appropriate state agency. Utilizing electronic signature tools can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the Nevada Tire Tax Form

Completing the Nevada tire tax form involves a systematic approach:

- Gather necessary sales data, including the total number of new tires sold during the reporting period.

- Calculate the total tire tax owed based on the current tax rate, which is typically set by the state.

- Fill out the form with accurate business information and sales figures.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, along with the payment for the tax owed.

Legal use of the Nevada Tire Tax Form

The legal use of the Nevada tire tax form is essential for compliance with state tax laws. This form serves as an official record of tire sales and tax payments, which can be audited by state authorities. Businesses must ensure that the form is completed accurately and submitted on time to avoid penalties. Utilizing a platform that provides eSignature capabilities can enhance the legal standing of the submitted form, as it ensures that all signatures are verifiable and compliant with electronic signature laws.

Required Documents

To successfully complete the Nevada tire tax form, certain documents are required:

- Sales records detailing the number of tires sold.

- Tax identification number for the business.

- Previous tax filings, if applicable, to ensure continuity and accuracy.

- Payment information for remitting the tax owed.

Form Submission Methods

The Nevada tire tax form can be submitted through various methods, offering flexibility to businesses:

- Online submission via the state’s tax portal, which may include eSignature options for ease of use.

- Mailing a physical copy of the completed form along with payment to the designated state agency.

- In-person submission at local tax offices, if preferred.

Quick guide on how to complete nevada tire tax form 159451

Complete Nevada Tire Tax Form seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Nevada Tire Tax Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Nevada Tire Tax Form with ease

- Obtain Nevada Tire Tax Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or mislaid documents, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Nevada Tire Tax Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada tire tax form 159451

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nevada tire tax form?

The Nevada tire tax form is a mandatory document required for businesses involved in the sale of tires in the state of Nevada. It helps the state track the tire tax collected from consumers, ensuring compliance with state tax regulations. By using the Nevada tire tax form, businesses can efficiently manage their tax obligations.

-

How can I access the Nevada tire tax form using airSlate SignNow?

You can easily access the Nevada tire tax form by using airSlate SignNow’s document management features. Our platform allows you to upload, edit, and eSign the form digitally, making it convenient to complete your tax requirements. With our user-friendly interface, finding and filling out the Nevada tire tax form is seamless.

-

Are there any fees associated with using airSlate SignNow for the Nevada tire tax form?

Yes, airSlate SignNow offers several pricing plans that are budget-friendly, designed to meet various business needs, including processing the Nevada tire tax form. Depending on the plan you choose, you can access features tailored to simplify your document workflow, ensuring you get excellent value for your investment.

-

What are the benefits of using airSlate SignNow for eSigning the Nevada tire tax form?

Using airSlate SignNow to eSign the Nevada tire tax form offers numerous benefits, such as enhanced efficiency and speed in processing your documents. Our platform allows you to sign and send documents securely and instantly, reducing delays and improving your compliance efforts. Additionally, the eSigning feature eliminates the hassle of printing and mailing paper forms.

-

Can I integrate airSlate SignNow with other tools for managing the Nevada tire tax form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of productivity tools and platforms, which can enhance your ability to manage the Nevada tire tax form. This includes integration with accounting software and CRMs, allowing you to streamline your entire workflow and keep all your documents in sync.

-

Is airSlate SignNow secure for handling sensitive documents like the Nevada tire tax form?

Yes, airSlate SignNow prioritizes security and uses advanced encryption protocols to protect sensitive documents, including the Nevada tire tax form. Our platform complies with industry standards to ensure that your information remains confidential and secure throughout the eSigning process, giving you peace of mind.

-

How do I ensure compliance while filling out the Nevada tire tax form?

To ensure compliance when filling out the Nevada tire tax form, utilize airSlate SignNow’s built-in tools that help verify and validate your information. Additionally, our database offers guidance on the specific requirements needed for the form, which can aid you in avoiding common mistakes and ensure timely submission.

Get more for Nevada Tire Tax Form

- Employee statement cambridge security services form

- Olathe noon rotary scholarship bapplicationb form

- Energy management and control systems emcs design manual form

- Dhs 4315 dme mobility devices kepro mhcp form

- Owwa online application form

- Download annual verification certificate form

- Cidb green card renewal form

- Lagos state health service commission form

Find out other Nevada Tire Tax Form

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe