Irs Form 13973 2016-2026

What is the IRS Form 13973

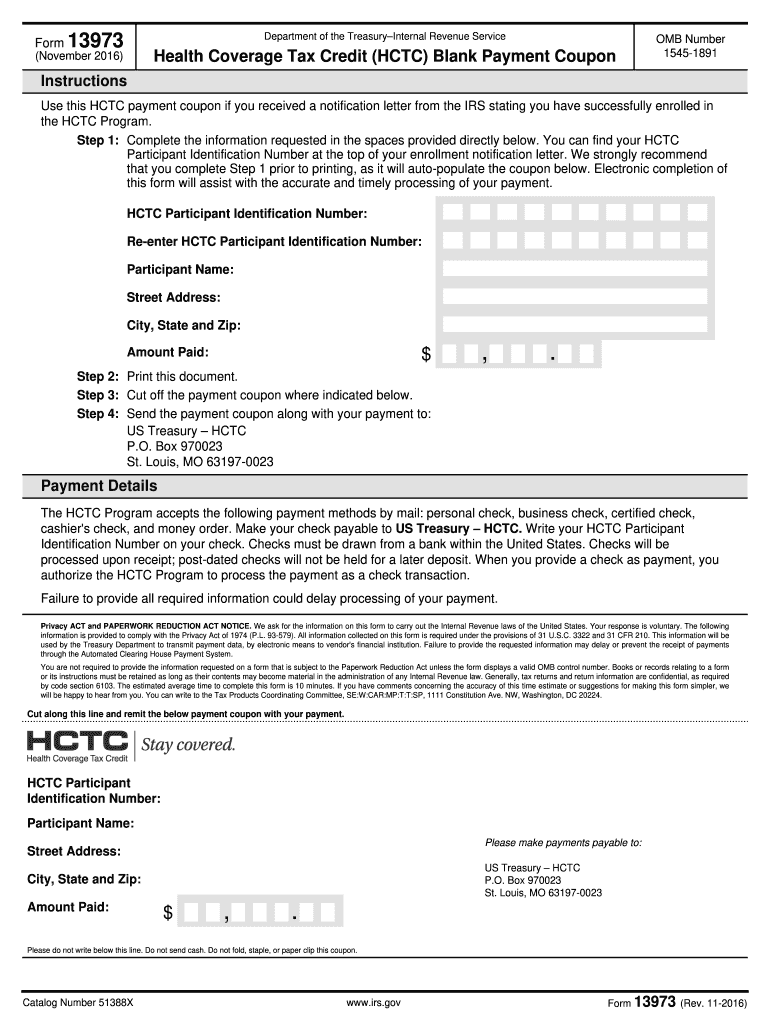

The IRS Form 13973 is a crucial document used for claiming the Health Coverage Tax Credit (HCTC). This form is specifically designed for individuals who are eligible for the HCTC, which helps to offset the cost of health insurance premiums. The form collects essential information about the taxpayer and their health coverage, ensuring that the IRS can accurately process the credit. It is important to use the most current version of this form to avoid any issues during the filing process.

How to Use the IRS Form 13973

Using the IRS Form 13973 involves several steps to ensure accurate completion. First, gather all necessary documentation, including proof of health insurance coverage and eligibility criteria. Next, fill out the form carefully, providing accurate personal information and details regarding your health coverage. Once completed, review the form for any errors before submission. This attention to detail helps prevent delays in processing your tax credit.

Steps to Complete the IRS Form 13973

Completing the IRS Form 13973 requires a systematic approach:

- Gather required documents, such as health insurance statements and proof of eligibility.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide details about your health coverage, including the type of plan and coverage period.

- Double-check all entries for accuracy and completeness.

- Submit the form according to the IRS guidelines, either online or by mail.

Eligibility Criteria for the IRS Form 13973

To qualify for the Health Coverage Tax Credit using the IRS Form 13973, certain eligibility criteria must be met. Generally, individuals must be receiving Trade Adjustment Assistance (TAA) or be eligible for Pension Benefit Guaranty Corporation (PBGC) benefits. Additionally, the health insurance plan must meet specific requirements set by the IRS. It is essential to verify your eligibility before filing to ensure compliance and maximize your potential tax benefits.

Filing Deadlines for the IRS Form 13973

Filing deadlines for the IRS Form 13973 are critical to ensure that you receive your tax credit on time. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 of each year. However, if you are filing for an extension, be sure to check specific IRS guidelines for any changes to deadlines. Timely submission helps avoid penalties and ensures that you can take advantage of the health coverage tax credit.

Form Submission Methods for the IRS Form 13973

The IRS Form 13973 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-filing system, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Choosing the right submission method can help streamline the process and ensure that your form is received promptly.

Quick guide on how to complete form 13973 health coverage tax credit blank payment coupon irs

Uncover the most efficient method to complete and endorse your Irs Form 13973

Are you still spending time creating your official paperwork on physical copies instead of handling it online? airSlate SignNow presents a superior approach to finalize and sign your Irs Form 13973 and associated forms for public services. Our advanced electronic signature service equips you with all the tools necessary to manage documents swiftly and in line with official standards - comprehensive PDF editing, organizing, securing, authorizing, and distributing capabilities at your fingertips through an intuitive interface.

Only a few steps are needed to fill in and sign your Irs Form 13973:

- Insert the editable template into the editor by clicking the Get Form button.

- Review the information you are required to supply in your Irs Form 13973.

- Move between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Mask fields that are no longer applicable.

- Select Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date alongside your signature and wrap up your task with the Done button.

Store your completed Irs Form 13973 in the Documents section of your profile, download it, or move it to your preferred cloud storage. Our platform also offers versatile form sharing options. There’s no need to print your templates when you need to submit them to the relevant public office - utilize email, fax, or request a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the form 13973 health coverage tax credit blank payment coupon irs

How to make an eSignature for the Form 13973 Health Coverage Tax Credit Blank Payment Coupon Irs in the online mode

How to make an eSignature for your Form 13973 Health Coverage Tax Credit Blank Payment Coupon Irs in Chrome

How to create an electronic signature for putting it on the Form 13973 Health Coverage Tax Credit Blank Payment Coupon Irs in Gmail

How to generate an eSignature for the Form 13973 Health Coverage Tax Credit Blank Payment Coupon Irs straight from your mobile device

How to generate an electronic signature for the Form 13973 Health Coverage Tax Credit Blank Payment Coupon Irs on iOS devices

How to make an eSignature for the Form 13973 Health Coverage Tax Credit Blank Payment Coupon Irs on Android

People also ask

-

What is a tax credit, and how does it work?

A tax credit is a dollar-for-dollar reduction in your tax liability, meaning it directly lowers the amount of tax you owe. Tax credits can reduce your overall tax bill and are often available for specific expenses, such as education or energy efficiency improvements. Understanding how tax credits work can help you utilize them effectively to maximize your savings.

-

How can airSlate SignNow help with tax credit documentation?

AirSlate SignNow streamlines the process of sending and eSigning documents, which can be crucial for submitting tax credit applications. By using our platform, you can quickly gather signatures and ensure all necessary paperwork is completed accurately. This can save you time and reduce errors in your documentation for tax credits.

-

What features does airSlate SignNow offer for managing tax credit documents?

AirSlate SignNow provides a range of features including document templates, in-app signing, and advanced tracking. These features make it easy to manage the documents necessary for claiming tax credits. With secure storage and sharing options, ensuring compliance and organization for your tax credit applications becomes simple.

-

Is airSlate SignNow cost-effective for businesses leveraging tax credits?

Yes, airSlate SignNow offers a cost-effective solution that enhances productivity while enabling businesses to efficiently manage tax credit-related documentation. With tiered pricing plans, you can choose the level of service that fits your needs without breaking the bank. The savings from optimizing your tax credit processes can far exceed the investment in our platform.

-

Can I integrate airSlate SignNow with other tools to improve tax credit management?

Absolutely! AirSlate SignNow integrates seamlessly with various applications like CRMs and document management systems. These integrations allow for a smooth workflow, making it easier to track and manage documents related to tax credits. This ensures that you have all necessary information at your fingertips, maximizing your tax credit claims.

-

What are the benefits of using airSlate SignNow for tax credit processing?

Using airSlate SignNow for tax credit processing ensures efficiency and accuracy in managing your documents. The electronic signature capabilities expedite the approval process, allowing you to claim tax credits faster. Additionally, our solution promotes compliance and security, giving you peace of mind as you handle sensitive tax-related materials.

-

How does airSlate SignNow ensure the security of my tax credit documents?

AirSlate SignNow prioritizes the security of all documents, including those related to tax credits, by employing top-tier encryption and secure cloud storage. This safeguards sensitive information against unauthorized access. Our compliance with industry standards ensures that your tax credit documentation is protected, allowing you to focus on what matters most.

Get more for Irs Form 13973

- Application form for hostel accommodation

- Download the personal training interest form ymca cba

- When is war justified lesson 2 answers form

- Big book awakening pdf form

- Wr form

- Application for civilian base access form

- Pdf roof inspection affidavit this form may be completed by an

- Congressman mario diaz balart service academy nomination form

Find out other Irs Form 13973

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online