Short Loan Application Form

What is the Short Loan Application

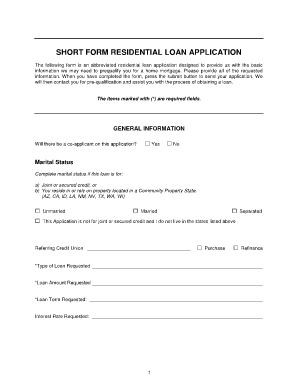

The short loan application is a streamlined form designed for individuals seeking quick access to funds. It typically requires basic personal and financial information, allowing lenders to assess eligibility rapidly. This form is essential for those who need short-term financial assistance, whether for unexpected expenses or urgent cash flow needs. By completing this application, borrowers can initiate the loan process efficiently, often receiving a response within a short timeframe.

Steps to complete the Short Loan Application

Completing the short loan application involves several straightforward steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Provide financial details, such as income sources and employment status.

- Specify the loan amount you wish to request and the intended purpose of the loan.

- Review the application for accuracy to ensure all required fields are filled out correctly.

- Submit the application electronically or via mail, depending on the lender's requirements.

Legal use of the Short Loan Application

The short loan application is legally binding when completed and signed according to specific regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that certain conditions are met. This means that an e-signed short loan application holds the same legal weight as a handwritten signature, as long as the signer intends to authenticate the document and the process complies with applicable laws.

Eligibility Criteria

Eligibility for a short loan application typically depends on several factors, including:

- Minimum age requirement, usually eighteen years or older.

- Proof of stable income, which may include pay stubs or bank statements.

- Valid identification, such as a driver's license or passport.

- Credit history, which some lenders may review to assess risk.

Required Documents

When applying for a short loan, borrowers should prepare the following documents:

- Identification proof (government-issued ID).

- Income verification (recent pay stubs or tax returns).

- Bank statements to demonstrate financial stability.

- Any additional documentation requested by the lender, such as proof of residence.

Application Process & Approval Time

The application process for a short loan is generally quick and efficient. After submitting the short loan application, borrowers can expect the following:

- Initial review by the lender, often completed within one business day.

- Notification of approval or denial, which may occur via email or phone call.

- If approved, funds are typically disbursed within a few days, depending on the lender's policies.

Quick guide on how to complete short loan application

Complete Short Loan Application effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can obtain the correct documents and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Short Loan Application on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Short Loan Application with ease

- Find Short Loan Application and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of your documents or obscure confidential information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious document searches, or mistakes that necessitate printing new versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Short Loan Application while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the short loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a short loan application?

A short loan application is a streamlined process that allows borrowers to quickly apply for a loan with minimal paperwork and requirements. This approach speeds up approvals and makes it easier to access funds when needed. The airSlate SignNow platform facilitates this process by enabling quick e-signatures, ensuring a seamless experience.

-

How does airSlate SignNow streamline the short loan application process?

airSlate SignNow simplifies the short loan application by allowing users to eSign documents electronically, reducing the need for physical signatures and paper trails. With its user-friendly interface, borrowers can complete their applications within minutes, signNowly cutting down processing time. This efficiency is crucial for borrowers in urgent financial situations.

-

What are the costs associated with using airSlate SignNow for a short loan application?

Using airSlate SignNow is a cost-effective solution for managing short loan applications. The pricing structure is designed to accommodate various business sizes and needs, offering plans that provide value without breaking the bank. Additionally, the time saved in processing applications can reduce operational costs for businesses.

-

Can I integrate airSlate SignNow with my existing loan management system?

Yes, airSlate SignNow offers robust integrations with various loan management systems to enhance the short loan application process. This compatibility allows you to seamlessly transfer data and documents, reducing manual entry and the potential for errors. Integrating these systems streamlines workflows and improves overall efficiency.

-

What features does airSlate SignNow offer for managing short loan applications?

airSlate SignNow provides key features tailored to short loan applications, including customizable templates, automated workflows, and secure document storage. These features help businesses manage the application process efficiently while maintaining compliance and security. Additionally, real-time tracking ensures you stay updated on the status of each application.

-

What benefits does airSlate SignNow offer for businesses handling short loan applications?

The primary benefit of using airSlate SignNow for short loan applications is increased efficiency. By automating tasks like eSigning and document routing, businesses can process applications faster and with fewer resources. This leads to enhanced customer satisfaction by providing quicker responses and funding options.

-

Is airSlate SignNow secure for handling sensitive short loan application information?

Absolutely! airSlate SignNow prioritizes security and compliance, using encryption and secure storage to protect sensitive short loan application information. The platform adheres to industry standards to ensure that both personal and financial data are kept confidential and protected from unauthorized access.

Get more for Short Loan Application

- Guam regional medical city form

- Interactive fillable conset letter canada form

- Notice of motion to enforce litigant rights nj form

- Bashinda micar bpqy 7 11 concurrent new format dps missouri

- Statutory notice of worthless check form

- Formulario 4807 oe 2008

- Dichiarazione garanzia e o alloggio form

- When to apply for nclex retake in saipan form

Find out other Short Loan Application

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document