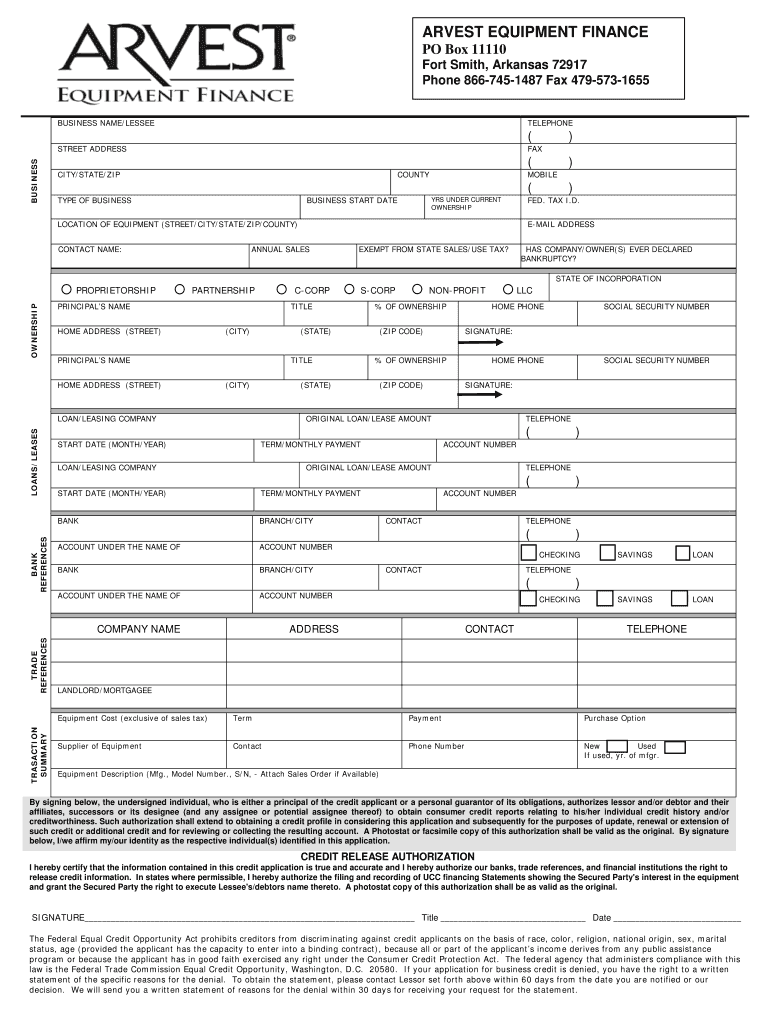

What is Arvest Bank Adverse Action Form

What is the adverse action form?

The adverse action form is a crucial document used by financial institutions, including banks, to notify individuals when a decision to deny credit, increase costs, or alter terms has been made based on information from a consumer report. This form is essential for compliance with the Fair Credit Reporting Act (FCRA), which mandates that consumers be informed of the reasons for adverse actions taken against them. The adverse action form typically includes details about the decision, the credit reporting agency that provided the information, and instructions on how the consumer can obtain a free copy of their report.

Key elements of the adverse action form

Understanding the key elements of the adverse action form helps ensure that it is filled out correctly. Important components include:

- Identification of the institution: The form should clearly state the name and contact information of the institution issuing the notice.

- Reason for the adverse action: A brief explanation of why the adverse action was taken, which may include factors such as credit history or income level.

- Consumer report details: Information about the credit reporting agency that provided the report, including how to contact them.

- Consumer rights: A statement informing the consumer of their rights under the FCRA, including the right to dispute inaccuracies in their credit report.

Steps to complete the adverse action form

Completing the adverse action form involves several clear steps to ensure compliance and clarity. Follow these steps:

- Gather necessary information: Collect all relevant details about the consumer's application, including their name, address, and any pertinent credit information.

- Fill out the form: Enter the required information in the designated fields, ensuring accuracy and completeness.

- Provide the reason for the adverse action: Clearly state the reason for the decision, referencing specific information from the consumer report.

- Include consumer rights information: Add a section that outlines the consumer's rights regarding their credit report and the dispute process.

- Review and finalize: Double-check all entries for accuracy before submitting the form to ensure compliance with legal requirements.

Legal use of the adverse action form

The legal use of the adverse action form is governed by federal regulations, particularly the Fair Credit Reporting Act (FCRA). Institutions must provide this form when they take adverse actions based on information from consumer reports. Failure to issue the form can result in penalties and legal repercussions. It is essential for institutions to understand their obligations under the law to protect consumer rights and maintain compliance.

How to obtain the adverse action form

Obtaining the adverse action form is straightforward. Financial institutions typically have standardized forms available for their staff to use. These forms can often be accessed through the institution's internal resources or compliance department. For consumers, if they receive an adverse action notice, they can request a copy of the form from the issuing institution to understand the reasons behind the decision.

Examples of using the adverse action form

Examples of when the adverse action form is used include:

- A bank denying a loan application due to insufficient credit history.

- A credit card company increasing interest rates based on a consumer's credit score.

- A rental agency rejecting a lease application due to negative information from a credit report.

Quick guide on how to complete what is arvest bank adverse action form

Complete What Is Arvest Bank Adverse Action Form easily on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage What Is Arvest Bank Adverse Action Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

How to adjust and electronically sign What Is Arvest Bank Adverse Action Form effortlessly

- Find What Is Arvest Bank Adverse Action Form and select Get Form to begin.

- Utilize the tools we make available to fill out your form.

- Mark pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign What Is Arvest Bank Adverse Action Form to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I get an internet banking user ID for the Bank of India?

It’s simple!• You just have to visit the nearest branch.• Fill up a form for internet banking activation.(This is the form which clearly asks you form providing any three convenient user ids)• In that form there, you’ll provide the suitable user Id as you want.• Within a span of 10–15 days, you will receive the userId and the password by post.• Immediately after that you can visit the Bank of India website and then net banking.• Login with userId and password provided and then change your password to something of your choice.

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

Is it very tough to clear the RRB bank PO? I am confused. Should I fill out the form or not?

Clearing RRB PO is not at all a tough job. Trust me, it is a bit easier to crack than cracking IBPS PO and SBI PO. Because in IBPS PO and SBI PO, you are competing with the candidates from all over India whereas RRB PO, you are competing only with the candidates of your state. Of course, vacancies would be reduced when the competition is confined to state level.Kindly note that you have nothing to do with no. of vacancies. I am a dull student who lacks focus and hates studying. But I cleared RRB PO in 2016.Even if you are a poor student, you can’t be as poor as me. I was one of the worst students one could imagine. But you underestimate yourself. You don’t know how far you can go. Some are born with talents but remember that hard work beats talent. I’m not a philosophical teacher to advise. As you said you are confused to apply, I am telling my opinion.Don’t be confused to apply. Apply for the exam and think about what you can do to clear it. I would often say that other aspirants are not going to give you a tough competition. You are the one who is going to give everyone a tough competition. Prepare hard to beat the competition.All the best.

Create this form in 5 minutes!

How to create an eSignature for the what is arvest bank adverse action form

How to generate an electronic signature for your What Is Arvest Bank Adverse Action Form online

How to generate an eSignature for your What Is Arvest Bank Adverse Action Form in Google Chrome

How to create an eSignature for signing the What Is Arvest Bank Adverse Action Form in Gmail

How to create an eSignature for the What Is Arvest Bank Adverse Action Form straight from your mobile device

How to make an eSignature for the What Is Arvest Bank Adverse Action Form on iOS

How to make an eSignature for the What Is Arvest Bank Adverse Action Form on Android

People also ask

-

What Is Arvest Bank Adverse Action Form?

The Arvest Bank Adverse Action Form is a document used to notify applicants of adverse decisions made on their credit applications. This form is essential for compliance with fair lending laws, ensuring that applicants are informed of their rights. Understanding what the Arvest Bank Adverse Action Form entails helps businesses maintain transparency in the application process.

-

How does airSlate SignNow facilitate the use of the Arvest Bank Adverse Action Form?

airSlate SignNow allows businesses to easily create, send, and eSign the Arvest Bank Adverse Action Form digitally. With its intuitive interface, you can streamline the process of notifying applicants while ensuring that all necessary legal requirements are met. This saves time and reduces the risk of errors in communication.

-

What are the pricing options for using airSlate SignNow with the Arvest Bank Adverse Action Form?

airSlate SignNow offers competitive pricing plans that cater to different business needs, making it easy to manage documents like the Arvest Bank Adverse Action Form affordably. Plan options typically include monthly and annual subscriptions, providing flexibility based on usage. You can start with a free trial to explore the features before committing to a plan.

-

What features does airSlate SignNow offer for managing the Arvest Bank Adverse Action Form?

With airSlate SignNow, you can create customizable templates for the Arvest Bank Adverse Action Form, ensuring that all necessary information is included. Other features such as automated reminders, secure cloud storage, and electronic signatures enhance the efficiency of the document management process. These tools make compliance and communication seamless.

-

Can I integrate airSlate SignNow with other software for handling the Arvest Bank Adverse Action Form?

Yes, airSlate SignNow offers integrations with various software solutions, allowing you to manage the Arvest Bank Adverse Action Form within your existing workflows. Whether you use CRM systems, email platforms, or document management tools, integration enhances your operational efficiency. This means you can automate processes and improve the overall user experience.

-

What benefits does using airSlate SignNow provide for the Arvest Bank Adverse Action Form?

Using airSlate SignNow for the Arvest Bank Adverse Action Form provides benefits such as reduced turnaround times and improved accuracy in document handling. The platform's eSignature feature ensures that documents are signed securely and promptly, which accelerates the decision-making process. Additionally, it helps maintain compliance with regulatory requirements.

-

Is airSlate SignNow secure for handling sensitive documents like the Arvest Bank Adverse Action Form?

Absolutely! airSlate SignNow prioritizes security with features like bank-level encryption, secure access controls, and audit trails for all documents, including the Arvest Bank Adverse Action Form. This ensures that sensitive information remains protected throughout the document lifecycle, providing peace of mind for both businesses and applicants.

Get more for What Is Arvest Bank Adverse Action Form

Find out other What Is Arvest Bank Adverse Action Form

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile