Irs Form 4564 Mandatory Tax Shelter Idr

What is the IRS Form 4564 Mandatory Tax Shelter IDR

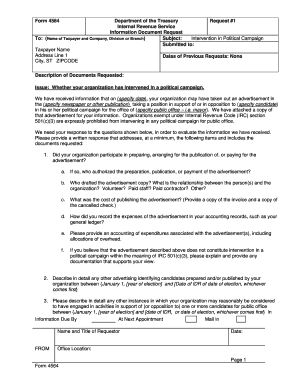

The IRS Form 4564, known as the Mandatory Tax Shelter Identification Request (IDR), is a document used by the Internal Revenue Service to gather information related to tax shelters. This form is essential for taxpayers who are involved in transactions that may be considered tax shelters, as it helps the IRS identify and evaluate potential tax avoidance strategies. By requiring this form, the IRS aims to ensure compliance with tax laws and prevent abusive tax shelter practices.

How to Use the IRS Form 4564 Mandatory Tax Shelter IDR

Using the IRS Form 4564 involves providing detailed information about the tax shelter in question. Taxpayers must accurately complete the form, detailing the structure of the tax shelter, the parties involved, and the expected tax benefits. This information allows the IRS to assess the legitimacy of the tax shelter and determine if further investigation is necessary. It is important to ensure that all information is complete and truthful to avoid penalties.

Steps to Complete the IRS Form 4564 Mandatory Tax Shelter IDR

Completing the IRS Form 4564 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant information about the tax shelter, including its structure and participants.

- Fill out the form, ensuring that each section is completed accurately.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate it.

- Submit the completed form to the IRS by the specified deadline.

Legal Use of the IRS Form 4564 Mandatory Tax Shelter IDR

The legal use of the IRS Form 4564 is crucial for maintaining compliance with federal tax laws. Taxpayers must submit this form when requested by the IRS, particularly in cases where tax shelters are involved. Failure to provide the required information can lead to penalties and increased scrutiny from the IRS. Understanding the legal implications of this form helps ensure that taxpayers fulfill their obligations while minimizing the risk of legal issues.

Key Elements of the IRS Form 4564 Mandatory Tax Shelter IDR

The IRS Form 4564 includes several key elements that must be addressed by the taxpayer. These elements typically include:

- The name and identification number of the taxpayer.

- A detailed description of the tax shelter.

- Information about the promoters and participants involved in the tax shelter.

- The expected tax benefits derived from the shelter.

Providing comprehensive and accurate information in these sections is vital for the IRS's evaluation process.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 4564 can vary based on the specific circumstances surrounding the tax shelter. Generally, taxpayers should submit the form within the timeframe specified by the IRS when requested. It is essential to keep track of these deadlines to avoid potential penalties. Taxpayers should also be aware of any additional deadlines related to tax filings that may coincide with the submission of this form.

Quick guide on how to complete irs form 4564 mandatory tax shelter idr

Complete Irs Form 4564 Mandatory Tax Shelter Idr effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Irs Form 4564 Mandatory Tax Shelter Idr on any device using airSlate SignNow's Android or iOS applications and streamline your document operations today.

The simplest way to edit and eSign Irs Form 4564 Mandatory Tax Shelter Idr effortlessly

- Find Irs Form 4564 Mandatory Tax Shelter Idr and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 4564 Mandatory Tax Shelter Idr and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 4564 mandatory tax shelter idr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 4564 mandatory tax shelter IDR?

The IRS Form 4564 mandatory tax shelter IDR is a document that taxpayers must file when claiming a tax shelter investment. This form is crucial for compliance with IRS regulations and ensures that all necessary information about the tax shelter is reported accurately.

-

How can airSlate SignNow help with IRS Form 4564 mandatory tax shelter IDR?

airSlate SignNow provides a seamless platform for eSigning and sending IRS Form 4564 mandatory tax shelter IDRs. Our user-friendly interface simplifies the document management process, so you can focus on more important tasks while ensuring compliance.

-

Is airSlate SignNow suitable for small businesses handling IRS Form 4564 mandatory tax shelter IDR?

Yes, airSlate SignNow is ideal for small businesses looking to manage IRS Form 4564 mandatory tax shelter IDRs effectively. Our cost-effective solution ensures that you can streamline document workflows without sacrificing quality or compliance.

-

What features does airSlate SignNow offer for handling IRS Form 4564 mandatory tax shelter IDR?

airSlate SignNow offers features like document templates, secure eSigning, and real-time tracking for IRS Form 4564 mandatory tax shelter IDRs. These features make it easy to ensure that all necessary information is included and that deadlines are met.

-

How does airSlate SignNow ensure security for IRS Form 4564 mandatory tax shelter IDR documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption methods and compliance with industry standards to protect your IRS Form 4564 mandatory tax shelter IDR documents, ensuring that sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other accounting software when managing IRS Form 4564 mandatory tax shelter IDR?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software solutions. This allows you to manage IRS Form 4564 mandatory tax shelter IDRs alongside your accounting processes for improved efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 4564 mandatory tax shelter IDR?

Using airSlate SignNow for IRS Form 4564 mandatory tax shelter IDRs enhances efficiency and accuracy. With automated workflows, document tracking, and eSignature capabilities, you can process tax documents faster while minimizing errors.

Get more for Irs Form 4564 Mandatory Tax Shelter Idr

Find out other Irs Form 4564 Mandatory Tax Shelter Idr

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form