Hawaii U 6 Form 2016

What is the Hawaii U 6 Form

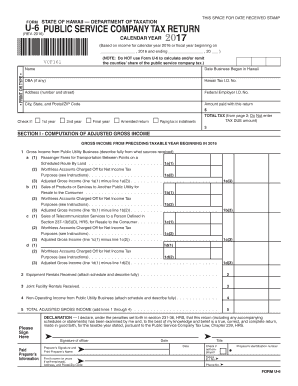

The Hawaii U 6 Form is a tax document used by businesses operating in Hawaii to report their income and expenses. This form is essential for ensuring compliance with state tax regulations. It is typically utilized by various business entities, including corporations, partnerships, and limited liability companies (LLCs). Understanding the purpose of the Hawaii U 6 Form is crucial for accurate tax reporting and maintaining good standing with state authorities.

How to use the Hawaii U 6 Form

Using the Hawaii U 6 Form involves several key steps. First, gather all necessary financial documents, including income statements, expense reports, and any relevant receipts. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate state tax authority, either electronically or via mail, depending on your preference and the specific submission guidelines.

Steps to complete the Hawaii U 6 Form

Completing the Hawaii U 6 Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial information, including income and expenses.

- Access the Hawaii U 6 Form through the appropriate state tax website or office.

- Fill in the required fields, ensuring accuracy in reporting all figures.

- Double-check the form for any errors or missing information.

- Submit the completed form by the designated deadline.

Legal use of the Hawaii U 6 Form

The legal use of the Hawaii U 6 Form is governed by state tax laws. It is essential for businesses to file this form accurately and on time to avoid penalties. The form serves as an official declaration of income and expenses, and it must be signed by an authorized representative of the business. Understanding the legal implications of this form helps ensure compliance with state regulations and protects the business from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii U 6 Form are critical for businesses to adhere to. Typically, the form must be submitted by the end of the fiscal year, but specific deadlines may vary based on the business structure and tax year. It is important to stay informed about these dates to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submission of the Hawaii U 6 Form.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii U 6 Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to submit the form electronically through the state's tax portal, which can expedite processing times.

- Mail Submission: The form can also be printed and mailed to the appropriate tax office. Ensure that it is sent well before the deadline to allow for postal delays.

- In-Person Submission: For those who prefer direct interaction, submitting the form in person at a local tax office is also an option.

Quick guide on how to complete hawaii u 6 2016 form

Your assistance manual on how to prepare your Hawaii U 6 Form

If you’re curious about how to fill out and send your Hawaii U 6 Form, here are some concise instructions to simplify the tax filing process.

To begin, all you need to do is create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to alter, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revisit responses to make changes as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow these steps to finalize your Hawaii U 6 Form in just a few minutes:

- Create your account and start working on PDFs in moments.

- Access our library to find any IRS tax form; explore different versions and schedules.

- Click Get form to launch your Hawaii U 6 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to affix your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save updates, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting in paper form can lead to an increase in return errors and delays in refunds. Additionally, prior to e-filing your taxes, consult the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct hawaii u 6 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

How do I fill UPSC 2016 form?

Below some steps are given to apply online NDA 2017 application form, follow given below steps:Go to the website.Then click on part-1 registration and enter details like name, education qualification, date of birth and other required details.complete part-1 of online registration.Select the fee payment mode.Then go to part-1 registration of NDA Exam and upload scanned signature and photo in the prescribed format.Take print out of application forms after completing part-2 registration.Generate bank challan and then make payment of application fee. After fee payment check your application status by entering your registration number and date of birth.For more details you will check How to fill NDA Application Form.

-

In the CLAT form, do we have to fill out the percentage of all 6 subjects?

Not at all.You don't have to fill the percentage of any subject in the form. You just need to scan your marksheet. (Either of 10th or 12th). As forms of CLAT are filled online.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the hawaii u 6 2016 form

How to generate an eSignature for your Hawaii U 6 2016 Form in the online mode

How to generate an electronic signature for the Hawaii U 6 2016 Form in Google Chrome

How to make an eSignature for putting it on the Hawaii U 6 2016 Form in Gmail

How to create an electronic signature for the Hawaii U 6 2016 Form from your mobile device

How to create an eSignature for the Hawaii U 6 2016 Form on iOS devices

How to create an eSignature for the Hawaii U 6 2016 Form on Android devices

People also ask

-

What is the Hawaii U 6 Form and how is it used?

The Hawaii U 6 Form is a crucial document for businesses in Hawaii, used for various purposes including employee verification and tax compliance. By using airSlate SignNow, you can easily create, send, and eSign your Hawaii U 6 Form, ensuring a seamless and legally binding process for your documentation needs.

-

How can airSlate SignNow help me with the Hawaii U 6 Form?

airSlate SignNow streamlines the process of managing your Hawaii U 6 Form by providing an intuitive platform for creating and signing documents. With features like reusable templates and customizable workflows, you can efficiently handle the paperwork, saving time and reducing errors in your documentation.

-

What are the pricing options for using airSlate SignNow for the Hawaii U 6 Form?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes, allowing you to choose the best fit for your needs when managing the Hawaii U 6 Form. The plans are designed to be cost-effective, providing you with robust features without breaking the bank, ensuring you get value while completing your essential forms.

-

Can I integrate airSlate SignNow with other software for managing the Hawaii U 6 Form?

Yes, airSlate SignNow offers seamless integrations with popular software tools, making it easy to manage your Hawaii U 6 Form alongside other business applications. Whether you use CRM systems or document management tools, the integration capabilities enhance your workflow and ensure all your data remains connected and accessible.

-

What security features does airSlate SignNow provide for the Hawaii U 6 Form?

When handling sensitive documents like the Hawaii U 6 Form, security is paramount. airSlate SignNow employs top-notch security measures, including encryption and secure access controls, ensuring that your documents are protected and compliant with regulatory standards.

-

Is it easy to eSign the Hawaii U 6 Form using airSlate SignNow?

Absolutely! eSigning the Hawaii U 6 Form with airSlate SignNow is straightforward and user-friendly. With just a few clicks, you can sign documents electronically, streamlining the approval process and enhancing efficiency for all parties involved.

-

Are there mobile options available for completing the Hawaii U 6 Form with airSlate SignNow?

Yes, airSlate SignNow offers mobile compatibility, allowing you to complete and eSign the Hawaii U 6 Form on the go. Whether you're using a smartphone or tablet, you can manage your documents anytime, anywhere, making it convenient for busy professionals.

Get more for Hawaii U 6 Form

Find out other Hawaii U 6 Form

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF