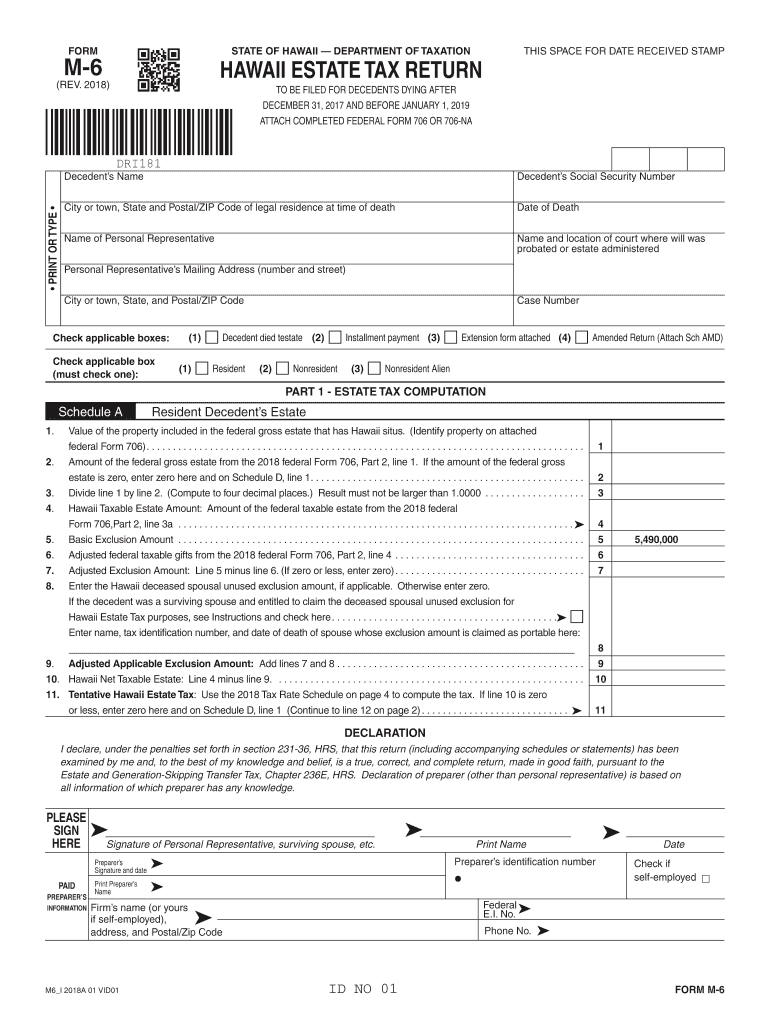

Hawaii Form M 6 2018

What is the Hawaii Form M 6

The Hawaii Form M 6 is a tax form used by residents of Hawaii to apply for an extension to file their individual income tax returns. This form allows taxpayers to request additional time to submit their tax documentation without incurring penalties for late filing. It is essential for individuals who need extra time to gather necessary information or complete their tax returns accurately. The form is specifically designed to comply with Hawaii state tax regulations and is part of the broader tax filing process for residents.

How to use the Hawaii Form M 6

Using the Hawaii Form M 6 involves a straightforward process. First, download the form from the official state tax website or obtain a physical copy. Next, fill in the required information, including your name, address, and Social Security number. Indicate the tax year for which you are requesting the extension. After completing the form, you can submit it electronically through an approved eSignature platform or mail it to the appropriate tax office. Ensure that you file the form before the original tax deadline to avoid penalties.

Steps to complete the Hawaii Form M 6

Completing the Hawaii Form M 6 requires careful attention to detail. Follow these steps:

- Download the latest version of the form from the Hawaii Department of Taxation website.

- Fill in your personal information accurately, including your full name, address, and Social Security number.

- Specify the tax year for which you are requesting an extension.

- Review the form for completeness and accuracy before submission.

- Submit the form electronically or by mail, ensuring it reaches the tax office by the deadline.

Legal use of the Hawaii Form M 6

The Hawaii Form M 6 is legally recognized as a valid request for an extension to file individual income tax returns. By submitting this form, taxpayers can avoid penalties associated with late filing, provided they adhere to the guidelines set by the Hawaii Department of Taxation. It is crucial to ensure that the form is completed accurately and submitted on time to maintain its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Form M 6 are critical to avoid penalties. Typically, the form must be submitted by the original due date of the tax return, which is usually April 20 for individual income tax returns. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should keep track of these dates to ensure timely submission and compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Form M 6 can be submitted through various methods, offering flexibility to taxpayers. Options include:

- Online Submission: Use an approved eSignature platform to submit the form electronically, ensuring a quick and secure process.

- Mail: Print the completed form and send it to the designated address provided by the Hawaii Department of Taxation.

- In-Person: Visit a local tax office to submit the form directly, if preferred.

Quick guide on how to complete form m 6 2018 2019

Your assistance manual on how to prepare your Hawaii Form M 6

If you’re curious about how to finalize and submit your Hawaii Form M 6, here are a few brief tips on how to simplify tax declaring.

To start, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to alter, generate, and complete your tax forms effortlessly. Using its editor, you can toggle between text, checkboxes, and eSignatures and return to modify information when necessary. Enhance your tax organization with advanced PDF editing, eSigning, and easy sharing options.

Complete the following actions to achieve your Hawaii Form M 6 in just a few minutes:

- Establish your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Hawaii Form M 6 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any inaccuracies.

- Apply changes, print a copy for yourself, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Keep in mind that filing manually may increase return errors and prolong refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form m 6 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form m 6 2018 2019

How to create an eSignature for the Form M 6 2018 2019 online

How to make an electronic signature for your Form M 6 2018 2019 in Google Chrome

How to create an eSignature for signing the Form M 6 2018 2019 in Gmail

How to make an electronic signature for the Form M 6 2018 2019 from your mobile device

How to generate an eSignature for the Form M 6 2018 2019 on iOS

How to generate an electronic signature for the Form M 6 2018 2019 on Android devices

People also ask

-

What is Form M 6 and how does it work?

Form M 6 is a standardized document used for various business applications. With airSlate SignNow, users can easily create, send, and eSign Form M 6, ensuring a streamlined workflow. The platform simplifies document management by allowing users to track the status of their Form M 6 in real time.

-

How much does it cost to use airSlate SignNow for Form M 6?

airSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes. Depending on your needs, you can choose a monthly or annual subscription that includes features tailored for efficient processing of Form M 6. Check our pricing page for specific details and potential savings.

-

What features does airSlate SignNow provide for Form M 6?

airSlate SignNow includes a variety of features designed to enhance the usability of Form M 6. Users can utilize templates, automated workflows, and advanced security options to ensure their documents are handled safely and efficiently. Additionally, eSigning capabilities expedite the approval process for Form M 6.

-

Are there any benefits to using airSlate SignNow for Form M 6?

Using airSlate SignNow for Form M 6 offers numerous benefits, such as increased efficiency and reduced paper usage. The platform enables businesses to speed up their document transactions signNowly, thereby improving overall productivity. Moreover, you can access your Form M 6 from any device, enhancing flexibility.

-

Can I integrate airSlate SignNow with other tools for managing Form M 6?

Yes, airSlate SignNow supports integration with various applications to streamline your workflows involving Form M 6. You can connect it to CRM systems, cloud storage solutions, and more, allowing for seamless data flow between platforms. This integration capability makes managing Form M 6 convenient and efficient.

-

How does airSlate SignNow ensure the security of Form M 6?

airSlate SignNow prioritizes security, providing multiple layers of protection for Form M 6. These include encryption protocols, secure access controls, and compliance with industry regulations. Your sensitive information is safeguarded, ensuring peace of mind when handling Form M 6.

-

Can I track the status of my Form M 6 in airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the real-time status of their Form M 6, providing updates when documents are sent, viewed, or signed. This feature enhances visibility and accountability within your document workflows, making it easier to manage timelines.

Get more for Hawaii Form M 6

- Axa credit card form

- The san diego quick assessment measures the recognition of words out of context form

- Financial disclosure affidavit of indigency butler county ohio butlercountyohio form

- Td ameritrade trust account form

- Online visa fillable application for india from pakistan form

- Ldss 5023 50096019 form

- Restaurant agreement template form

- Restaurant investment agreement template form

Find out other Hawaii Form M 6

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile