Public Partnership Payroll Schedule B Form

What is the Public Partnership Payroll Schedule B

The Public Partnership Payroll Schedule B is a crucial document used by organizations involved in public partnerships to outline payment schedules for employees and contractors. This form details the specific pay rates, payment intervals, and any applicable deductions or benefits associated with each payment. Understanding this schedule is essential for ensuring compliance with state and federal regulations, as well as for maintaining accurate financial records.

How to use the Public Partnership Payroll Schedule B

Using the Public Partnership Payroll Schedule B involves several steps. First, organizations must gather all relevant employee information, including names, roles, and pay rates. Next, the schedule should be filled out with accurate payment details, including the frequency of payments and any deductions. Once completed, this schedule must be distributed to all employees and stored securely for record-keeping. Regular updates may be necessary to reflect changes in employment status or pay rates.

Steps to complete the Public Partnership Payroll Schedule B

Completing the Public Partnership Payroll Schedule B requires attention to detail. Follow these steps:

- Collect necessary employee data, including full names and positions.

- Determine the appropriate pay rates for each employee based on their roles and agreements.

- Fill in the payment intervals, specifying whether payments are weekly, bi-weekly, or monthly.

- Include any deductions, such as taxes or benefits, that will affect the final payment amount.

- Review the completed schedule for accuracy before distribution.

Legal use of the Public Partnership Payroll Schedule B

The legal use of the Public Partnership Payroll Schedule B is essential for compliance with labor laws and regulations. This document must adhere to guidelines set forth by the Fair Labor Standards Act (FLSA) and any applicable state laws. Proper execution and storage of the schedule can protect organizations from potential disputes regarding employee compensation and ensure that all parties are informed of their payment rights and responsibilities.

Key elements of the Public Partnership Payroll Schedule B

Key elements of the Public Partnership Payroll Schedule B include:

- Employee Information: Names, roles, and identification numbers.

- Pay Rates: Specific amounts to be paid to each employee.

- Payment Frequency: How often payments will be made.

- Deductions: Any applicable taxes or withholdings.

- Approval Signatures: Required signatures from authorized personnel to validate the schedule.

Filing Deadlines / Important Dates

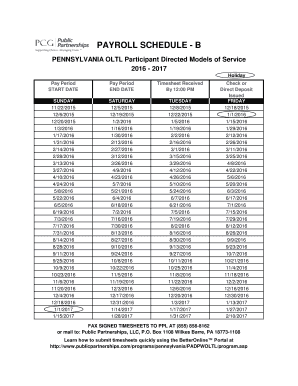

Adhering to filing deadlines for the Public Partnership Payroll Schedule B is critical. Organizations should be aware of specific dates related to payroll submissions, tax filings, and any state-specific requirements. Keeping a calendar of these important dates can help ensure timely compliance and avoid potential penalties associated with late submissions.

Quick guide on how to complete public partnership payroll schedule b

Complete Public Partnership Payroll Schedule B effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Public Partnership Payroll Schedule B on any device with airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to modify and eSign Public Partnership Payroll Schedule B without hassle

- Find Public Partnership Payroll Schedule B and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Leave behind lost or misplaced documents, monotonous form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Public Partnership Payroll Schedule B and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the public partnership payroll schedule b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the public partnership payroll login?

The public partnership payroll login is a secure portal that allows users to access payroll services offered by public partnerships. By using this login, users can efficiently manage their payroll information and ensure timely processing of payments.

-

How can I reset my public partnership payroll login password?

To reset your public partnership payroll login password, go to the login page and click on the 'Forgot Password' link. Follow the prompts to receive an email with instructions on how to create a new password to secure your account.

-

What features are included in the public partnership payroll login?

The public partnership payroll login provides features such as easy document uploads, real-time updates on payroll status, and access to historical pay information. These tools simplify payroll management for both employers and employees.

-

Is there a mobile app for the public partnership payroll login?

Yes, there is a mobile-optimized version of the public partnership payroll login, which allows users to access their payroll information from any device. This feature enhances flexibility and convenience for users on the go.

-

What are the pricing options for services linked to the public partnership payroll login?

Pricing for services associated with the public partnership payroll login varies based on the specific plans chosen. Contact us for detailed pricing information to find a solution that aligns with your payroll needs and budget.

-

What benefits does using the public partnership payroll login offer?

Using the public partnership payroll login streamlines payroll processes, enhances accuracy, and saves time. By automating many payroll tasks, businesses can focus on their core operations without worrying about administrative burdens.

-

Can the public partnership payroll login integrate with other software systems?

Yes, the public partnership payroll login can seamlessly integrate with various accounting and HR software systems. This integration allows for efficient data sharing and reduces the likelihood of errors during payroll processing.

Get more for Public Partnership Payroll Schedule B

Find out other Public Partnership Payroll Schedule B

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer