Sstgb Form F0003 2018

What is the Sstgb Form F0003?

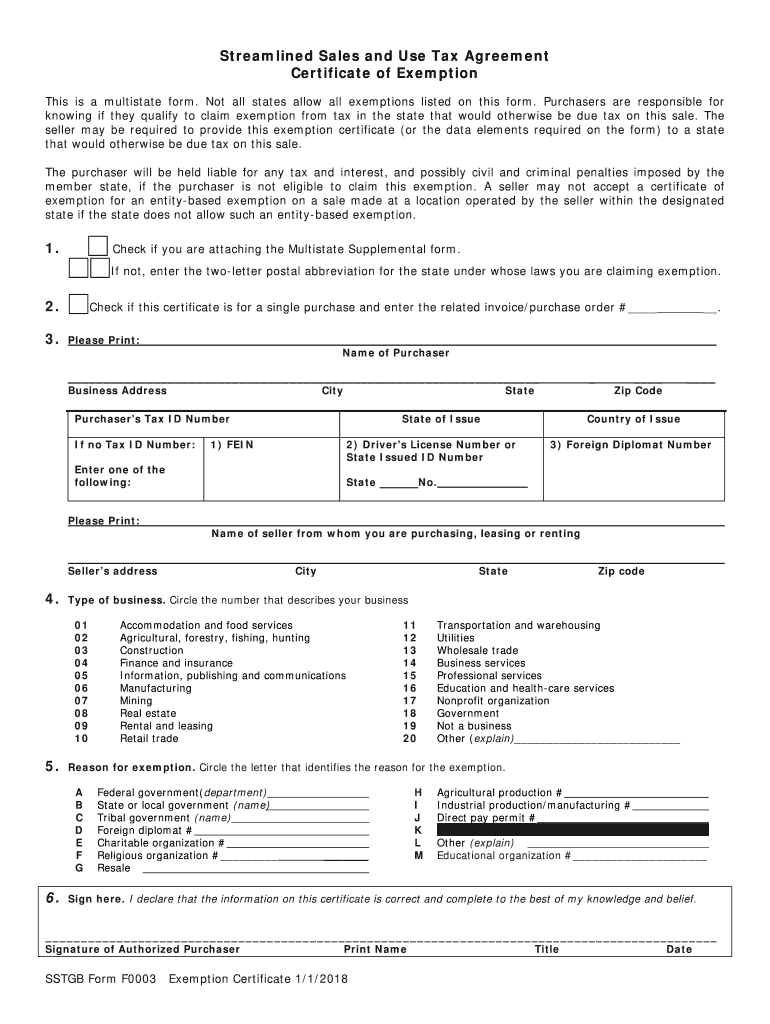

The Sstgb Form F0003, also known as the streamlined sales and use tax agreement exemption certificate, is a document used by businesses to claim exemption from sales and use tax in multiple states. This form is particularly important for entities that purchase goods or services for resale or for specific exempt purposes. By completing this form, businesses can avoid paying sales tax on eligible purchases, thus enhancing their cash flow and operational efficiency.

How to use the Sstgb Form F0003

To effectively use the Sstgb Form F0003, businesses must first determine their eligibility for exemption under the streamlined sales tax agreement. Once eligibility is confirmed, the form should be filled out accurately, providing necessary details such as the purchaser's name, address, and the specific type of exemption being claimed. It's crucial to ensure that the form is signed and dated by an authorized representative of the business to validate the exemption claim.

Steps to complete the Sstgb Form F0003

Completing the Sstgb Form F0003 involves several key steps:

- Gather necessary information about your business, including legal name, address, and tax identification number.

- Identify the specific exemption type you are claiming, ensuring it aligns with state regulations.

- Fill out the form accurately, ensuring all fields are completed to avoid delays or rejections.

- Review the completed form for accuracy and compliance with state requirements.

- Sign and date the form, ensuring it is authorized by a representative of your business.

Legal use of the Sstgb Form F0003

The legal use of the Sstgb Form F0003 is governed by state laws and regulations pertaining to sales tax exemptions. For the form to be valid, it must be completed in accordance with the specific requirements set forth by each participating state. This includes adhering to the guidelines established under the streamlined sales and use tax agreement, which provides a framework for uniform tax administration across states. Proper use of the form can protect businesses from potential legal issues related to tax compliance.

Eligibility Criteria

Eligibility to use the Sstgb Form F0003 typically includes businesses that are registered to collect sales tax in states participating in the streamlined sales tax agreement. Additionally, the purchases made must qualify for exemption, such as items intended for resale or specific exempt uses as defined by state law. Businesses should verify their eligibility and ensure they meet all criteria to avoid complications during tax audits.

Form Submission Methods

The Sstgb Form F0003 can be submitted through various methods, depending on state requirements. Common submission methods include:

- Online submission via state tax authority websites, where applicable.

- Mailing the completed form to the designated tax office in the relevant state.

- In-person submission at local tax offices or during tax-related appointments.

It is essential to check the specific submission guidelines for each state to ensure compliance and timely processing.

Quick guide on how to complete form f0003 exemption 2018 2019

Discover how to navigate the Sstgb Form F0003 completion with this simple guide

Submitting and authenticating documents digitally is becoming increasingly popular and is the preferred choice for numerous clients. It provides many advantages over outdated printed documents, such as convenience, time savings, enhanced precision, and security.

With services like airSlate SignNow, you can find, edit, sign, enhance, and transmit your Sstgb Form F0003 without the hassle of continuous printing and scanning. Follow this brief tutorial to begin and finalize your document.

Utilize these guidelines to acquire and complete Sstgb Form F0003

- Begin by clicking on the Get Form button to access your document in our editor.

- Pay attention to the green label on the left indicating mandatory fields to ensure you don’t overlook them.

- Employ our sophisticated tools to annotate, modify, sign, protect, and improve your document.

- Secure your document or convert it into a fillable form using the appropriate tab functionalities.

- Review the document thoroughly for any mistakes or inconsistencies.

- Click DONE to finalize your editing.

- Change the name of your document or leave it as is.

- Select the storage service where you wish to keep your document, send it via USPS, or click the Download Now button to save your document.

If Sstgb Form F0003 isn’t what you were looking for, you can explore our extensive collection of pre-imported forms that you can complete effortlessly. Try our platform today!

Create this form in 5 minutes or less

Find and fill out the correct form f0003 exemption 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the form f0003 exemption 2018 2019

How to make an electronic signature for the Form F0003 Exemption 2018 2019 in the online mode

How to generate an eSignature for your Form F0003 Exemption 2018 2019 in Google Chrome

How to make an eSignature for putting it on the Form F0003 Exemption 2018 2019 in Gmail

How to generate an electronic signature for the Form F0003 Exemption 2018 2019 right from your mobile device

How to create an eSignature for the Form F0003 Exemption 2018 2019 on iOS

How to make an electronic signature for the Form F0003 Exemption 2018 2019 on Android

People also ask

-

What are the conditions to claim exemption from tax withholding?

An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

-

Who qualifies for sales tax exemption in California?

In general, businesses which provide a service that does not result in a tangible good are exempt from sales tax, as it only applies to goods. For example a freelance writer or a tradesperson is not required to remit sales tax, although a carpenter making custom furniture is so required.

-

Who qualifies for sales tax exemption in New York?

You may use an exemption certificate if, as a purchaser: you intend to resell the property or service; you intend to use the property or service for a purpose that is exempt from sales tax; or. you make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities.

-

What can be tax-exempt in ohio?

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam.

-

How do I get a tax exemption certificate in California?

To apply for California tax exemption status, use form FTB 3500, Exemption Application. This is a long detailed form, much like the IRS form 1023. If you have already received your 501c3 status from the IRS, use form FTB 3500A, Submission of Exemption Request.

-

Why would you claim an exemption?

Generally, tax exemptions reduce the taxable income on a return. There are many kinds of tax exemptions; however, personal exemptions are included on nearly every individual return filed in the U.S. You can claim a personal exemption for yourself unless someone else can claim you as a dependent.

-

What are the reasons for tax exemption?

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

-

What are valid reasons for claiming tax exemption in Ohio?

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam. Many items used in farming or manufacturing.

Get more for Sstgb Form F0003

- Npcl form pdf

- Seacadet medical history form

- Arkansas notary discount association co form

- Johnstown pa transcription form

- Microsoft excel software on a pc and our laboratory information systems l cdc

- 94397008senddweb p form

- 70205745ss disc 1 no suspensedocx form

- Employee laptop loan agreement template form

Find out other Sstgb Form F0003

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast