W 3 Reconciliation City of Toledo 2014

What is the W-3 Reconciliation City Of Toledo

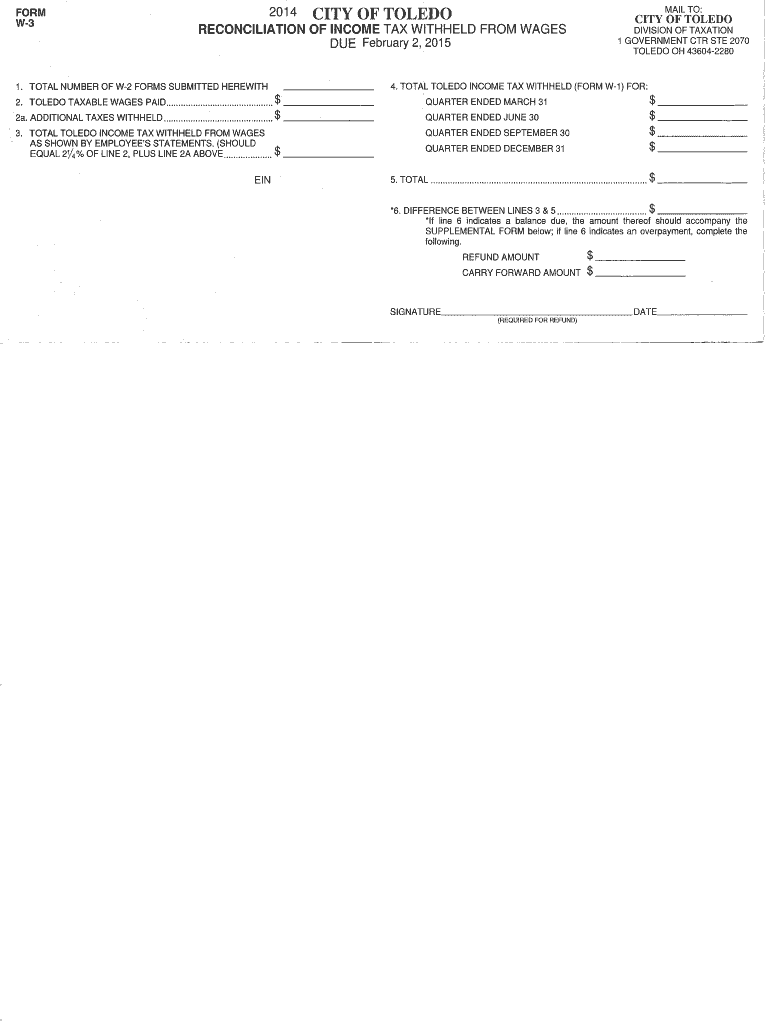

The W-3 Reconciliation City Of Toledo form is a crucial document used for reporting annual wage and tax information to the City of Toledo. This form serves as a summary of all W-2 forms issued by employers within the city. It consolidates information regarding employee wages, taxes withheld, and other relevant details that are necessary for accurate tax reporting. The W-3 form ensures that the City of Toledo can effectively track and verify the income reported by its residents, which is essential for maintaining compliance with local tax regulations.

Steps to Complete the W-3 Reconciliation City Of Toledo

Completing the W-3 Reconciliation City Of Toledo involves several key steps to ensure accuracy and compliance. First, gather all W-2 forms issued by your business for the tax year. Next, verify that the information on each W-2 is correct, including names, Social Security numbers, and wages. After confirming the accuracy of the W-2s, complete the W-3 form by entering the total number of W-2 forms submitted, total wages, and total taxes withheld. Finally, review the completed form for any errors before submitting it to the appropriate city department.

How to Obtain the W-3 Reconciliation City Of Toledo

The W-3 Reconciliation City Of Toledo form can be obtained through the City of Toledo's official website or by contacting the local tax office directly. Many employers find it convenient to download the form online, where it is typically available in a fillable PDF format. This allows for easy completion and ensures that all necessary information is included. Additionally, local tax offices may provide physical copies of the form upon request.

Legal Use of the W-3 Reconciliation City Of Toledo

The legal use of the W-3 Reconciliation City Of Toledo form is mandated by local tax laws. Employers are required to submit this form to report wages and taxes withheld from employees accurately. Failing to file the W-3 form, or submitting incorrect information, can result in penalties and fines from the city. Therefore, it is essential for employers to understand their obligations and ensure that the form is completed and submitted in accordance with local regulations.

Filing Deadlines / Important Dates

Filing deadlines for the W-3 Reconciliation City Of Toledo are typically aligned with federal tax deadlines. Employers must ensure that the form is submitted by the end of January following the tax year. It is important to stay informed about any changes to these deadlines, as local regulations may vary. Missing the deadline can result in penalties, so timely submission is crucial for compliance.

Form Submission Methods (Online / Mail / In-Person)

The W-3 Reconciliation City Of Toledo can be submitted through various methods, including online, by mail, or in person. Many employers prefer online submission for its convenience and speed. However, if submitting by mail, ensure that the form is sent to the correct address and allow sufficient time for delivery. In-person submissions may also be possible at designated city tax offices, providing an opportunity for immediate confirmation of receipt.

Quick guide on how to complete 2014 w 3 reconciliation city of toledo

Your assistance manual on how to prepare your W 3 Reconciliation City Of Toledo

If you're curious about how to generate and present your W 3 Reconciliation City Of Toledo, here are some concise directions on how to simplify tax processing.

To initiate, you just need to set up your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document management solution that enables you to adjust, create, and finalize your tax documents with ease. With its editing tools, you can alternate between text, checkboxes, and electronic signatures, and return to modify responses when necessary. Optimize your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Adhere to the instructions below to finalize your W 3 Reconciliation City Of Toledo in no time:

- Create your account and start working on PDFs almost instantly.

- Utilize our repository to acquire any IRS tax document; explore different versions and schedules.

- Click Obtain form to access your W 3 Reconciliation City Of Toledo in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Signing Tool to add your legally-recognized electronic signature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Please be aware that submitting on paper may increase return inaccuracies and delay refunds. It’s important to check the IRS website for submission rules specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 2014 w 3 reconciliation city of toledo

FAQs

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

Create this form in 5 minutes!

How to create an eSignature for the 2014 w 3 reconciliation city of toledo

How to make an eSignature for your 2014 W 3 Reconciliation City Of Toledo in the online mode

How to make an electronic signature for your 2014 W 3 Reconciliation City Of Toledo in Chrome

How to create an eSignature for putting it on the 2014 W 3 Reconciliation City Of Toledo in Gmail

How to generate an eSignature for the 2014 W 3 Reconciliation City Of Toledo straight from your smartphone

How to create an electronic signature for the 2014 W 3 Reconciliation City Of Toledo on iOS

How to create an eSignature for the 2014 W 3 Reconciliation City Of Toledo on Android

People also ask

-

What is W 3 Reconciliation City Of Toledo?

W 3 Reconciliation City Of Toledo refers to the process of reconciling quarterly or annual earnings reports for employees within the Toledo area. This is essential for ensuring that income tax withholding is accurate and that all employees receive proper tax documentation. Utilizing the airSlate SignNow platform can simplify this process signNowly.

-

How can airSlate SignNow assist with W 3 Reconciliation City Of Toledo?

airSlate SignNow offers simple eSigning features designed to streamline the W 3 Reconciliation City Of Toledo process. You can easily send, sign, and manage all related documents online, reducing paperwork and tracking errors. This makes compliance easier for businesses operating in Toledo.

-

What are the pricing options for airSlate SignNow regarding W 3 Reconciliation City Of Toledo?

airSlate SignNow provides various pricing plans that cater to businesses of all sizes, ensuring affordability when managing the W 3 Reconciliation City Of Toledo process. Our plans include features tailored for document management and eSigning, making it cost-effective to stay compliant. Visit our pricing page for more details.

-

What features does airSlate SignNow offer for W 3 Reconciliation City Of Toledo?

With airSlate SignNow, features such as document templates, team collaboration, and automated workflows are available to assist with the W 3 Reconciliation City Of Toledo. These features ensure that documents are prepared accurately and handled efficiently, helping businesses avoid penalties and delays.

-

What are the benefits of using airSlate SignNow for W 3 Reconciliation City Of Toledo?

Using airSlate SignNow for W 3 Reconciliation City Of Toledo offers several benefits, including improved speed, accuracy, and secure storage of documents. It streamlines the entire reconciliation process, enabling businesses to focus on their core activities while leaving compliance tasks to our platform. Plus, it allows easy access to essential documents anytime, anywhere.

-

Can airSlate SignNow integrate with my existing systems for W 3 Reconciliation City Of Toledo?

Yes, airSlate SignNow is designed to easily integrate with various accounting, CRM, and HR systems to enhance the W 3 Reconciliation City Of Toledo process. This ensures that all data is consistent across platforms, facilitating easier reconciliation and compliance. Check our integrations page for specific applications we support.

-

Is airSlate SignNow compliant with regulations regarding W 3 Reconciliation City Of Toledo?

Absolutely! airSlate SignNow is compliant with the necessary regulations and standards for handling W 3 Reconciliation City Of Toledo. We prioritize the security of your data and follow stringent protocols to ensure that all your documentation meets compliance requirements necessary for the local area.

Get more for W 3 Reconciliation City Of Toledo

Find out other W 3 Reconciliation City Of Toledo

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free