Nebraska Nsp 455 Certificate After Days Online 2018-2026

Understanding the LIC BOC Refund Letter

The LIC BOC refund letter is a formal document used to request a refund from the Life Insurance Corporation (LIC) of India. This letter is typically necessary for policyholders who have overpaid premiums or wish to cancel their policies. It serves as a written record of the request and outlines the reasons for seeking a refund. It is important to ensure that the letter includes all relevant details, such as policy numbers and personal identification information, to facilitate a smooth processing of the refund.

Key Elements of a LIC BOC Refund Letter

When drafting a LIC BOC refund letter, several key elements should be included to ensure clarity and effectiveness:

- Sender's Information: Include your full name, address, and contact details at the top of the letter.

- Recipient's Information: Address the letter to the appropriate LIC office or department handling refunds.

- Subject Line: Clearly state the purpose of the letter, such as "Request for Refund of Policy Number [Your Policy Number]."

- Body of the Letter: Explain the reason for the refund request, including details about the policy and any relevant dates.

- Signature: Sign the letter to authenticate the request.

Steps to Complete the LIC BOC Refund Letter

To effectively complete a LIC BOC refund letter, follow these steps:

- Gather all necessary information, including your policy number, personal identification, and the reason for the refund.

- Draft the letter, ensuring to include all key elements mentioned earlier.

- Review the letter for accuracy and completeness, checking for any missing information.

- Sign the letter to validate your request.

- Submit the letter to the appropriate LIC office, either by mail or in person, depending on their submission guidelines.

Filing Deadlines for LIC BOC Refund Requests

It is essential to be aware of any filing deadlines associated with LIC BOC refund requests. Typically, policyholders should submit their refund letters within a specific timeframe after the policy cancellation or overpayment. This timeframe may vary based on the terms of the policy and the regulations set by LIC. Checking the latest guidelines from LIC or consulting with a representative can provide clarity on these deadlines.

Legal Use of the LIC BOC Refund Letter

The LIC BOC refund letter is a legally recognized document that serves as a formal request for a refund. It is essential to ensure that the letter complies with any legal requirements set forth by LIC and relevant authorities. Proper documentation and adherence to guidelines will help protect the rights of the policyholder and ensure that the refund process is handled appropriately.

Who Issues the LIC BOC Refund Letter

The LIC BOC refund letter is typically issued by the policyholder requesting the refund. However, it may also be generated by LIC representatives in response to specific inquiries or requests regarding refunds. Understanding the process and who is responsible for issuing the letter can help streamline communication and ensure timely processing of refund requests.

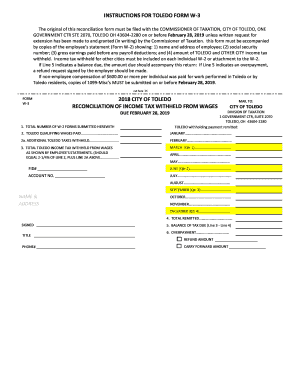

Quick guide on how to complete 2018 city of toledo reconciliation of income tax withheld from wages

Your assistance manual on how to prepare your Nebraska Nsp 455 Certificate After Days Online

If you’re interested in understanding how to generate and submit your Nebraska Nsp 455 Certificate After Days Online, below are a few brief suggestions on how to make tax submission simpler.

To begin, all you need to do is set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and go back to modify answers as necessary. Streamline your tax handling with advanced PDF modifications, eSigning, and an easy sharing process.

Follow these steps to complete your Nebraska Nsp 455 Certificate After Days Online in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse different versions and schedules.

- Click Get form to access your Nebraska Nsp 455 Certificate After Days Online in our editor.

- Input the mandatory fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to affix your legally-binding electronic signature (if necessary).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can increase return errors and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 city of toledo reconciliation of income tax withheld from wages

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How long does it take to get a refund of wrongly withheld Social Security taxes and Medicare taxes from IRS after the filing of form 843?

I have seen it take up to 2 years to get a refund processed, but you can contact the IRS to check on the status. I would not start at the taxpayer advocate office as they will not help you until you have tried the normal IRS channels first. Start with Contact Your Local IRS Office

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

A senior resident has dividend income of 2 lakhs from equity shares and 9 lakhs from mutual funds. How do you fill out ITR 2 for 2017-2018?

Hi ,The dividend income from equity is exempt and the dividend income from mutual fund is exempt if STT ( security transaction tax) has been paid on the same. If both the dividend income is exempt then you need to disclose the same in schedule of exempt income in ITR-2.For income tax relatex assiatance kindly connect with me on khushbu.2893@gmail.com with your contact no

Create this form in 5 minutes!

How to create an eSignature for the 2018 city of toledo reconciliation of income tax withheld from wages

How to generate an electronic signature for your 2018 City Of Toledo Reconciliation Of Income Tax Withheld From Wages in the online mode

How to make an eSignature for the 2018 City Of Toledo Reconciliation Of Income Tax Withheld From Wages in Google Chrome

How to make an eSignature for putting it on the 2018 City Of Toledo Reconciliation Of Income Tax Withheld From Wages in Gmail

How to make an electronic signature for the 2018 City Of Toledo Reconciliation Of Income Tax Withheld From Wages right from your smartphone

How to make an electronic signature for the 2018 City Of Toledo Reconciliation Of Income Tax Withheld From Wages on iOS

How to generate an eSignature for the 2018 City Of Toledo Reconciliation Of Income Tax Withheld From Wages on Android devices

People also ask

-

What are Toledo city tax forms and why do I need them?

Toledo city tax forms are documents required for filing local taxes in Toledo, Ohio. Completing these forms accurately is crucial for compliance with local tax regulations, and using tools like airSlate SignNow can streamline the eSigning and submission process.

-

How can airSlate SignNow help me with Toledo city tax forms?

airSlate SignNow allows you to easily send, eSign, and manage your Toledo city tax forms digitally. This not only speeds up the process but also ensures that your documents are securely stored and easily accessible when needed.

-

What features does airSlate SignNow offer for managing Toledo city tax forms?

airSlate SignNow offers features such as customizable templates, real-time tracking, and mobile accessibility, making it simple to manage Toledo city tax forms from anywhere. These features help simplify the filing process and enhance productivity.

-

Is airSlate SignNow affordable for small businesses needing Toledo city tax forms?

Yes, airSlate SignNow is a cost-effective solution ideal for small businesses. Our competitive pricing plans allow you to manage your Toledo city tax forms without breaking the budget while enjoying all essential eSignature features.

-

Can I integrate airSlate SignNow with other software to manage Toledo city tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various business applications such as CRM and accounting software. This integration allows you to easily access and manage your Toledo city tax forms alongside other critical business functions.

-

How secure is the airSlate SignNow platform when handling Toledo city tax forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Toledo city tax forms. Our platform uses advanced encryption and complies with industry standards to ensure your personal and financial information is always protected.

-

What if I need help with filling out my Toledo city tax forms using airSlate SignNow?

If you need assistance with filling out your Toledo city tax forms, airSlate SignNow provides a range of resources, including customer support and online tutorials. Our user-friendly interface also makes it easy to guide you through the process without hassle.

Get more for Nebraska Nsp 455 Certificate After Days Online

- Residential parking permit cost form

- Central government health scheme modified check form

- B105 standard short form of agreement between owner and

- Vat52 form

- Bad check letter in ohio template form

- Proof of physical exam form

- Revenue share agreement template form

- Revenue participation agreement template form

Find out other Nebraska Nsp 455 Certificate After Days Online

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF