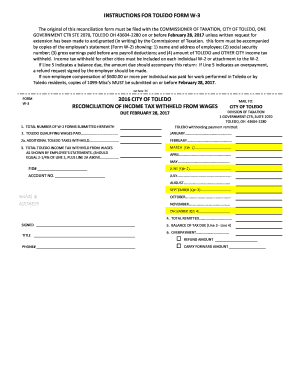

CITY of TOLEDO RECONCILIATION of INCOME TAX WITHHELD 2016

What is the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD

The CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD is a crucial tax document used by residents and businesses in Toledo to reconcile the income tax withheld from their earnings throughout the year. This form ensures that the amount withheld aligns with the actual income tax liability owed to the city. It is essential for accurate reporting and compliance with local tax regulations. The reconciliation process helps identify any discrepancies, allowing taxpayers to correct over- or under-withholding before filing their annual income tax returns.

Steps to complete the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD

Completing the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD involves several key steps:

- Gather all relevant financial documents, including W-2 forms, 1099 forms, and any other records of income received during the tax year.

- Calculate the total income earned and the total tax withheld from your paychecks and other income sources.

- Fill out the reconciliation form, ensuring that all sections are accurately completed with the necessary information.

- Review the form for any errors or omissions before signing and dating it.

- Submit the completed form electronically or via mail, adhering to the submission guidelines provided by the city.

How to obtain the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD

The CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD can be obtained through several methods. Taxpayers can visit the official city website to download the form directly. Additionally, local tax offices may provide physical copies of the form upon request. It is important to ensure that you are using the most current version of the form to comply with any updated regulations or requirements.

Legal use of the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD

The legal use of the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD is mandated by local tax laws. This form serves as a formal declaration of income tax withheld and is used to verify compliance with Toledo's income tax regulations. Filing this form accurately and on time is essential to avoid penalties and ensure that taxpayers meet their legal obligations. The form is also critical for resolving any disputes regarding tax liability or withholding amounts.

Filing Deadlines / Important Dates

Filing deadlines for the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD typically align with the annual income tax filing season. Taxpayers should be aware of the specific due dates, which are usually set by the city’s tax authority. It is advisable to check for any updates or changes to these deadlines, especially in light of any legislative changes or extensions that may occur.

Form Submission Methods (Online / Mail / In-Person)

The CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD can be submitted through various methods. Taxpayers have the option to file the form online via the city’s tax portal, which offers a convenient and efficient way to submit documents. Alternatively, forms can be mailed to the appropriate tax office or delivered in person. Each submission method may have specific guidelines that should be followed to ensure proper processing.

Quick guide on how to complete 2016 city of toledo reconciliation of income tax withheld

Your assistance manual on how to prepare your CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD

If you’re wondering how to generate and submit your CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD, here are some concise recommendations on how to simplify tax processing.

Firstly, you only need to set up your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, generate, and finalize your income tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, returning to amend details as needed. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Adhere to the instructions below to complete your CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD in no time:

- Establish your account and start engaging with PDFs in mere moments.

- Utilize our directory to access any IRS tax form; browse through variants and schedules.

- Click Obtain form to access your CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD in our editor.

- Populate the necessary fillable areas with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Store changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes digitally with airSlate SignNow. Please be aware that submitting on paper can lead to return errors and delay refunds. Lastly, before e-filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2016 city of toledo reconciliation of income tax withheld

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How long does it take to get a refund of wrongly withheld Social Security taxes and Medicare taxes from IRS after the filing of form 843?

I have seen it take up to 2 years to get a refund processed, but you can contact the IRS to check on the status. I would not start at the taxpayer advocate office as they will not help you until you have tried the normal IRS channels first. Start with Contact Your Local IRS Office

Create this form in 5 minutes!

How to create an eSignature for the 2016 city of toledo reconciliation of income tax withheld

How to generate an eSignature for the 2016 City Of Toledo Reconciliation Of Income Tax Withheld in the online mode

How to create an eSignature for your 2016 City Of Toledo Reconciliation Of Income Tax Withheld in Chrome

How to generate an eSignature for signing the 2016 City Of Toledo Reconciliation Of Income Tax Withheld in Gmail

How to create an eSignature for the 2016 City Of Toledo Reconciliation Of Income Tax Withheld right from your smart phone

How to create an electronic signature for the 2016 City Of Toledo Reconciliation Of Income Tax Withheld on iOS

How to generate an eSignature for the 2016 City Of Toledo Reconciliation Of Income Tax Withheld on Android devices

People also ask

-

What is the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD?

The CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD is a process that ensures your withheld income taxes align with the amounts reported to the city. This reconciliation is crucial for compliance and helps businesses avoid penalties. Using airSlate SignNow can simplify this process by allowing you to eSign necessary documents quickly and securely.

-

How can airSlate SignNow assist with the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD?

airSlate SignNow streamlines the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD by providing a platform for electronic signatures and document management. With our user-friendly interface, you can easily prepare and eSign tax reconciliation documents, ensuring accuracy and timely submissions to the city.

-

What features does airSlate SignNow offer for managing the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD?

Our platform offers features like customizable templates, real-time tracking, and secure storage for all your documents related to the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD. These tools help you manage your income tax documents efficiently and ensure compliance with local regulations.

-

Is airSlate SignNow cost-effective for businesses handling the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD. With our various pricing plans, you can find an option that fits your budget while gaining access to essential features that simplify your tax processes.

-

Can I integrate airSlate SignNow with other software for the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD?

Absolutely! airSlate SignNow offers seamless integration with various accounting and payroll software, making it easier to manage the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD. This integration helps streamline your workflow and ensures data accuracy across platforms.

-

What are the benefits of using airSlate SignNow for tax reconciliation?

Using airSlate SignNow for the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our electronic signature feature allows for quick approvals and document turnaround, which is essential for timely tax submissions.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication protocols to protect your sensitive documents related to the CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD. You can rest assured that your data is safe with us.

Get more for CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD

- Life insurance claim form please complete sign and return this form to start the claim process

- Lab referral form

- Instructions to complete form wcpc mre 036

- Ab1 loan form

- Initial each page example form

- Dhcs form 5086

- Groundwater entry point chlorine residual monitoring log form

- Revenue based financing agreement template form

Find out other CITY OF TOLEDO RECONCILIATION OF INCOME TAX WITHHELD

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement