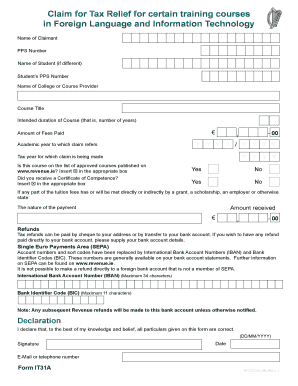

It31 Form

What is the IT31 Form

The IT31 form is a tax-related document used in the United States, specifically designed for certain tax situations. It is often utilized by individuals and businesses to report specific information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the IT31 form is essential for compliance and accurate tax reporting. This form may be relevant for various taxpayer scenarios, including self-employed individuals and small business owners.

How to Use the IT31 Form

Using the IT31 form involves several steps to ensure it is filled out correctly. First, gather all necessary documentation, such as income statements and expense records. Next, carefully complete each section of the form, ensuring that all information is accurate and up-to-date. Once the form is filled out, review it for any errors before submission. This process helps to avoid delays in processing and potential penalties.

Steps to Complete the IT31 Form

Completing the IT31 form requires attention to detail. Here are the steps to follow:

- Obtain the latest version of the IT31 form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the required financial details, such as income and deductions.

- Double-check all entries for accuracy.

- Sign and date the form to validate it.

Legal Use of the IT31 Form

The IT31 form is legally binding when completed and submitted according to IRS regulations. It is crucial to adhere to the guidelines set forth by the IRS to ensure that the form is accepted without issues. Utilizing a reliable electronic signature solution can further enhance the legality of the submission, providing a secure method for signing and sending the document.

Filing Deadlines / Important Dates

Filing deadlines for the IT31 form can vary based on individual circumstances. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. It is important to stay informed about any changes to deadlines, as late submissions may result in penalties or interest charges. Marking important dates on your calendar can help ensure timely filing.

Form Submission Methods

The IT31 form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing times. If submitting by mail, ensure that the form is sent to the correct IRS address and consider using a trackable mailing service. In-person submissions may be available at designated IRS offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete it31 form 14315453

Effortlessly Create It31 Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without obstacles. Manage It31 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign It31 Form with Ease

- Locate It31 Form and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow accommodates your document management needs in just a few clicks from any device you prefer. Modify and electronically sign It31 Form to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it31 form 14315453

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it31 form and how is it used?

The it31 form is a legal document used for various business transactions, often requiring signatures for validation. With airSlate SignNow, you can easily create, send, and eSign the it31 form, ensuring a smooth and efficient process for all parties involved.

-

How does airSlate SignNow simplify the process of filling out an it31 form?

airSlate SignNow offers a user-friendly interface that allows you to fill out the it31 form electronically. This not only saves time but also reduces errors, making the completion of the it31 form more efficient and reliable.

-

Is there a cost associated with using airSlate SignNow for the it31 form?

Yes, while airSlate SignNow provides a cost-effective solution for eSigning documents, including the it31 form, pricing varies depending on the features you choose. You can opt for different plans that best suit your business needs, ensuring you only pay for what you use.

-

What are the key features of airSlate SignNow for the it31 form?

Key features of airSlate SignNow for the it31 form include customizable templates, secure document storage, and real-time tracking of signatures. These features enhance the utility of the it31 form, ensuring you have complete oversight and control over document workflows.

-

Can I integrate airSlate SignNow with other applications while working with the it31 form?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow when dealing with the it31 form. Popular integrations include Google Drive, Salesforce, and Microsoft Office, allowing you to manage your documents more efficiently.

-

What are the benefits of using airSlate SignNow for the it31 form?

Using airSlate SignNow for the it31 form provides numerous benefits, such as reducing turnaround time, enhancing security, and simplifying the signing process. This ensures that your document transactions are not only faster but also more secure and organized.

-

Is it safe to eSign the it31 form using airSlate SignNow?

Yes, airSlate SignNow employs top-notch security measures to protect your data while eSigning the it31 form. With encryption and compliance with industry standards, you can trust that your documents and signatures are secure.

Get more for It31 Form

- Glaze training class pdf 2016 2019 form

- Change circumstances form 2015 2019

- Dshs employment verification 2015 2019 form

- Resident inventory sheet adult family home 2017 2019 form

- Cowlitz county std case report 2016 2019 form

- Wi form waiver 2015 2019

- Wv application lieap 2016 2019 form

- Solo 401k distribution form pdf use this form to request a distribution from a participant s solo 401k account we recommend

Find out other It31 Form

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now