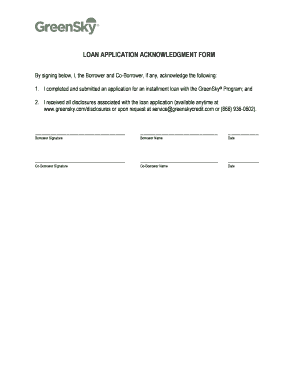

LOAN APPLICATION ACKNOWLEDGMENT FORM

Understanding the loan acknowledgement form

The loan acknowledgement form is a crucial document that serves as proof of a borrower's acceptance of the terms and conditions associated with a loan. It typically outlines the amount borrowed, the repayment schedule, and any interest rates applicable. This form is essential for both lenders and borrowers, as it formalizes the agreement and ensures that both parties are on the same page regarding the loan's specifics. In the digital age, completing this form electronically has become increasingly common, allowing for greater convenience and efficiency.

Key elements of the loan acknowledgement form

A loan acknowledgement form generally includes several important components:

- Borrower's Information: This section captures the borrower's full name, address, and contact details.

- Loan Details: It specifies the loan amount, interest rate, and repayment terms.

- Signatures: Both the borrower and lender must sign the document to validate the agreement.

- Date of Agreement: The date when the form is signed is crucial for tracking the loan's timeline.

These elements work together to ensure that the loan agreement is clear and legally binding, protecting the interests of both parties involved.

Steps to complete the loan acknowledgement form

Completing a loan acknowledgement form involves several straightforward steps:

- Gather Information: Collect all necessary details, including personal information and loan specifics.

- Fill Out the Form: Enter the required information accurately, ensuring that all fields are completed.

- Review the Document: Double-check the form for any errors or omissions before proceeding.

- Sign the Form: Both parties should sign the document to confirm their agreement to the terms.

- Store the Document: Keep a copy of the signed form for your records, as it serves as proof of the loan agreement.

Following these steps will help ensure that the loan acknowledgement form is completed correctly and is legally binding.

Legal use of the loan acknowledgement form

The loan acknowledgement form is legally recognized as a binding agreement when it meets specific legal requirements. In the United States, eSignatures are valid under the ESIGN Act and UETA, which means that a digitally signed loan acknowledgement form holds the same legal weight as a traditional paper document. It is essential to use a reliable digital platform that complies with these laws to ensure the form's validity. Additionally, maintaining proper documentation and following state-specific regulations can further reinforce the form's legal standing.

How to obtain the loan acknowledgement form

Obtaining a loan acknowledgement form can be done through various means. Most lenders provide their own version of the form as part of the loan application process. Additionally, many online platforms offer templates that can be customized to meet specific needs. It is important to ensure that the form used complies with relevant legal standards and includes all necessary elements to be considered valid. Accessing the form digitally can streamline the process and facilitate quicker completion.

Digital vs. paper version of the loan acknowledgement form

Choosing between a digital and paper version of the loan acknowledgement form depends on personal preference and specific circumstances. Digital forms offer several advantages, including ease of access, speed of completion, and automatic storage. They can be signed electronically, which simplifies the process and reduces the need for physical paperwork. Conversely, paper forms may be preferred by those who are more comfortable with traditional methods or who require a physical copy for their records. Ultimately, both versions serve the same purpose, but digital forms provide added convenience in today’s fast-paced environment.

Quick guide on how to complete loan application acknowledgment form

Prepare LOAN APPLICATION ACKNOWLEDGMENT FORM easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your files swiftly without delays. Manage LOAN APPLICATION ACKNOWLEDGMENT FORM on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign LOAN APPLICATION ACKNOWLEDGMENT FORM effortlessly

- Find LOAN APPLICATION ACKNOWLEDGMENT FORM and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your preference. Alter and eSign LOAN APPLICATION ACKNOWLEDGMENT FORM and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan application acknowledgment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan acknowledgement?

A loan acknowledgement is a formal document that recognizes the terms and conditions of a loan agreement between a lender and a borrower. It serves as proof that the borrower has received the loan amount and agrees to repay it under specified terms. Using airSlate SignNow, you can easily create and send loan acknowledgements for electronic signing.

-

How does airSlate SignNow facilitate loan acknowledgements?

airSlate SignNow allows users to create customized loan acknowledgement documents quickly and efficiently. With its easy-to-use interface, you can input loan details, add signers, and send the document for eSignature, ensuring a smooth process. This eliminates the need for paper documents and accelerates loan processing times.

-

What are the advantages of using airSlate SignNow for loan acknowledgements?

Using airSlate SignNow for loan acknowledgements provides multiple benefits, including increased efficiency, cost savings, and enhanced security. The platform allows businesses to automate the agreement process, reducing time spent on paperwork, and provides secure storage for signed documents. Additionally, it’s an environmentally friendly alternative to traditional paper methods.

-

Is there a cost associated with using airSlate SignNow for loan acknowledgements?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including options for businesses that frequently need to create loan acknowledgements. Each plan provides features tailored to enhance document management and eSigning processes. You can choose a plan based on your volume of documents and desired features.

-

What features does airSlate SignNow offer for managing loan acknowledgements?

airSlate SignNow includes a multitude of features for managing loan acknowledgements, such as template creation, team collaboration tools, and real-time tracking of document status. It also integrates with other applications such as CRM and accounting software, maximizing workflow efficiency. These features make it easier to manage loans and ensure compliance with regulations.

-

Can airSlate SignNow integrate with other software for loan acknowledgements?

Absolutely! airSlate SignNow integrates seamlessly with a range of third-party applications including CRM systems, email platforms, and payment gateways, enhancing your workflow for loan acknowledgements. This integration capability allows users to transfer data smoothly between applications, saving time and reducing errors.

-

How secure is the loan acknowledgement process with airSlate SignNow?

The loan acknowledgement process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication protocols to protect sensitive information. The platform ensures compliance with industry standards and regulations to keep your documents safe. You can sign, send, and store loan acknowledgements with peace of mind.

Get more for LOAN APPLICATION ACKNOWLEDGMENT FORM

Find out other LOAN APPLICATION ACKNOWLEDGMENT FORM

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement