Form W 8BEN Certificate of Foreign Status of Beneficial

What is the Form W-8BEN Certificate Of Foreign Status Of Beneficial

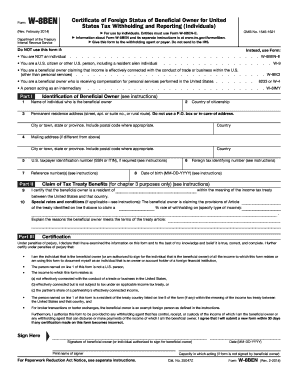

The Form W-8BEN, officially known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is a crucial document for non-U.S. persons. It certifies that the individual or entity submitting the form is a foreign person and thus entitled to certain benefits under U.S. tax law. This form is primarily used to claim tax treaty benefits, which can reduce or eliminate U.S. withholding tax on certain types of income, such as dividends or interest. By submitting the W-8BEN, foreign individuals can ensure they are not subject to higher withholding rates that apply to U.S. residents.

How to use the Form W-8BEN Certificate Of Foreign Status Of Beneficial

The W-8BEN form is utilized by foreign individuals to establish their non-U.S. status for tax purposes. To use the form, individuals must complete it accurately, providing personal information such as name, country of citizenship, and address. Once completed, the form should be submitted to the withholding agent or financial institution that requires it. This form does not get sent to the IRS directly; instead, it serves as documentation for the withholding agent to apply the correct tax treatment. It is essential to keep a copy for personal records as well.

Steps to complete the Form W-8BEN Certificate Of Foreign Status Of Beneficial

Completing the W-8BEN involves several straightforward steps:

- Provide your name and country of citizenship in Part I.

- Enter your permanent address, ensuring it is outside the United States.

- Fill in your mailing address if it differs from your permanent address.

- Complete the Taxpayer Identification Number (TIN) section, if applicable.

- Sign and date the form, certifying that the information provided is accurate.

After filling out the form, review it for accuracy before submission to avoid delays or issues with tax withholding.

Legal use of the Form W-8BEN Certificate Of Foreign Status Of Beneficial

The legal use of the W-8BEN form is essential for compliance with U.S. tax laws. By submitting this form, foreign individuals can legally claim benefits under tax treaties between their country and the United States. It protects them from being taxed at the higher default rates applicable to U.S. residents. Failure to provide a valid W-8BEN when required can result in the withholding agent applying the maximum withholding tax rate, which can significantly impact income received from U.S. sources.

Key elements of the Form W-8BEN Certificate Of Foreign Status Of Beneficial

Several key elements make up the W-8BEN form:

- Identification Information: This includes the name, country of citizenship, and address of the beneficial owner.

- Claim of Tax Treaty Benefits: This section allows individuals to claim reduced withholding rates based on applicable tax treaties.

- Signature and Certification: The form must be signed and dated by the beneficial owner to confirm the accuracy of the information provided.

Each of these elements is crucial for ensuring proper tax treatment and compliance with U.S. regulations.

Eligibility Criteria

To be eligible to use the W-8BEN form, individuals must meet specific criteria:

- Must be a non-U.S. person, which includes foreign individuals and entities.

- Should have income from U.S. sources that is subject to withholding tax.

- Must not be a resident alien for U.S. tax purposes.

Meeting these criteria is essential for successfully claiming benefits and ensuring compliance with U.S. tax laws.

Quick guide on how to complete form w 8ben certificate of foreign status of beneficial

Effortlessly Prepare Form W 8BEN Certificate Of Foreign Status Of Beneficial on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents since you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Form W 8BEN Certificate Of Foreign Status Of Beneficial on any platform using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

How to Edit and Electronically Sign Form W 8BEN Certificate Of Foreign Status Of Beneficial with Ease

- Obtain Form W 8BEN Certificate Of Foreign Status Of Beneficial and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature utilizing the Sign tool, which only takes seconds and holds the same legal validity as an ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, and the need to print new copies due to errors. airSlate SignNow meets all your document management needs with just a few clicks from any device. Edit and electronically sign Form W 8BEN Certificate Of Foreign Status Of Beneficial to ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8ben certificate of foreign status of beneficial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 8BEN Certificate Of Foreign Status Of Beneficial?

The Form W 8BEN Certificate Of Foreign Status Of Beneficial is a tax document used by foreign persons to signNow their foreign status for tax withholding purposes. It helps avoid double taxation on income effectively by allowing foreign entities to claim reduced withholding rates on U.S. source income.

-

How can airSlate SignNow help with the Form W 8BEN Certificate Of Foreign Status Of Beneficial?

airSlate SignNow makes it easy to create, send, and securely eSign the Form W 8BEN Certificate Of Foreign Status Of Beneficial. Our intuitive interface streamlines the process, ensuring that you can complete and submit this vital document efficiently.

-

Are there any pricing plans for using airSlate SignNow for the Form W 8BEN Certificate Of Foreign Status Of Beneficial?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. You can select a plan that fits your budget and needs, allowing for unlimited sending and signing of important documents like the Form W 8BEN Certificate Of Foreign Status Of Beneficial.

-

What features does airSlate SignNow offer for managing the Form W 8BEN Certificate Of Foreign Status Of Beneficial?

airSlate SignNow provides features such as document templates, real-time tracking, reminders, and secure storage for managing the Form W 8BEN Certificate Of Foreign Status Of Beneficial. These features help ensure that your documents are organized and easily accessible.

-

Can I integrate airSlate SignNow with other software to manage the Form W 8BEN Certificate Of Foreign Status Of Beneficial?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, including CRM and accounting software. This integration enables efficient management of the Form W 8BEN Certificate Of Foreign Status Of Beneficial alongside your existing business processes.

-

Is airSlate SignNow secure for completing the Form W 8BEN Certificate Of Foreign Status Of Beneficial?

Yes, airSlate SignNow prioritizes security by using encryption and secure servers to protect your documents, including the Form W 8BEN Certificate Of Foreign Status Of Beneficial. You can trust that your sensitive information remains secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the Form W 8BEN Certificate Of Foreign Status Of Beneficial?

Using airSlate SignNow for the Form W 8BEN Certificate Of Foreign Status Of Beneficial offers numerous benefits, such as faster processing times, reduced paper use, and improved compliance with tax regulations. This streamlined approach helps save time and resources for your business.

Get more for Form W 8BEN Certificate Of Foreign Status Of Beneficial

Find out other Form W 8BEN Certificate Of Foreign Status Of Beneficial

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors