ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard

What is the Reliance Standard Annuity Withdrawal Form?

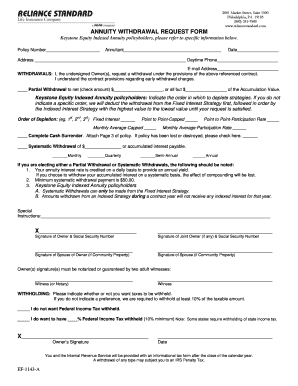

The Reliance Standard Annuity Withdrawal Form is a crucial document that allows policyholders to request withdrawals from their annuity accounts. This form is designed to facilitate the process of accessing funds that have been accumulated in an annuity contract. It includes essential information such as the account holder's details, the specific amount requested for withdrawal, and the purpose of the withdrawal. Understanding this form is vital for ensuring that the withdrawal process is completed smoothly and in compliance with the terms of the annuity contract.

Steps to Complete the Reliance Standard Annuity Withdrawal Form

Completing the Reliance Standard Annuity Withdrawal Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather Required Information: Collect your personal details, including your policy number, contact information, and Social Security number.

- Specify Withdrawal Amount: Clearly indicate the amount you wish to withdraw from your annuity account.

- Provide Purpose: State the reason for the withdrawal, as this may be required for compliance purposes.

- Review Terms: Read through the terms and conditions associated with your annuity to understand any potential penalties or fees.

- Sign and Date: Ensure you sign and date the form to validate your request.

How to Obtain the Reliance Standard Annuity Withdrawal Form

The Reliance Standard Annuity Withdrawal Form can be obtained through several channels. Policyholders can visit the official Reliance Standard website, where forms are often available for download. Additionally, contacting customer service can provide direct access to the necessary forms, ensuring that you receive the most current version. It is essential to use the official form to avoid any issues during the withdrawal process.

Legal Use of the Reliance Standard Annuity Withdrawal Form

The legal validity of the Reliance Standard Annuity Withdrawal Form is contingent upon proper completion and submission. To ensure that your form is legally recognized, it must meet specific requirements under U.S. law. This includes providing accurate information, obtaining necessary signatures, and adhering to any state-specific regulations that may apply. Utilizing a reliable eSignature solution can further enhance the legal standing of your submission, ensuring compliance with electronic signature laws.

Key Elements of the Reliance Standard Annuity Withdrawal Form

Understanding the key elements of the Reliance Standard Annuity Withdrawal Form is essential for a successful withdrawal process. Important components include:

- Account Holder Information: Personal details of the individual requesting the withdrawal.

- Policy Number: Unique identifier for the annuity contract.

- Withdrawal Amount: The specific sum being requested.

- Signature: Required to authorize the transaction.

- Date: The date on which the form is completed and submitted.

Form Submission Methods for the Reliance Standard Annuity Withdrawal Form

Submitting the Reliance Standard Annuity Withdrawal Form can be done through various methods, depending on the preferences of the policyholder. Common submission methods include:

- Online Submission: Many companies offer the option to submit forms electronically through their secure portals.

- Mail: Completed forms can be sent to the designated address provided by Reliance Standard.

- In-Person: Some policyholders may prefer to deliver their forms directly to a local office for immediate processing.

Quick guide on how to complete annuity withdrawal request form reliance standard

Complete ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard without hassle

- Obtain ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annuity withdrawal request form reliance standard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Reliance Standard annuity forms?

Reliance Standard annuity forms are essential documents used to initiate and manage annuity contracts with Reliance Standard. These forms facilitate the application process, ensuring that all necessary information is collected for proper account setup. Utilizing airSlate SignNow, you can easily eSign and submit these forms, streamlining your experience.

-

How can airSlate SignNow help with Reliance Standard annuity forms?

airSlate SignNow simplifies the process of completing and signing Reliance Standard annuity forms. With its user-friendly interface, businesses can quickly send and eSign these documents, reducing paperwork and expediting transactions. This efficiency can enhance customer satisfaction and improve overall workflow.

-

Are there any costs associated with using airSlate SignNow for Reliance Standard annuity forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Reliance Standard annuity forms. You can choose from various pricing plans tailored to your business needs, ensuring you only pay for the features that work best for you. The investment often leads to signNow savings in time and resources.

-

Do I need any technical skills to use airSlate SignNow for Reliance Standard annuity forms?

No, airSlate SignNow is designed to be intuitive and user-friendly, requiring no technical skills to manage Reliance Standard annuity forms. Even users with minimal experience can navigate the platform easily, making it accessible for all team members. Training and support resources are also available to assist you.

-

What key features does airSlate SignNow offer for Reliance Standard annuity forms?

airSlate SignNow provides several key features for Reliance Standard annuity forms, including eSigning, document tracking, and customizable templates. These features simplify the management of forms, ensuring you can monitor the signing process and ensure compliance. Easily integrate with existing systems for greater efficiency.

-

Can airSlate SignNow integrate with other software to handle Reliance Standard annuity forms?

Absolutely! airSlate SignNow offers seamless integrations with various platforms that can enhance the handling of Reliance Standard annuity forms. You can easily connect with CRM systems, cloud storage services, and more, enabling a streamlined workflow. This connectivity helps centralize your data management.

-

What are the benefits of using airSlate SignNow for Reliance Standard annuity forms?

Using airSlate SignNow for Reliance Standard annuity forms offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security. The electronic signing process eliminates delays associated with paper forms while also reducing human error. Additionally, your documents are securely stored and easily retrievable.

Get more for ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard

Find out other ANNUITY WITHDRAWAL REQUEST FORM Reliance Standard

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement