Irs Schedule D Form 2013

What is the IRS Schedule D Form

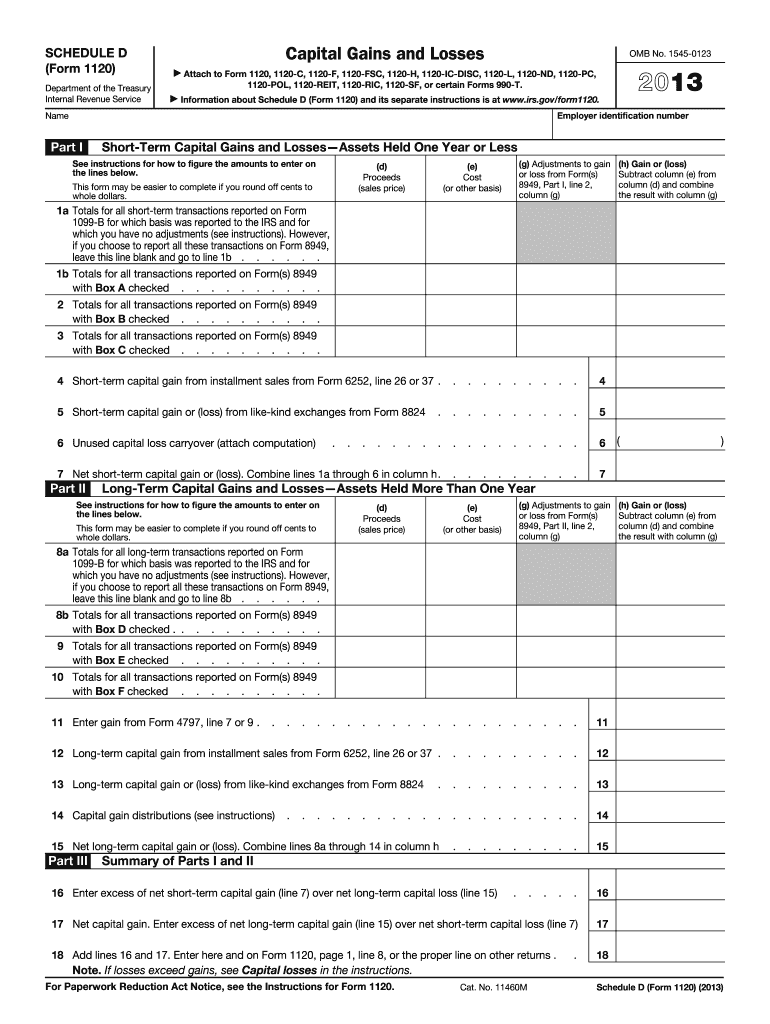

The IRS Schedule D Form is a tax document used by individuals and businesses to report capital gains and losses from the sale of securities or assets. This form is essential for taxpayers who have engaged in transactions involving stocks, bonds, or other capital assets during the tax year. By detailing these transactions, the form helps determine the overall tax liability related to capital gains, which can significantly impact the total amount owed or refunded during tax filing. Understanding the purpose and requirements of the IRS Schedule D Form is crucial for accurate tax reporting.

How to Use the IRS Schedule D Form

To effectively use the IRS Schedule D Form, taxpayers must first gather all relevant information regarding their capital transactions. This includes details such as the date of acquisition, date of sale, purchase price, sale price, and any associated costs. After collecting this information, individuals can fill out the form by categorizing their gains and losses into short-term and long-term sections. Short-term gains are typically taxed at ordinary income rates, while long-term gains may benefit from lower tax rates. Properly completing this form is vital for ensuring compliance with IRS regulations and accurately reporting financial activity.

Steps to Complete the IRS Schedule D Form

Completing the IRS Schedule D Form involves several key steps:

- Gather all necessary documentation related to capital asset transactions.

- Determine which transactions are classified as short-term and which are long-term.

- Fill out the form by entering the details of each transaction, including dates, amounts, and any adjustments.

- Calculate total gains and losses by summing the results from both the short-term and long-term sections.

- Transfer the final totals to your main tax return form, typically Form 1040.

Following these steps ensures that the IRS Schedule D Form is completed accurately, minimizing the risk of errors that could lead to penalties or audits.

Legal Use of the IRS Schedule D Form

The IRS Schedule D Form is legally binding when completed and submitted according to IRS guidelines. Taxpayers must ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal repercussions. The form must be filed with the individual's annual tax return, and it is essential to retain copies of all supporting documents for future reference. Compliance with tax laws is critical, and using the IRS Schedule D Form correctly helps maintain legal standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule D Form align with the annual tax return due date, which is typically April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may file for their tax returns, as these will also apply to the Schedule D Form. Keeping track of these important dates is vital for timely and compliant tax filing.

Form Submission Methods

The IRS Schedule D Form can be submitted in various ways, allowing flexibility for taxpayers. The primary methods include:

- Online submission through e-filing, which is often the fastest and most efficient method.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, though this method is less common.

Choosing the right submission method can impact the processing time and overall experience, so taxpayers should consider their options carefully.

Quick guide on how to complete 2013 irs schedule d form

Accomplish Irs Schedule D Form effortlessly on any gadget

Web-based document management has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and eSign your documents swiftly without delays. Manage Irs Schedule D Form on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Irs Schedule D Form with ease

- Obtain Irs Schedule D Form and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would prefer to transmit your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your choice. Alter and eSign Irs Schedule D Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs schedule d form

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Irs Schedule D Form?

The Irs Schedule D Form is used to report capital gains and losses from the sale of securities and assets. This form is crucial for calculating your tax obligations accurately. Understanding how to complete the Irs Schedule D Form can help you manage your finances effectively.

-

How can airSlate SignNow help with the Irs Schedule D Form?

airSlate SignNow simplifies the process of signing and sending your Irs Schedule D Form. Our platform allows users to create, eSign, and manage documents efficiently, ensuring that your tax forms are handled seamlessly. This streamlined process saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for the Irs Schedule D Form?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure document storage, making it ideal for handling the Irs Schedule D Form. Users can create tailored solutions for their tax documents while ensuring compliance and security. These features enhance efficiency and ensure accurate submissions.

-

Is there a cost associated with using airSlate SignNow for the Irs Schedule D Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including options for handling the Irs Schedule D Form. Our cost-effective solutions make it accessible for individuals and businesses alike. Explore our pricing page for more details on features available at each level.

-

Can I integrate airSlate SignNow with other applications for the Irs Schedule D Form?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing how you manage the Irs Schedule D Form. By linking with accounting tools or document management systems, you can streamline your tax preparation process and ensure that all related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for my Irs Schedule D Form submissions?

Using airSlate SignNow for your Irs Schedule D Form submissions provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform helps you stay organized and ensures that your documents are legally compliant and easily retrievable. Users can also track the status of their submissions in real time.

-

Is it easy to eSign the Irs Schedule D Form with airSlate SignNow?

Yes, it is very easy to eSign the Irs Schedule D Form using airSlate SignNow. Our user-friendly interface guides you through the signing process, allowing you to complete your tax forms without complications. You can sign documents from any device, making it convenient and fast.

Get more for Irs Schedule D Form

Find out other Irs Schedule D Form

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online