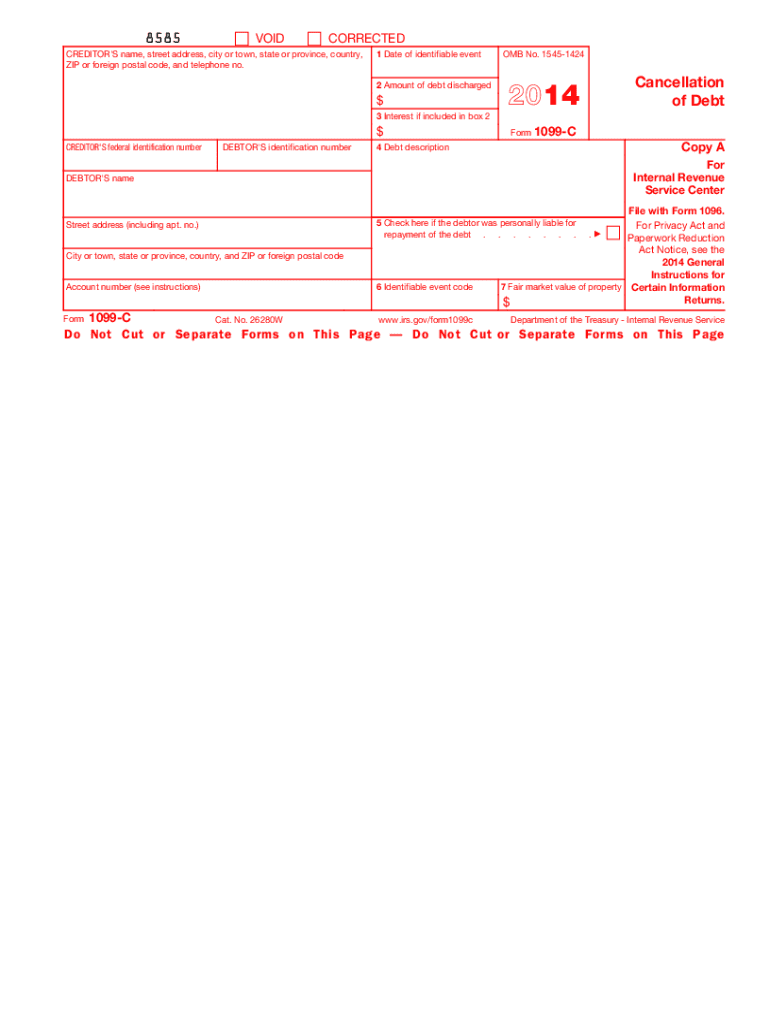

1099 C Form 2014

What is the 1099 C Form

The 1099 C Form, officially known as the Cancellation of Debt form, is a tax document used in the United States to report the cancellation of a debt of $600 or more. This form is typically issued by financial institutions, lenders, or other creditors when they forgive a debt, which may include credit card debt, personal loans, or other types of financial obligations. The IRS considers canceled debt as taxable income, meaning that individuals may need to report this income when filing their taxes.

How to use the 1099 C Form

To use the 1099 C Form effectively, individuals must first receive it from the creditor who canceled the debt. Once received, it is essential to review the information for accuracy, including the amount of debt canceled and the creditor's details. Taxpayers should then report the canceled debt as income on their federal tax return, typically on Form 1040. Depending on the circumstances, individuals may qualify for exceptions or exclusions that can reduce their taxable income, such as insolvency or bankruptcy.

Steps to complete the 1099 C Form

Completing the 1099 C Form involves several steps:

- Gather necessary information, including the creditor's name, address, and taxpayer identification number.

- Enter the debtor's information, including name, address, and taxpayer identification number.

- Fill in the amount of debt canceled in Box 2.

- Specify the date of cancellation in Box 1.

- Complete any additional boxes that may apply, such as the type of debt in Box 3.

- Review the form for accuracy before submission.

Legal use of the 1099 C Form

The legal use of the 1099 C Form is governed by IRS regulations. Creditors are required to issue this form when they cancel a debt of $600 or more, ensuring compliance with tax reporting obligations. Recipients of the form must report the canceled debt as income on their tax returns. Failure to report this income can lead to penalties and interest on unpaid taxes. It is crucial for both creditors and debtors to maintain accurate records of any canceled debts.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 C Form are critical for compliance. Creditors must send the form to the IRS by February 28 if filing by paper or by March 31 if filing electronically. Additionally, creditors must provide a copy to the debtor by January 31. Taxpayers should include the canceled debt on their tax returns by the standard filing deadline, typically April 15, unless they file for an extension.

Who Issues the Form

The 1099 C Form is issued by creditors, which can include banks, credit unions, credit card companies, and other financial institutions. These entities are required to report any canceled debts to the IRS and to the debtor. It is important for debtors to keep track of any 1099 C Forms received, as they will need this information for their tax filings.

Quick guide on how to complete 1099 c 2014 form

Easily Prepare 1099 C Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the proper form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your files swiftly without any delays. Manage 1099 C Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven task today.

How to Modify and Electronically Sign 1099 C Form with Ease

- Find 1099 C Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive data with specialized tools that airSlate SignNow provides for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Forget about lost or misplaced documents, lengthy form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign 1099 C Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 c 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 c 2014 form

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a 1099 C Form and when do I need it?

A 1099 C Form is a tax document used by creditors to report the cancellation of debt to the IRS. You will need it when a debt of $600 or more is forgiven or canceled, as it can affect your tax obligations. It's essential to ensure you receive this form if applicable to avoid any tax issues.

-

How can airSlate SignNow help me with my 1099 C Form?

AirSlate SignNow simplifies the process of sending and signing your 1099 C Form electronically. With our user-friendly platform, you can easily upload the form, send it to the necessary parties for eSignature, and securely store it all in one place. This streamlines your workflow and ensures compliance with IRS requirements.

-

Is airSlate SignNow cost-effective for handling 1099 C Forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing your 1099 C Form. By utilizing our platform, you can save on printing, mailing, and storage costs, while also enhancing your efficiency in document management.

-

What features does airSlate SignNow offer for 1099 C Form processing?

AirSlate SignNow provides features like electronic signatures, customizable templates, and document tracking specifically for the 1099 C Form. These tools enable you to send, sign, and manage your tax documents seamlessly, ensuring that you stay organized and compliant with tax regulations.

-

Can I integrate airSlate SignNow with my accounting software for 1099 C Forms?

Yes, airSlate SignNow easily integrates with popular accounting software, allowing for smooth data transfer and management of 1099 C Forms. This integration helps streamline your entire financial process, ensuring that all your tax documents are accurately processed and stored.

-

What are the benefits of using airSlate SignNow for eSigning my 1099 C Form?

Using airSlate SignNow for eSigning your 1099 C Form offers benefits such as enhanced security, time savings, and improved tracking. Our platform ensures that your documents are signed quickly and securely, reducing the turnaround time and allowing you to meet deadlines effortlessly.

-

Is it safe to use airSlate SignNow for sensitive documents like the 1099 C Form?

Absolutely! AirSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your sensitive documents like the 1099 C Form. You can trust that your information is safe while you manage your tax forms electronically.

Get more for 1099 C Form

- The american express personal additional card application form

- Agreement advance of petty cash funds the employee form

- Affiliated business arrangement disclosure wells fargo form

- Vystar down form

- Important check x the appropriate boxes below and complete the applicable sections form

- Information intake form for pida loan

- The medical assisting ma program is accredited by the commission on accreditation of allied health form

- Visa credit cardresponders emergency services credit form

Find out other 1099 C Form

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free