Schedule a Form 1040 2013

What is the Schedule A Form 1040

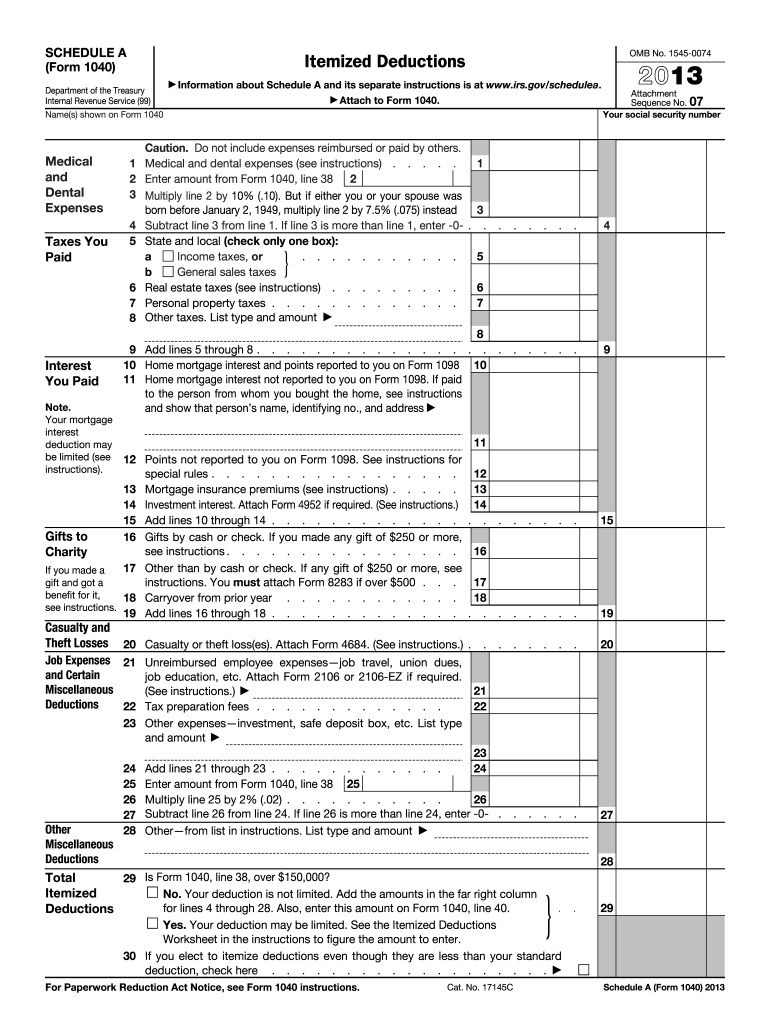

The Schedule A Form 1040 is a tax form used by individual taxpayers in the United States to report itemized deductions. This form allows taxpayers to detail various deductions that can reduce their taxable income, ultimately lowering their overall tax liability. Common deductions reported on Schedule A include medical expenses, state and local taxes, mortgage interest, and charitable contributions. By using this form, taxpayers can choose to itemize their deductions instead of taking the standard deduction, which may be more beneficial depending on their specific financial situation.

How to use the Schedule A Form 1040

Using the Schedule A Form 1040 involves several steps to ensure accurate reporting of itemized deductions. Taxpayers first need to gather all relevant financial documents, such as receipts and statements for deductible expenses. After that, they should fill out the form by entering the amounts for each category of deduction. It is essential to follow the IRS guidelines closely, as inaccuracies can lead to delays or penalties. Once completed, the form should be attached to the main Form 1040 when filing taxes.

Steps to complete the Schedule A Form 1040

Completing the Schedule A Form 1040 requires careful attention to detail. Here are the general steps:

- Gather all necessary documentation, including receipts for medical expenses, property tax statements, and charitable contribution records.

- Begin filling out the form by entering your medical and dental expenses in the appropriate section, ensuring to include only the qualifying amounts.

- Next, report state and local taxes, including income or sales taxes paid.

- Fill in the mortgage interest and points paid, along with any other relevant deductions such as gifts to charity.

- Calculate the total itemized deductions and ensure they are accurately reflected on your main Form 1040.

Key elements of the Schedule A Form 1040

The Schedule A Form 1040 comprises several key elements that are crucial for accurate tax reporting. These include:

- Medical and Dental Expenses: This section allows taxpayers to report qualifying medical expenses that exceed a certain percentage of their adjusted gross income.

- Taxes You Paid: Taxpayers can report state and local income taxes, sales taxes, and property taxes here.

- Interest You Paid: This section covers mortgage interest and points paid on loans secured by the taxpayer's home.

- Gifts to Charity: Taxpayers can report contributions made to qualified charitable organizations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Schedule A Form 1040. These guidelines include details on what qualifies as a deductible expense, limits on certain deductions, and documentation requirements. Taxpayers should refer to the IRS instructions for Schedule A to ensure compliance with current tax laws and regulations. Understanding these guidelines is essential for maximizing deductions and avoiding potential issues during the tax filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule A Form 1040 align with the standard tax return deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 each year. If this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers seeking an extension can file Form 4868 to receive an additional six months to submit their returns. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 2013 schedule a form 1040

Complete Schedule A Form 1040 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Schedule A Form 1040 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Schedule A Form 1040 with ease

- Find Schedule A Form 1040 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or mask sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Schedule A Form 1040 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 schedule a form 1040

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule a form 1040

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the process to Schedule A Form 1040 using airSlate SignNow?

To Schedule A Form 1040 with airSlate SignNow, simply upload your form on our platform, add the necessary fields for signatures, and send it to your recipients. They can easily eSign the document online, which streamlines the entire process. Our user-friendly interface ensures that scheduling your Form 1040 is quick and hassle-free.

-

How much does it cost to use airSlate SignNow for scheduling a Form 1040?

airSlate SignNow offers competitive pricing plans that cater to various needs, including options for individual users and businesses. You can choose a plan that fits your budget while enjoying the ability to easily Schedule A Form 1040. Check our pricing page for details on subscriptions and any available discounts.

-

What features does airSlate SignNow offer for scheduling Form 1040?

With airSlate SignNow, you can enjoy features like document templates, real-time tracking, and customizable signing workflows, which make scheduling your Form 1040 efficient. Additionally, you can integrate with various tools and applications to enhance your productivity. These features simplify the process and ensure your documents are handled securely.

-

Can I integrate airSlate SignNow with other software when scheduling Form 1040?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and CRM systems. This allows you to easily access and manage your documents while scheduling your Form 1040. Our integration capabilities enhance your workflow and save you time.

-

Is airSlate SignNow secure for scheduling sensitive documents like Form 1040?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your documents. When you Schedule A Form 1040, you can rest assured that your personal and financial information is safe and secure.

-

Can I track the status of my Form 1040 once I schedule it with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents you send, including your Form 1040. You will receive notifications when recipients view or complete the signing process. This feature helps you stay informed and manage your documents effectively.

-

What benefits do I get from using airSlate SignNow to Schedule A Form 1040?

Using airSlate SignNow to Schedule A Form 1040 offers numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times on document signing. Our platform simplifies the process, allowing you to focus more on your business while ensuring your forms are completed accurately and promptly.

Get more for Schedule A Form 1040

- Personal use program form rgf environmental group

- Independent contractor application form bnelrodb

- Fairvue plantation architectural review board arb plan submittal form

- Self inspection handbook for nisp contractors 2019 form

- Document 00 6536 contractor warranty form project zenith

- Bwarranty formb kbd group inc

- Partial unconditional waiver form

- Construction pay application form

Find out other Schedule A Form 1040

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple