5471 Schedule O Form

What is the 5471 Schedule O

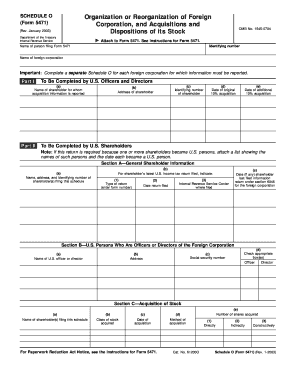

The 5471 Schedule O is a crucial component of the Form 5471, which is used by U.S. citizens and residents to report their interests in foreign corporations. This schedule specifically focuses on the organization and financial structure of these foreign entities. It provides detailed information about the foreign corporation's ownership, management, and operations, helping the IRS assess the tax implications for U.S. taxpayers involved with foreign businesses.

Steps to complete the 5471 Schedule O

Completing the 5471 Schedule O involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the foreign corporation, including its name, address, and Employer Identification Number (EIN). Next, identify the U.S. shareholders and their respective ownership percentages. Fill out the schedule by providing detailed information about the foreign corporation's activities, financial statements, and any changes in ownership during the reporting period. Finally, review the completed form for accuracy before submission.

Legal use of the 5471 Schedule O

The legal use of the 5471 Schedule O is governed by U.S. tax laws, which require U.S. taxpayers to report their foreign investments. Failing to file this schedule can lead to significant penalties. The information provided must be accurate and complete, as it helps the IRS monitor compliance with tax regulations related to foreign entities. Understanding the legal obligations surrounding this form is essential for avoiding potential legal issues and ensuring that all tax responsibilities are met.

IRS Guidelines

The IRS has established specific guidelines for completing and filing the 5471 Schedule O. These guidelines outline the necessary information required, the deadlines for submission, and the penalties for non-compliance. Taxpayers must adhere to these guidelines to ensure that their filings are accepted and that they remain in good standing with the IRS. It is advisable to consult the latest IRS publications or a tax professional for detailed instructions and updates regarding the form.

Filing Deadlines / Important Dates

Filing deadlines for the 5471 Schedule O are critical for compliance. Typically, the form is due on the same date as the U.S. tax return for the taxpayer. Extensions may be available, but they do not automatically extend the deadline for the 5471 Schedule O. It is essential to mark important dates on your calendar to avoid late filing penalties. Keeping track of these deadlines ensures that you fulfill your reporting obligations in a timely manner.

Examples of using the 5471 Schedule O

Examples of using the 5471 Schedule O can help clarify its application. For instance, a U.S. citizen who owns a twenty percent stake in a foreign corporation must report this interest using the schedule. Another example includes a U.S. corporation that holds shares in a foreign subsidiary; it must also file the 5471 Schedule O to disclose its ownership and the subsidiary's financial activities. These examples illustrate the importance of accurate reporting for various taxpayer scenarios.

Quick guide on how to complete 5471 schedule o

Complete 5471 Schedule O effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely retain it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage 5471 Schedule O on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 5471 Schedule O seamlessly

- Obtain 5471 Schedule O then click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 5471 Schedule O and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5471 schedule o

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5471 sch o form, and why is it important?

The 5471 sch o form is essential for U.S. taxpayers with foreign corporations. It provides crucial information to the IRS regarding ownership and financial details of these entities. Understanding the details of the 5471 sch o helps ensure compliance and avoid potential penalties.

-

How can airSlate SignNow assist with the 5471 sch o process?

airSlate SignNow streamlines the documentation process for the 5471 sch o by allowing users to electronically sign and send necessary documents securely. Its user-friendly interface simplifies managing these complex forms, ensuring all signatures are captured promptly and efficiently.

-

Is airSlate SignNow affordable for small businesses managing 5471 sch o forms?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes, including small businesses. Investing in this solution can save signNow time and resources, especially when dealing with crucial forms like the 5471 sch o.

-

What features does airSlate SignNow offer for enhancing 5471 sch o submissions?

With airSlate SignNow, users can enjoy features such as online document signing, templates for frequent tasks, and secure cloud storage. These features ensure that the submission process for the 5471 sch o is both efficient and compliant with regulatory requirements.

-

Can airSlate SignNow integrate with other tools to optimize 5471 sch o management?

Absolutely! airSlate SignNow integrates with a range of business applications, including CRM and accounting software. This connectivity allows for seamless management of your documents related to the 5471 sch o, making the entire process smoother and more efficient.

-

What benefits can I expect from using airSlate SignNow for 5471 sch o documents?

Using airSlate SignNow for your 5471 sch o documents offers numerous benefits, including improved compliance, faster document turnaround times, and enhanced security for sensitive information. It's a comprehensive solution designed to meet the needs of modern businesses managing foreign taxes.

-

How secure is airSlate SignNow when handling sensitive documents like the 5471 sch o?

Security is a top priority for airSlate SignNow. It employs advanced encryption protocols and secure storage solutions to protect sensitive documents, including the 5471 sch o. Users can trust that their information remains confidential and secure throughout the signing process.

Get more for 5471 Schedule O

Find out other 5471 Schedule O

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document