Tax Form 8965

What is the Tax Form 8965

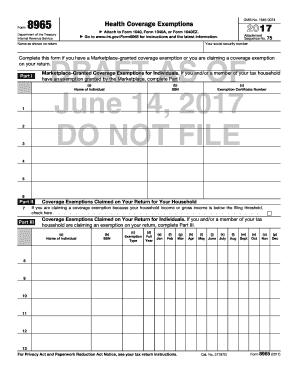

The tax form 8965 is used to report a taxpayer's health coverage status and to claim an exemption from the Affordable Care Act's individual mandate. This form is essential for individuals who did not have health coverage for all or part of the year and wish to avoid a penalty when filing their federal income tax return. The form requires specific information about the months during which the taxpayer was uninsured and the reason for the exemption, such as financial hardship or eligibility for certain programs.

How to obtain the Tax Form 8965

To obtain the tax form 8965, individuals can visit the official IRS website, where forms are available for download. The form can also be requested through tax preparation software or obtained from tax professionals. Additionally, physical copies may be available at local IRS offices or libraries that provide tax resources. It is important to ensure that you have the correct version of the form for the tax year you are filing.

Steps to complete the Tax Form 8965

Completing the tax form 8965 involves several key steps:

- Gather necessary information, including details about your health coverage status for each month of the tax year.

- Fill out Part I of the form, indicating the months you were without coverage.

- Complete Part II to claim your exemption, providing the appropriate reason and any required documentation.

- Review the form for accuracy and completeness before submitting it with your tax return.

Legal use of the Tax Form 8965

The legal use of the tax form 8965 is governed by IRS regulations regarding health coverage exemptions. It is crucial to ensure that the information provided is accurate and truthful, as submitting false information can lead to penalties. The form must be filed along with your federal tax return to ensure compliance with the Affordable Care Act's requirements. Understanding the legal implications of the exemptions claimed on the form is essential for taxpayers to avoid potential legal issues.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the tax form 8965. Generally, the form is due on the same date as your federal income tax return, which is typically April 15 of each year. If you are unable to file by this date, you may request an extension, but it is important to ensure that the form is submitted by the extended deadline to avoid penalties. Keeping track of these important dates is essential for compliance.

Eligibility Criteria

To qualify for an exemption using the tax form 8965, taxpayers must meet specific eligibility criteria. These may include being uninsured for a certain period, experiencing financial hardship, or being eligible for certain government programs. Understanding these criteria is crucial for accurately completing the form and ensuring that you qualify for the exemptions claimed. It is advisable to review the IRS guidelines to confirm your eligibility before filing.

Quick guide on how to complete tax form 8965

Complete Tax Form 8965 effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without hold-ups. Manage Tax Form 8965 on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Tax Form 8965 with ease

- Obtain Tax Form 8965 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Form 8965 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form 8965

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8965 and why do I need it?

Form 8965 is used by individuals to indicate their health coverage exemptions when filing taxes. Understanding how to properly fill out form 8965 is crucial to avoid penalties. airSlate SignNow simplifies the signing and submission process, ensuring you can quickly manage your exemptions.

-

How does airSlate SignNow help with form 8965?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your form 8965. With our cost-effective solution, you can ensure that your form is filled out accurately and securely. Additionally, our platform enhances collaboration with your tax professionals for a smoother filing process.

-

Is there a cost to use airSlate SignNow for form 8965?

Using airSlate SignNow to manage your form 8965 comes with various pricing plans designed to fit different needs. Our subscription plans are cost-effective, allowing businesses and individuals to manage multiple documents without breaking the bank. You can try our service with a free trial to see if it meets your needs.

-

What features does airSlate SignNow offer for form 8965?

airSlate SignNow offers a wide range of features for handling form 8965, including templates, document storage, and secure eSignature capabilities. The platform enables users to track changes and manage document workflows efficiently. These features make preparing your form 8965 easier and more streamlined.

-

Can I integrate airSlate SignNow with other applications for form 8965?

Yes, airSlate SignNow seamlessly integrates with various applications that can assist in managing your form 8965. This includes popular tools like Google Drive, Salesforce, and others that can enhance your document management capabilities. Integrations help unify your workflow and keep all your files organized.

-

Is airSlate SignNow secure for submitting form 8965?

Absolutely! airSlate SignNow prioritizes the security of your documents, including form 8965. We employ advanced encryption and compliance measures to protect your sensitive information during submission and storage, allowing you to file with confidence.

-

How can I get support for issues related to form 8965?

If you encounter issues while using airSlate SignNow for form 8965, our customer support team is here to help. You can access our support resources via tutorials, FAQ sections, and direct customer service. We aim to ensure you have a smooth experience while completing your form 8965.

Get more for Tax Form 8965

- Montgomery county homestead exemption form

- Jdf 1115 separation agreement denver divorce attorney form

- American judgement decree 2008 form

- Final divorce decree georgia form

- Settlement agreement with minor children form

- Gpcsf 5 2007 form

- Answer and counterclaim form

- Crtc 1 and crtc 2 institute of continuing judicial education icje uga form

Find out other Tax Form 8965

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract