Form LLC 12NC LLC Statement of No Change 2017

What is the Form LLC 12NC LLC Statement Of No Change

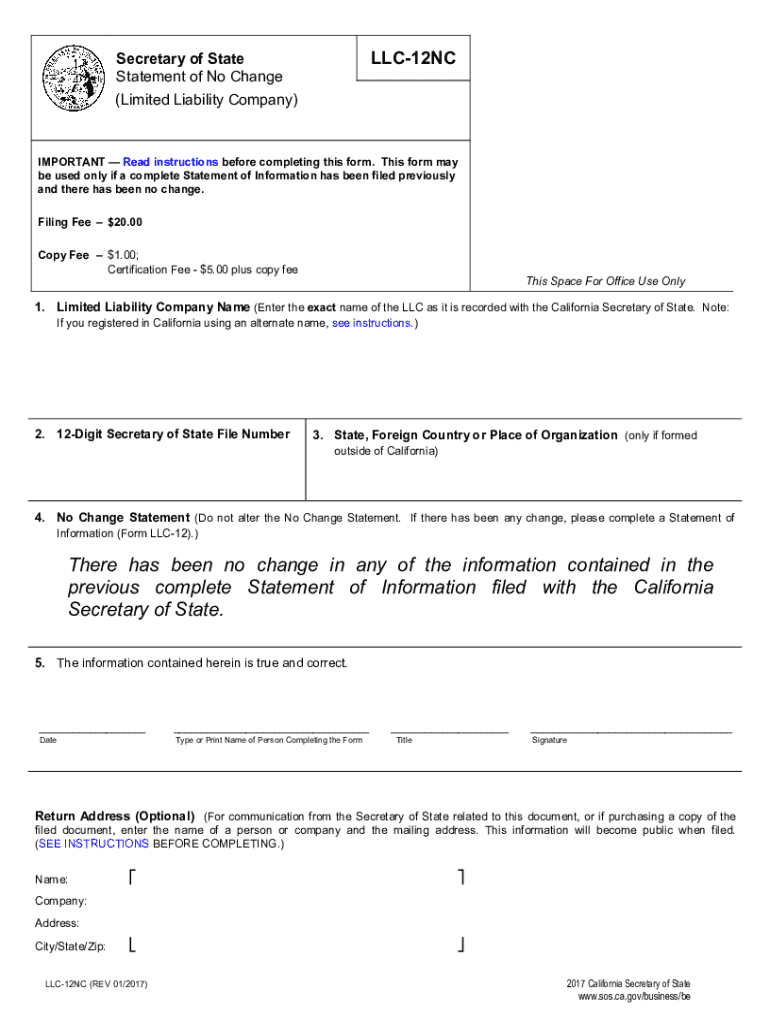

The Form LLC 12NC LLC Statement Of No Change is a legal document used by limited liability companies (LLCs) in the United States to confirm that there have been no changes to the information previously submitted to the state. This form is essential for maintaining compliance with state regulations and ensuring that the company's records are up to date. It typically includes basic information about the LLC, such as its name, address, and the names of its members or managers.

Steps to complete the Form LLC 12NC LLC Statement Of No Change

Completing the Form LLC 12NC LLC Statement Of No Change involves several straightforward steps:

- Gather necessary information about your LLC, including its official name, address, and member or manager details.

- Obtain the latest version of the form from your state’s business filing agency.

- Fill out the form accurately, ensuring all information matches what is on record.

- Review the completed form for any errors or omissions.

- Submit the form according to your state’s guidelines, either online, by mail, or in person.

Legal use of the Form LLC 12NC LLC Statement Of No Change

The legal use of the Form LLC 12NC LLC Statement Of No Change is crucial for maintaining the good standing of an LLC. By filing this form, the LLC affirms that its information remains unchanged, which is often a requirement for annual reporting. This helps prevent penalties or administrative dissolution of the LLC due to outdated information. It is important to file this form within the specified time frame set by the state to avoid any compliance issues.

Who Issues the Form

The Form LLC 12NC LLC Statement Of No Change is typically issued by the Secretary of State or the equivalent state agency responsible for business registrations. Each state may have its own version of the form, so it is essential to ensure that you are using the correct form for your specific state.

Filing Deadlines / Important Dates

Filing deadlines for the Form LLC 12NC LLC Statement Of No Change can vary by state. Generally, it is recommended to submit this form annually or as required by state law. It is advisable to check with your state’s business filing agency for specific deadlines to ensure compliance and avoid any potential penalties.

Required Documents

When submitting the Form LLC 12NC LLC Statement Of No Change, you may need to provide additional documents, such as:

- Proof of identity for the person submitting the form.

- Any previous filings that confirm the existing information.

- Payment for any applicable filing fees, if required by your state.

Quick guide on how to complete form llc 12nc llc statement of no change

Manage Form LLC 12NC LLC Statement Of No Change everywhere, anytime

Your daily business operations may require additional focus when handling state-specific business documentation. Reclaim your working hours and lessen the paper expenses associated with document-driven procedures with airSlate SignNow. airSlate SignNow provides a wide array of pre-uploaded business documents, including Form LLC 12NC LLC Statement Of No Change, which you can utilize and distribute with your business collaborators. Manage your Form LLC 12NC LLC Statement Of No Change effortlessly with robust editing and eSignature capabilities and send it straight to your recipients.

How to acquire Form LLC 12NC LLC Statement Of No Change in just a few clicks:

- Select a form appropriate for your state.

- Click Learn More to access the document and verify its accuracy.

- Choose Get Form to begin editing it.

- Form LLC 12NC LLC Statement Of No Change will instantly appear in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Select the Sign option to create your signature and electronically sign your document.

- When prepared, simply click Done, save revisions, and access your document.

- Send the form via email or text message, or use a link-to-fill feature with your partners or allow them to download the document.

airSlate SignNow signNowly reduces the time spent managing Form LLC 12NC LLC Statement Of No Change and enables you to locate vital documents all in one location. A comprehensive library of forms is organized and designed to encompass critical business functions essential for your enterprise. The enhanced editor minimizes the likelihood of errors, allowing you to swiftly rectify mistakes and review your documents on any device before sending them out. Start your free trial today to experience all the advantages of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

Find and fill out the correct form llc 12nc llc statement of no change

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

How do I fill up EIN form as a non us citizen for single member LLC? That is confusing to me?

I have helped dozens of international (non-U.S.) citizens obtain EINs for their entities and have blogged extensively about my experiences.It is understandable that you are confused. Although the instructions for Form SS-4 are relatively complete, some requirements may not be readily understood by non-Americans. Even more important, the IRS has certain policies, practices and expectations concerning foreigners that they don’t even publicize!I can’t take the time to tell you what to put in each of the dozens of lines on the Form. Instead, you should read Foreign Company Alert: Obtaining an EIN may be your Biggest Challenge in the U.S. It is long and detailed and reflects much of what I have learned about the process.I wish you the best!

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the form llc 12nc llc statement of no change

How to generate an eSignature for your Form Llc 12nc Llc Statement Of No Change online

How to generate an electronic signature for your Form Llc 12nc Llc Statement Of No Change in Google Chrome

How to create an electronic signature for putting it on the Form Llc 12nc Llc Statement Of No Change in Gmail

How to make an eSignature for the Form Llc 12nc Llc Statement Of No Change right from your smart phone

How to create an eSignature for the Form Llc 12nc Llc Statement Of No Change on iOS

How to make an eSignature for the Form Llc 12nc Llc Statement Of No Change on Android

People also ask

-

What is the Form LLC 12NC LLC Statement Of No Change?

The Form LLC 12NC LLC Statement Of No Change is a document required to confirm that there have been no changes to the details of an LLC after its formation. It ensures that your business remains compliant with state regulations and helps maintain your good standing.

-

How can airSlate SignNow help with the Form LLC 12NC LLC Statement Of No Change?

airSlate SignNow provides an easy-to-use platform for you to create, send, and eSign your Form LLC 12NC LLC Statement Of No Change in a secure environment. Our digital solution eliminates paperwork, saving you time and ensuring accuracy in your filings.

-

What are the costs associated with using airSlate SignNow for the Form LLC 12NC LLC Statement Of No Change?

airSlate SignNow offers cost-effective pricing plans that cater to different business needs. You can choose a plan that suits your requirements, allowing you to manage the Form LLC 12NC LLC Statement Of No Change and other documents without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing the Form LLC 12NC LLC Statement Of No Change?

Yes, airSlate SignNow seamlessly integrates with various platforms, including CRM tools and cloud storage services. This integration simplifies the management of your documents, including the Form LLC 12NC LLC Statement Of No Change, enhancing your workflow.

-

Is it easy to eSign the Form LLC 12NC LLC Statement Of No Change with airSlate SignNow?

Absolutely! Using airSlate SignNow, you can eSign the Form LLC 12NC LLC Statement Of No Change in just a few clicks. Our user-friendly interface makes it simple, ensuring you can complete your signing tasks quickly and efficiently.

-

What features does airSlate SignNow offer for managing the Form LLC 12NC LLC Statement Of No Change?

airSlate SignNow offers various features including templates, automated workflows, and real-time tracking for your Form LLC 12NC LLC Statement Of No Change. These tools streamline your document management process, saving you time and ensuring compliance.

-

Are there any customer support resources available for questions about the Form LLC 12NC LLC Statement Of No Change?

Yes, airSlate SignNow offers extensive customer support resources, including FAQs, tutorials, and live chat assistance. Our team is ready to help you with any inquiries related to the Form LLC 12NC LLC Statement Of No Change and other document needs.

Get more for Form LLC 12NC LLC Statement Of No Change

- This form may be used to notify express scripts of a personal representative for the individual identified in section i below

- Pro edge water testing form

- Hot work permit ontario template form

- 20 techniques of persuasive language form

- Spelling bee grade 7 word list form

- Central file room solicitation 582 19 90027 request for proposal form

- Appointment amp cancellation policy form

- Fuel supply agreement template 787742410 form

Find out other Form LLC 12NC LLC Statement Of No Change

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document