12nc 2018

What is the 12nc

The California Secretary of State Form LLC 12NC, commonly referred to as the 12nc, is a document used by limited liability companies (LLCs) in California to report a statement of no change. This form is typically filed when an LLC has not experienced any changes in its management or structure since its last filing. It serves to confirm that the information on record with the Secretary of State remains accurate and up to date. Filing this form is essential for maintaining compliance with state regulations and ensuring that the company remains in good standing.

Steps to complete the 12nc

Completing the California Secretary of State Form LLC 12NC involves several straightforward steps. First, gather all necessary information about your LLC, including its name, Secretary of State file number, and the names and addresses of its members or managers. Next, fill out the form accurately, ensuring that all information matches what is currently on file. After completing the form, review it for any errors or omissions. Finally, submit the form either online, by mail, or in person at the appropriate office, depending on your preference and the specific requirements of the Secretary of State.

How to obtain the 12nc

The 12nc form can be obtained directly from the California Secretary of State's website. It is available as a downloadable PDF, which you can fill out electronically or print to complete by hand. Additionally, you may request a physical copy of the form by contacting the Secretary of State's office. Ensure that you are using the most current version of the form to avoid any issues during submission.

Legal use of the 12nc

Legally, the California Secretary of State Form LLC 12NC must be filed in accordance with state laws governing LLCs. It is important to file this form accurately and on time to avoid penalties or complications with your business status. The form serves as a declaration that there have been no changes to the LLC's structure or management, which is a requirement for maintaining compliance with California's business regulations.

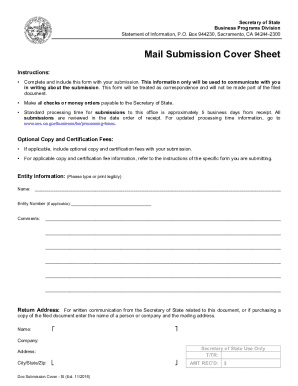

Form Submission Methods

The submission of the California Secretary of State Form LLC 12NC can be done through various methods. You can file the form online via the Secretary of State's website, which is often the quickest option. Alternatively, you can submit the form by mail, sending it to the appropriate address listed on the form. If you prefer to deliver it in person, you can visit the Secretary of State's office. Each method has its own processing times and requirements, so choose the one that best fits your needs.

Key elements of the 12nc

Key elements of the California Secretary of State Form LLC 12NC include the LLC's name, Secretary of State file number, and the names and addresses of its members or managers. Additionally, the form requires a declaration that there have been no changes to the LLC's structure or management since the last filing. Completing all sections accurately is crucial for the form to be accepted and processed by the Secretary of State.

Quick guide on how to complete statement of information no change form llc 12nc

Administer 12nc from anywhere, at any time

Your everyday business operations might require additional focus when handling state-specific business paperwork. Reclaim your working hours and minimize the costs associated with document-driven processes with airSlate SignNow. airSlate SignNow provides you with a multitude of pre-loaded business documents, including 12nc, which you can utilize and share with your business associates. Oversee your 12nc effortlessly with powerful editing and eSignature features and send it directly to your recipients.

How to obtain 12nc in just a few clicks:

- Select a form pertinent to your state.

- Click on Learn More to access the document and ensure it is accurate.

- Choose Get Form to start using it.

- 12nc will promptly open in the editor. No further steps are necessary.

- Utilize airSlate SignNow’s advanced editing features to complete or modify the form.

- Click on the Sign tool to create your signature and eSign your document.

- Once prepared, click Done, save changes, and access your document.

- Send the form via email or text, or use a link-to-fill option with your partners or have them download the documents.

airSlate SignNow signNowly reduces your time spent managing 12nc and allows you to find necessary documents in one location. A comprehensive library of forms is organized and designed to address critical business functions required for your organization. The sophisticated editor minimizes the chance of errors, as you can swiftly correct issues and review your documents on any device before sending them out. Initiate your free trial today to explore all the benefits of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

Find and fill out the correct statement of information no change form llc 12nc

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Since the results are out now, I realised that I filled out a bit of wrong information on my IP university form. How do I mend it?

What kind of information?If the information is basic like spelling error and all then thats o.kJust chill it is not a very big thing…just think that there are thousands of students who fill that form, so is it possible that everybody would have filled it correctly?? I am sure NO.That information has nothing to do with your admission, you just need to show your correct rank & thats it.When you will take admission in a particular college you will surely get a chance to fill the details again.Please mention what you have written wrongly??

Create this form in 5 minutes!

How to create an eSignature for the statement of information no change form llc 12nc

How to create an eSignature for your Statement Of Information No Change Form Llc 12nc in the online mode

How to create an eSignature for your Statement Of Information No Change Form Llc 12nc in Google Chrome

How to create an eSignature for putting it on the Statement Of Information No Change Form Llc 12nc in Gmail

How to make an eSignature for the Statement Of Information No Change Form Llc 12nc straight from your smart phone

How to make an electronic signature for the Statement Of Information No Change Form Llc 12nc on iOS devices

How to make an eSignature for the Statement Of Information No Change Form Llc 12nc on Android OS

People also ask

-

What is the California Secretary of State Form LLC-12NC?

The California Secretary of State Form LLC-12NC is a document that limited liability companies (LLCs) must file to update their information with the state. This form is essential for maintaining compliance and ensuring that your business records are up to date with the California Secretary of State.

-

How can airSlate SignNow help with filing the California Secretary of State Form LLC-12NC?

airSlate SignNow simplifies the process of filling out and submitting the California Secretary of State Form LLC-12NC. Our platform allows users to easily eSign documents and manage their filings, ensuring that everything is completed accurately and on time.

-

What are the costs associated with using airSlate SignNow for the California Secretary of State Form LLC-12NC?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. You can access our features to help with the California Secretary of State Form LLC-12NC starting at a competitive monthly rate, providing a cost-effective solution for managing your business forms.

-

What features does airSlate SignNow provide for managing the California Secretary of State Form LLC-12NC?

Our platform includes features such as eSignature capabilities, document templates, and automated reminders, all of which facilitate the completion of the California Secretary of State Form LLC-12NC. These tools are designed to streamline the process, save time, and reduce the risk of errors.

-

Is it easy to integrate airSlate SignNow with other business tools for managing the California Secretary of State Form LLC-12NC?

Yes, airSlate SignNow offers seamless integration with various business applications and tools. This makes it simple to connect our electronic signature solutions with your existing systems, allowing for a smooth process in handling the California Secretary of State Form LLC-12NC and other documents.

-

What are the benefits of using airSlate SignNow for eSigning the California Secretary of State Form LLC-12NC?

Using airSlate SignNow to eSign the California Secretary of State Form LLC-12NC enhances convenience and efficiency, as you can complete and submit forms from anywhere. Our secure platform also ensures that your data remains protected while providing an easy-to-use interface.

-

Can I track the status of my California Secretary of State Form LLC-12NC using airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your California Secretary of State Form LLC-12NC in real-time. This feature allows you to stay informed about your document's progress and ensures that nothing falls through the cracks during the filing process.

Get more for 12nc

- Pre algebra word problems form

- Declaration for funeral arrangements summit county probate court form

- Food allergy assessment form christian school olympiachristianschool

- Unum cl 1061 form

- Bemployee warning noticeb toolscirastatetxus form

- Comorbid forms of psychopathology key patterns and future epirev oxfordjournals

- Error bounds for correlation clustering form

- Agricultural production contract template form

Find out other 12nc

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form