Formulario De Solicitud De Reembolso

What is the Formulario De Solicitud De Reembolso

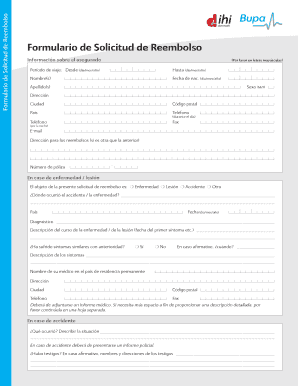

The formulario de solicitud de reembolso is a formal document used to request a refund for various services or products. This form is essential for individuals and businesses seeking to recover funds due to overpayments, returns, or service cancellations. It typically requires detailed information about the transaction, including the date of purchase, amount paid, and reasons for the refund request. Understanding the purpose and structure of this form is crucial for ensuring a smooth refund process.

How to use the Formulario De Solicitud De Reembolso

Using the formulario de solicitud de reembolso involves several key steps. First, gather all necessary documentation related to the transaction, such as receipts or invoices. Next, fill out the form accurately, providing all requested information, including your contact details and the reason for the refund. Once completed, review the form to ensure accuracy before submitting it to the appropriate department or organization. Following these steps can help facilitate a timely response to your refund request.

Steps to complete the Formulario De Solicitud De Reembolso

Completing the formulario de solicitud de reembolso requires careful attention to detail. Here are the steps to follow:

- Collect all relevant documentation, including receipts and proof of payment.

- Fill out the form, ensuring all fields are completed accurately.

- Provide a clear explanation for the refund request in the designated section.

- Attach any supporting documents that may strengthen your case.

- Review the form for any errors or missing information.

- Submit the completed form through the specified method, whether online, by mail, or in person.

Required Documents

When submitting the formulario de solicitud de reembolso, certain documents are typically required to support your claim. These may include:

- A copy of the original receipt or invoice.

- Proof of payment, such as bank statements or credit card statements.

- Any correspondence related to the transaction, including emails or letters.

- Additional documentation that may be relevant to your refund request.

Having these documents ready can expedite the processing of your request and help avoid delays.

Legal use of the Formulario De Solicitud De Reembolso

The formulario de solicitud de reembolso is legally binding when completed correctly and submitted in accordance with the relevant regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies could lead to complications or denial of the refund. Additionally, understanding the legal implications of submitting this form can help individuals and businesses navigate the refund process more effectively.

Form Submission Methods

The formulario de solicitud de reembolso can typically be submitted in various ways, depending on the organization or company involved. Common submission methods include:

- Online submission through the company’s website or designated portal.

- Mailing the completed form to the appropriate address.

- In-person delivery at a designated location or office.

Choosing the right submission method can impact the speed and efficiency of processing your refund request.

Quick guide on how to complete formulario de solicitud de reembolso

Complete Formulario De Solicitud De Reembolso with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Formulario De Solicitud De Reembolso on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to edit and eSign Formulario De Solicitud De Reembolso effortlessly

- Locate Formulario De Solicitud De Reembolso and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Edit and eSign Formulario De Solicitud De Reembolso and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario de solicitud de reembolso

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a carta de reembolso and how can airSlate SignNow help?

A carta de reembolso is a reimbursement request letter used to recover expenses. airSlate SignNow simplifies the process by allowing you to create, send, and eSign your carta de reembolso quickly and efficiently, streamlining your expense management.

-

How much does it cost to use airSlate SignNow for creating a carta de reembolso?

airSlate SignNow offers flexible pricing plans to fit any budget. You can choose a plan that best suits your needs, ensuring that you get the best value for creating your carta de reembolso while enjoying a range of features.

-

Can I customize my carta de reembolso template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your carta de reembolso template according to your business needs. You can easily input specific details and modify the layout, ensuring it fits your organization's unique branding.

-

What features does airSlate SignNow offer for managing a carta de reembolso?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage, specifically tailored for handling a carta de reembolso. These features enhance efficiency and ensure that your documents are both professional and compliant.

-

Is it possible to integrate airSlate SignNow with other applications for carta de reembolso management?

Absolutely! airSlate SignNow integrates seamlessly with multiple applications, such as Google Drive and CRM systems. This integration allows for better management and easier access to your carta de reembolso documents within your existing workflows.

-

How does airSlate SignNow ensure the security of my carta de reembolso documents?

airSlate SignNow prioritizes security by offering features such as advanced encryption and secure access controls for your carta de reembolso documents. This ensures that your sensitive information remains protected and accessible only to authorized individuals.

-

Can multiple users collaborate on a carta de reembolso using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on a carta de reembolso document. You can invite team members to review and eSign the document, ensuring a smoother process and faster turnaround times.

Get more for Formulario De Solicitud De Reembolso

Find out other Formulario De Solicitud De Reembolso

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF