Recipient Agreement for Donations to Non AGLC Licensed Groups Form

What is the Recipient Agreement For Donations To Non AGLC Licensed Groups

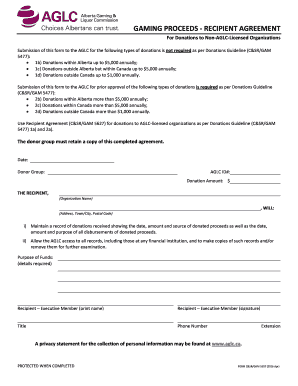

The Recipient Agreement for Donations to Non AGLC Licensed Groups is a formal document that outlines the terms and conditions under which donations are made to organizations that do not hold a license from the Alberta Gaming, Liquor and Cannabis (AGLC) authority. This agreement is essential for ensuring transparency and accountability in the donation process. It typically includes details such as the purpose of the donation, the responsibilities of both the donor and the recipient, and any stipulations regarding how the funds should be used. Understanding this agreement is crucial for both parties to protect their interests and comply with relevant regulations.

How to use the Recipient Agreement For Donations To Non AGLC Licensed Groups

Using the Recipient Agreement for Donations to Non AGLC Licensed Groups involves several steps to ensure that the document is completed accurately and legally. First, both the donor and the recipient should review the terms of the agreement to ensure mutual understanding. Next, the parties must fill out the necessary sections of the form, including details about the donation amount, purpose, and any conditions attached to the donation. After filling out the form, both parties should sign it, either physically or electronically, to validate the agreement. Utilizing a reliable eSignature solution can streamline this process, ensuring that the document is executed securely and in compliance with applicable laws.

Key elements of the Recipient Agreement For Donations To Non AGLC Licensed Groups

Several key elements are essential for the Recipient Agreement for Donations to Non AGLC Licensed Groups to be effective. These elements include:

- Donor Information: Details about the individual or organization making the donation.

- Recipient Information: Information about the group receiving the donation, including its legal status.

- Donation Amount: The specific amount being donated and any conditions attached to it.

- Purpose of the Donation: A clear description of how the funds will be used by the recipient.

- Signatures: Both parties must sign the document to make it legally binding.

Steps to complete the Recipient Agreement For Donations To Non AGLC Licensed Groups

Completing the Recipient Agreement for Donations to Non AGLC Licensed Groups involves a systematic approach. Here are the steps to follow:

- Review the agreement to understand all terms and conditions.

- Fill in the donor's and recipient's information accurately.

- Specify the donation amount and its intended use.

- Include any conditions or stipulations related to the donation.

- Both parties should sign the agreement, either digitally or physically.

Legal use of the Recipient Agreement For Donations To Non AGLC Licensed Groups

The legal use of the Recipient Agreement for Donations to Non AGLC Licensed Groups hinges on compliance with applicable laws and regulations. This includes ensuring that the agreement is executed with the proper signatures and that it adheres to the guidelines set forth by relevant authorities. Additionally, both parties should retain copies of the signed agreement for their records. By following these legal requirements, the agreement can serve as a protective measure for both the donor and the recipient, safeguarding their rights and responsibilities.

State-specific rules for the Recipient Agreement For Donations To Non AGLC Licensed Groups

State-specific rules may apply to the Recipient Agreement for Donations to Non AGLC Licensed Groups, depending on the jurisdiction in which the donation occurs. Each state may have its own regulations regarding charitable donations, tax implications, and reporting requirements. It is important for both the donor and the recipient to familiarize themselves with these rules to ensure compliance. Consulting with a legal professional or tax advisor can provide clarity on any state-specific obligations that must be met when executing this agreement.

Quick guide on how to complete recipient agreement for donations to non aglc licensed groups

Complete Recipient Agreement For Donations To Non AGLC Licensed Groups effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Recipient Agreement For Donations To Non AGLC Licensed Groups on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Recipient Agreement For Donations To Non AGLC Licensed Groups seamlessly

- Locate Recipient Agreement For Donations To Non AGLC Licensed Groups and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Recipient Agreement For Donations To Non AGLC Licensed Groups and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the recipient agreement for donations to non aglc licensed groups

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Recipient Agreement For Donations To Non AGLC Licensed Groups?

A Recipient Agreement For Donations To Non AGLC Licensed Groups is a legal document that outlines the terms under which donations are made to groups that do not have a license from the Alberta Gaming, Liquor and Cannabis Commission (AGLC). This agreement ensures both parties understand their rights and responsibilities, providing clarity and protection in the donation process.

-

How can airSlate SignNow assist with creating a Recipient Agreement For Donations To Non AGLC Licensed Groups?

With airSlate SignNow, you can easily create and customize templates for a Recipient Agreement For Donations To Non AGLC Licensed Groups. Our intuitive platform allows you to fill in necessary details, add eSignatures, and manage the agreement seamlessly, ensuring your documents remain legally valid and professional.

-

What are the benefits of using airSlate SignNow for Recipient Agreements?

Using airSlate SignNow for your Recipient Agreement For Donations To Non AGLC Licensed Groups streamlines the signing process, making it faster and more efficient. You can reduce paperwork, minimize errors, and ensure compliance with legal requirements, all while tracking the status of your agreements in real time.

-

Is airSlate SignNow affordable for non-profits looking to manage Recipient Agreements?

Yes, airSlate SignNow provides cost-effective solutions that are well-suited for non-profits managing Recipient Agreements For Donations To Non AGLC Licensed Groups. We offer various pricing plans, including options that cater specifically to organizations working within budget constraints, ensuring you can manage your donations efficiently.

-

Can airSlate SignNow integrate with other tools that support donation management?

Absolutely! airSlate SignNow offers seamless integrations with various donation management platforms and CRM tools. This integration allows you to automate workflows and keep all your important documents, such as Recipient Agreements For Donations To Non AGLC Licensed Groups, in one accessible location.

-

What types of documents can I manage alongside Recipient Agreements on airSlate SignNow?

Besides Recipient Agreements For Donations To Non AGLC Licensed Groups, airSlate SignNow supports a variety of document types including contracts, NDAs, and other legal forms. This versatility allows you to handle all your important documentation in a single platform, simplifying your operational workflow.

-

How secure is airSlate SignNow for storing Recipient Agreements?

airSlate SignNow prioritizes the security of your documents, including Recipient Agreements For Donations To Non AGLC Licensed Groups. Our platform employs advanced encryption and security protocols to ensure that your data is protected, giving you peace of mind when managing sensitive agreements.

Get more for Recipient Agreement For Donations To Non AGLC Licensed Groups

- Cms field trip permission slip form

- Brochure about new england colonies form

- Blood types worksheet short answer answers form

- Math corrections form

- Aiu transcript request online form

- Nths teacher recommendation formpdf

- Maintenance work order paine form

- Broward county public schools student emergency contact card form

Find out other Recipient Agreement For Donations To Non AGLC Licensed Groups

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy