Instructions for Form 592 Franchise Tax Board CA Gov

Understanding Form 592 Instructions

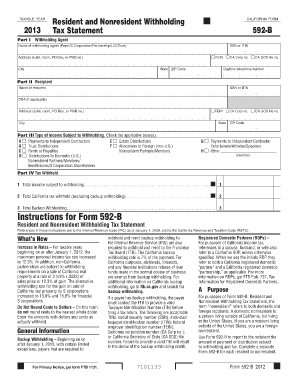

The Instructions for Form 592 are provided by the Franchise Tax Board of California to guide taxpayers in reporting income that is subject to withholding. This form is primarily used by partnerships, LLCs, and corporations that need to report California source income paid to non-residents. It outlines the necessary steps and requirements for completing the form accurately to ensure compliance with California tax laws.

Steps to Complete Form 592 Instructions

Completing Form 592 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information about the income being reported. This includes details about the payee, the amount paid, and any applicable withholding amounts. Next, follow these steps:

- Fill in the identifying information for the entity making the payment.

- Report the total amounts paid to each non-resident.

- Calculate the withholding amounts based on the applicable rates.

- Review the completed form for accuracy before submission.

Legal Use of Form 592 Instructions

Form 592 must be used in accordance with California tax regulations to ensure that all income reporting and withholding requirements are met. The form serves as a legal document that outlines the amounts withheld from payments made to non-residents. It is essential to adhere to the guidelines provided in the instructions to avoid penalties and ensure that the form is accepted by the Franchise Tax Board.

Filing Deadlines for Form 592

Timely filing of Form 592 is crucial to avoid penalties. The form must be submitted by the 15th day of the third month following the close of the taxable year. For entities that operate on a calendar year, this typically means the deadline is March 15. It is important to keep track of these deadlines to ensure compliance with California tax laws.

Required Documents for Form 592

When completing Form 592, certain documents may be required to support the information reported. This includes:

- Records of payments made to non-residents.

- Documentation of withholding amounts.

- Any prior correspondence with the Franchise Tax Board regarding the entity's tax obligations.

Having these documents readily available can facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

Form 592 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the Franchise Tax Board's e-file system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Franchise Tax Board offices.

Choosing the right submission method can depend on the entity's preferences and the urgency of the filing.

Quick guide on how to complete instructions for form 592 franchise tax board ca gov

Effortlessly Prepare Instructions For Form 592 Franchise Tax Board CA gov on Any Device

The management of online documents has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Instructions For Form 592 Franchise Tax Board CA gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Instructions For Form 592 Franchise Tax Board CA gov with Ease

- Locate Instructions For Form 592 Franchise Tax Board CA gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Identify important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Instructions For Form 592 Franchise Tax Board CA gov while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 592 franchise tax board ca gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic form 592 instructions I need to follow?

The basic form 592 instructions guide you through the process of completing the 592 form correctly, ensuring compliance with tax regulations. This includes providing accurate personal information, income details, and following the outlined sections for exemptions. It's crucial to read the instructions thoroughly to avoid common mistakes.

-

How does airSlate SignNow help with form 592 instructions?

airSlate SignNow offers streamlined tools and templates to assist you in filling out the 592 form accurately. By utilizing the platform, you can electronically sign and send your filled forms securely while adhering to the form 592 instructions. This saves time and reduces the risk of errors during submission.

-

Are there any costs associated with using airSlate SignNow for form 592 instructions?

While airSlate SignNow provides a cost-effective solution for eSigning documents, there are various pricing plans depending on your business needs. Each plan includes features to facilitate the completion of forms like the 592 form, making it an economical choice for managing form 592 instructions seamlessly.

-

What features does airSlate SignNow provide to assist with form 592 instructions?

airSlate SignNow comes equipped with features like customizable templates, document tracking, and detailed analytics to enhance your experience with form 592 instructions. These tools enable easy modifications, ensure timely submissions, and keep you organized, thereby enhancing your workflow.

-

Can I integrate airSlate SignNow with other tools for form 592 instructions?

Yes, airSlate SignNow integrates easily with various third-party applications and platforms to streamline your document management process. This flexibility allows you to incorporate your existing workflow with form 592 instructions, improving efficiency and reducing the time spent on administrative tasks.

-

What benefits can I expect from using airSlate SignNow for form 592 instructions?

Using airSlate SignNow for your form 592 instructions can signNowly enhance productivity and ensure accuracy. The platform’s user-friendly interface and advanced features simplify the signing process, making it easier to comply with tax requirements and manage forms effectively.

-

Is there support available for completing form 592 instructions with airSlate SignNow?

Absolutely! airSlate SignNow provides extensive support resources, including tutorials and customer support, to assist you with form 592 instructions. Whether you need help navigating the platform or understanding the form requirements, our team is ready to help.

Get more for Instructions For Form 592 Franchise Tax Board CA gov

- Explanatory form

- Cold war crossword puzzle pdf form

- Scholarship recipient form lifeshare lifeshare

- Ion formation worksheet

- Deletion form

- End of activity coach evaluation form eagle river high school

- Contract for success current studentsdocx rsu form

- Rogers state university educational talent search student rsu form

Find out other Instructions For Form 592 Franchise Tax Board CA gov

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile