Ncui 604 Form

What is the Ncui 604

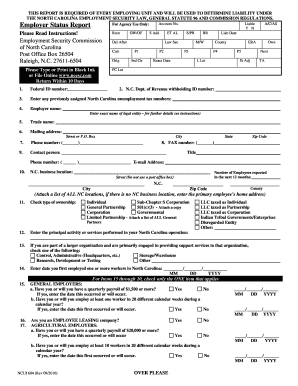

The Ncui 604 is a specific form used for reporting certain tax-related information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to comply with federal tax regulations. It is designed to capture details that may affect tax liability or eligibility for various credits and deductions. Understanding the purpose and requirements of the Ncui 604 is crucial for ensuring accurate and timely tax reporting.

How to use the Ncui 604

Using the Ncui 604 involves several steps that ensure the form is completed correctly. First, gather all necessary documentation that supports the information you will provide on the form. This may include income statements, previous tax returns, and any relevant financial records. Next, carefully fill out each section of the Ncui 604, ensuring that all information is accurate and complete. After completing the form, review it thoroughly for any errors before submitting it to the IRS.

Steps to complete the Ncui 604

Completing the Ncui 604 requires attention to detail and adherence to specific guidelines. Follow these steps for a smooth process:

- Collect all required documents, such as income statements and tax identification numbers.

- Fill out the form, ensuring that you enter accurate data in each field.

- Double-check your entries for any potential mistakes or omissions.

- Sign and date the form where indicated.

- Submit the completed Ncui 604 to the IRS by the specified deadline.

Legal use of the Ncui 604

The Ncui 604 is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, it is important to adhere to all guidelines for filling out the form, including providing accurate information and obtaining necessary signatures. Compliance with federal tax laws is essential, as failure to do so can result in penalties or legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Ncui 604 are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. It is advisable to stay informed about any updates or changes to filing dates to ensure timely submission.

Who Issues the Form

The Ncui 604 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. This form is part of the IRS's efforts to ensure compliance with tax laws and to facilitate accurate reporting by taxpayers. Understanding the role of the IRS in issuing this form is important for anyone required to complete it.

Quick guide on how to complete ncui 604

Accomplish Ncui 604 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed materials, allowing you to obtain the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without holdups. Manage Ncui 604 on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to amend and electronically sign Ncui 604 without hassle

- Obtain Ncui 604 and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of searching for forms, or errors that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Ncui 604 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ncui 604

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ncui 604 and how does it relate to airSlate SignNow?

The ncui 604 is an essential tool that streamlines document management within airSlate SignNow. It enables users to efficiently eSign and send documents, simplifying workflows across various industries. By integrating the ncui 604 into your processes, you can enhance productivity and ensure compliance.

-

What are the pricing options for airSlate SignNow with the ncui 604 feature?

airSlate SignNow offers flexible pricing plans that include the ncui 604 feature, catering to businesses of all sizes. Each plan provides different functionalities, so you can choose one that best fits your budget and document handling needs. Detailed pricing information is available on our website.

-

How can the ncui 604 enhance my team's efficiency?

The ncui 604 improves your team's efficiency by automating document workflows and reducing manual errors. With its user-friendly interface, team members can quickly send and eSign documents, saving time and ensuring a smoother process. Efficiency gains can lead to signNow productivity boosts for your organization.

-

What features does the ncui 604 offer in airSlate SignNow?

The ncui 604 includes features such as customizable templates, real-time tracking of document status, and advanced security measures. These functionalities ensure that your documents are managed securely and efficiently. Additionally, it offers easy integration with other tools for a seamless workflow.

-

Is the ncui 604 compliant with industry regulations?

Yes, the ncui 604 is designed to meet various industry regulations, ensuring that your eSigning processes are compliant with legal standards. airSlate SignNow adheres to strict data protection protocols, keeping your sensitive information secure. Compliance is a top priority for us and we provide resources to help you stay informed.

-

Can I integrate the ncui 604 with other software applications?

Absolutely! The ncui 604 offers robust integration capabilities with popular software applications like Salesforce, Google Workspace, and Microsoft Office. This allows you to enhance your current workflows by connecting airSlate SignNow to the tools your business already uses, streamlining your document processes.

-

What are the benefits of using ncui 604 in airSlate SignNow for small businesses?

For small businesses, the ncui 604 provides a cost-effective way to manage documents without compromising on functionality. It helps save time and reduce operational costs by automating repetitive tasks. Additionally, it enhances professionalism and customer experience through quick and secure eSigning.

Get more for Ncui 604

Find out other Ncui 604

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later