PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo 2016

What is the Pueblo County Marijuana Excise Tax Return?

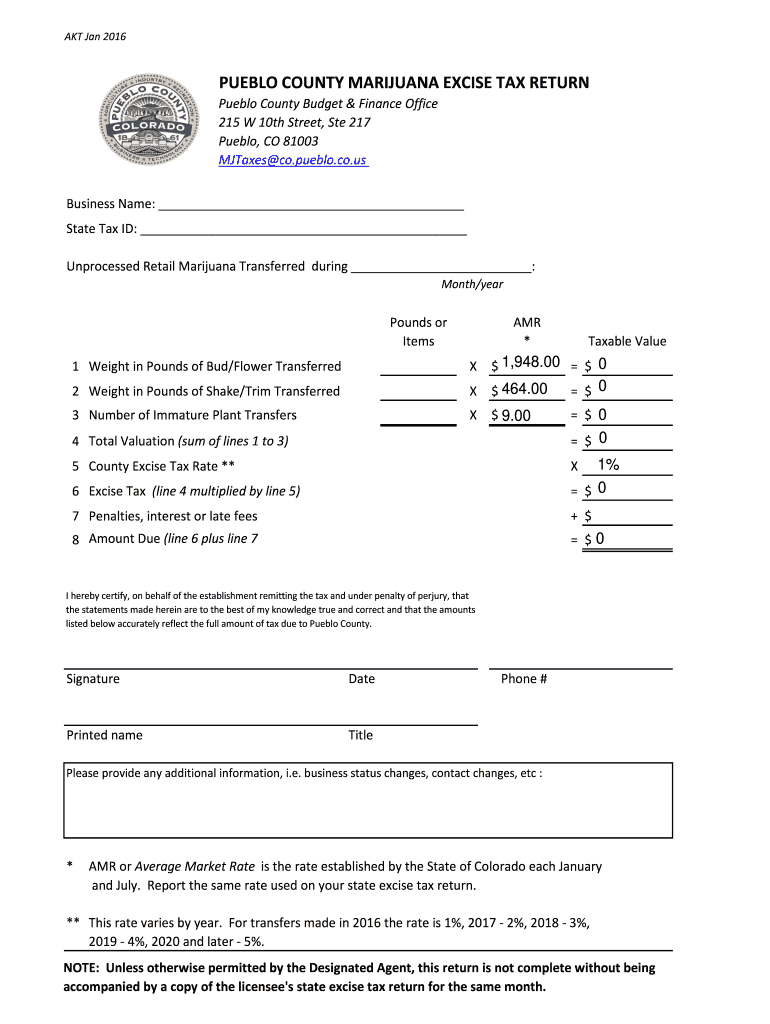

The Pueblo County Marijuana Excise Tax Return is a specific tax form required for businesses engaged in the sale of marijuana within Pueblo County. This form is essential for reporting the excise tax owed on marijuana sales, which is imposed by local regulations. Proper completion of this form ensures compliance with county tax laws and helps maintain accurate financial records for marijuana-related businesses.

Steps to Complete the Pueblo County Marijuana Excise Tax Return

Completing the Pueblo County Marijuana Excise Tax Return involves several key steps:

- Gather necessary financial records, including sales data and previous tax returns.

- Access the official form, ensuring you have the most current version.

- Fill in the required information, including total sales and applicable tax rates.

- Review the completed form for accuracy and completeness.

- Sign the form electronically using a secure eSignature platform.

- Submit the form electronically or via mail, as per county guidelines.

Legal Use of the Pueblo County Marijuana Excise Tax Return

The legal use of the Pueblo County Marijuana Excise Tax Return is crucial for businesses operating in compliance with state and local laws. This form serves as a formal declaration of tax obligations and must be filed within specified deadlines. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines and additional legal repercussions.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Pueblo County Marijuana Excise Tax Return. Typically, these deadlines align with quarterly or annual tax reporting periods. Businesses should mark their calendars to ensure timely submission, as late filings may incur penalties or interest on owed taxes.

Form Submission Methods

The Pueblo County Marijuana Excise Tax Return can be submitted through various methods, including:

- Online Submission: Utilize a secure eSignature platform for electronic filing.

- Mail: Send a printed copy of the completed form to the designated county office.

- In-Person: Deliver the form directly to the county tax office if preferred.

Required Documents

To complete the Pueblo County Marijuana Excise Tax Return, businesses must prepare several required documents, including:

- Sales records for the reporting period.

- Previous tax returns for reference.

- Any supporting documentation that verifies tax calculations.

Quick guide on how to complete pueblo county marijuana excise tax return county pueblo

Your assistance manual on how to prepare your PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo

If you’re eager to learn how to create and submit your PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo, here are some straightforward guidelines to simplify the tax declaration process.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and complete your tax forms effortlessly. With its editor, you can switch between text, check boxes, and eSignatures and revisit to modify responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and intuitive sharing options.

Follow the instructions below to finish your PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo in just a few minutes:

- Create your account and begin working on PDFs shortly.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo within our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if needed).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically using airSlate SignNow. Please remember that filing on paper can lead to return errors and delay reimbursements. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct pueblo county marijuana excise tax return county pueblo

Create this form in 5 minutes!

How to create an eSignature for the pueblo county marijuana excise tax return county pueblo

How to make an eSignature for your Pueblo County Marijuana Excise Tax Return County Pueblo online

How to make an electronic signature for the Pueblo County Marijuana Excise Tax Return County Pueblo in Google Chrome

How to create an eSignature for signing the Pueblo County Marijuana Excise Tax Return County Pueblo in Gmail

How to create an eSignature for the Pueblo County Marijuana Excise Tax Return County Pueblo straight from your mobile device

How to generate an eSignature for the Pueblo County Marijuana Excise Tax Return County Pueblo on iOS devices

How to create an eSignature for the Pueblo County Marijuana Excise Tax Return County Pueblo on Android devices

People also ask

-

What is the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo?

The PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo is a required document for businesses engaged in the sale of marijuana within Pueblo County. This form ensures compliance with local tax regulations and helps businesses properly calculate their excise tax obligations.

-

How can airSlate SignNow assist with the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo?

airSlate SignNow provides an easy-to-use platform for businesses to electronically sign and send their PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo. Our digital solution simplifies the submission process, making it more efficient and cost-effective for users.

-

What are the pricing options for using airSlate SignNow for the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, our competitive pricing ensures that filing the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo is accessible and budget-friendly.

-

What features does airSlate SignNow offer for managing the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo?

Our platform includes features like customizable templates, document tracking, and automated reminders, which enhance the management of the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo. These functionalities streamline the signing process and foster better compliance with local regulations.

-

Is airSlate SignNow compliant with the requirements for the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo?

Yes, airSlate SignNow adheres to industry standards for digital signatures, ensuring that your PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo meets all legal requirements. Our platform provides secure and compliant solutions for all your document needs.

-

Can I integrate airSlate SignNow with other software for the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo?

Absolutely! airSlate SignNow offers integrations with various business software, enhancing your ability to manage the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo seamlessly. This allows for better workflows and consistent document management across platforms.

-

What are the benefits of using airSlate SignNow for the PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo?

Using airSlate SignNow for your PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo brings efficiency, security, and ease of use. Our platform reduces paperwork, accelerates the signing process, and helps ensure compliance with local tax laws.

Get more for PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo

Find out other PUEBLO COUNTY MARIJUANA EXCISE TAX RETURN County Pueblo

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed