Pueblo Colorado Marijuana Excise Tax Form 2019

What is the Pueblo Colorado Marijuana Excise Tax Form

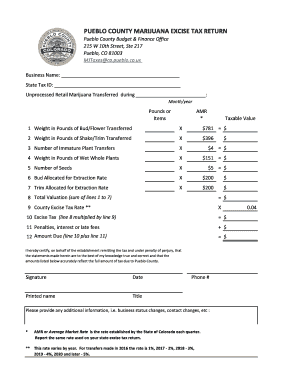

The Pueblo Colorado Marijuana Excise Tax Form is a specific document used to report and pay excise taxes related to marijuana sales within Pueblo County. This form is essential for businesses operating in the cannabis industry, ensuring compliance with local tax regulations. The excise tax is typically assessed on the sale of marijuana products, and the collected funds contribute to various community services and infrastructure projects.

Steps to Complete the Pueblo Colorado Marijuana Excise Tax Form

Completing the Pueblo County excise tax form involves several key steps:

- Gather necessary information, including business identification details and sales records.

- Access the official form, ensuring you have the most current version available.

- Fill out the form accurately, providing all requested details such as sales amounts and applicable tax rates.

- Review the completed form for accuracy to avoid any potential errors that could lead to penalties.

- Submit the form through the designated method, whether online, by mail, or in person.

How to Obtain the Pueblo Colorado Marijuana Excise Tax Form

The Pueblo Colorado Marijuana Excise Tax Form can be obtained from the official Pueblo County government website or through the local tax authority. It is important to ensure that you are using the latest version of the form to comply with current regulations. Additionally, the form may be available at local government offices for those who prefer to obtain it in person.

Required Documents

When completing the Pueblo County excise tax form, certain documents are required to support your submission. These may include:

- Sales records detailing all marijuana transactions during the reporting period.

- Business identification number or tax identification number.

- Any previous tax returns filed for the same period, if applicable.

Form Submission Methods

The Pueblo County excise tax form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the official tax authority website, which often allows for quicker processing.

- Mailing the completed form to the designated tax office address.

- In-person submission at local government offices for those who prefer face-to-face interactions.

Penalties for Non-Compliance

Failure to properly complete and submit the Pueblo Colorado Marijuana Excise Tax Form can result in significant penalties. These may include:

- Fines based on the amount of tax owed or the severity of the non-compliance.

- Interest charges on unpaid taxes, which can accumulate over time.

- Potential legal actions or audits by tax authorities if discrepancies are found.

Key Elements of the Pueblo Colorado Marijuana Excise Tax Form

Understanding the key elements of the Pueblo County excise tax form is crucial for accurate completion. Important sections typically include:

- Business information, including name, address, and tax identification number.

- Details of marijuana sales, including quantities sold and total revenue generated.

- Calculation of the excise tax owed based on applicable rates.

- Signature line for the authorized representative of the business, confirming the accuracy of the information provided.

Quick guide on how to complete 1 weight in pounds of budflower transferred

Your assistance manual on how to get ready your Pueblo Colorado Marijuana Excise Tax Form

If you wish to understand how to complete and submit your Pueblo Colorado Marijuana Excise Tax Form, here are some concise guidelines on how to simplify tax declaration.

To begin, you just need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax files effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to adjust responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easily manageable sharing.

Complete the following steps to finalize your Pueblo Colorado Marijuana Excise Tax Form within moments:

- Create your account and start editing PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through editions and schedules.

- Click Access form to open your Pueblo Colorado Marijuana Excise Tax Form in our editor.

- Enter the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to place your legally-binding eSignature (if necessary).

- Check your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please note that submitting in print can elevate return errors and prolong refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 1 weight in pounds of budflower transferred

FAQs

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

How do you solve: A tank in the shape of an inverted cone of height 10 feet and top diameter of 1.25 feet is filled with a fluid density 1 pound/ft^3. To the nearest foot-pound, how much work is required to pump all the liquid out of the tank?

You don't provide enough data. You can find the volume and how much liquid there is, but in order to find work, you need to specify how far you move the liquid. For instance, if the pump is at the bottom of the cone, you wouldn't even need to turn it on for the cone to empty. If you put the pump at the top, it will have a bit of work to just pump the liquid out. If you put the pump 10 feet above the cone, it will have to work harder to get the liquid out.

-

How can I fill out the form of DTE MPonline to take admission in IET DAVV Indore? Provide the site (link).

See their is no seperate form for iet davv, you have to fill this college during the choice filling stage of counselling.The procedure for the DTE counselling is very simple thier are 3 main steps you need to follow.RegistrationChoice fillingReporting to alloted institute.For all this the website you should visit is https://dte.mponline.gov.in/port...Here at the top right corner you will see a menu as select course for counselling, click on it, select bachelor of engineering then full time and then apply online. This is how you will register for counselling.Hope it helps.Feel free to ask any other problem you face regarding counselling or college selection.

-

Five pumps are required to fill a tank in 1 1/2 hours. How many forms of the same type are used to fill the tank in half an hour?

Five pumps are required to fill a tank in one and half hours.Here the question is how many pumps requires to fill a tank in half an hour..Here we can make an equation like thatIn 1 and 1/2 hours, requires 5 pumps to fill the tank..Therefore in 1/2 an hour, how many pumps are requires to fill the tank?=(0.5 hour×5 pumps)÷(1.5 hours)=1.6666…. PumpsBut we know that the number of pumps should be whole..So we should take near by digit of 1.66It is 2 .So we have to take atleast 2 pumps to fill the tank in half an hour…I hope my answer convinces you..And if this answer need any type of edit please message me or comment…

Create this form in 5 minutes!

How to create an eSignature for the 1 weight in pounds of budflower transferred

How to create an eSignature for the 1 Weight In Pounds Of Budflower Transferred online

How to make an eSignature for the 1 Weight In Pounds Of Budflower Transferred in Google Chrome

How to generate an eSignature for signing the 1 Weight In Pounds Of Budflower Transferred in Gmail

How to create an eSignature for the 1 Weight In Pounds Of Budflower Transferred right from your smart phone

How to create an electronic signature for the 1 Weight In Pounds Of Budflower Transferred on iOS devices

How to make an electronic signature for the 1 Weight In Pounds Of Budflower Transferred on Android

People also ask

-

What is the Pueblo County excise tax form?

The Pueblo County excise tax form is a document required for certain transactions involving real estate in Pueblo County, Colorado. It helps to assess and collect tax on the sale of property, providing necessary information to the local government. Understanding how to fill out this form can streamline your property sales process.

-

How can airSlate SignNow assist with the Pueblo County excise tax form?

airSlate SignNow offers a user-friendly platform to prepare, send, and eSign the Pueblo County excise tax form quickly and efficiently. With its electronic signature capabilities, you can ensure secure and compliant document handling that saves time. This can signNowly enhance your workflow during property transactions.

-

Is there a cost associated with using airSlate SignNow for the Pueblo County excise tax form?

Yes, airSlate SignNow has a variety of pricing plans tailored to different business needs, allowing you to choose the best option for managing documents like the Pueblo County excise tax form. The pricing is competitive, providing excellent value for the features offered. You can also try a free trial to evaluate its capabilities.

-

What features does airSlate SignNow offer for filling out the Pueblo County excise tax form?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time collaboration to streamline the process of completing the Pueblo County excise tax form. These tools help ensure accuracy and efficiency, allowing users to focus on important decisions rather than paperwork. Additionally, the mobile-friendly interface helps users stay productive on the go.

-

Can I integrate airSlate SignNow with other tools I use for the Pueblo County excise tax form?

Absolutely! airSlate SignNow offers integrations with a variety of third-party applications, including CRM systems and document management tools, enhancing your workflow for the Pueblo County excise tax form. This flexibility allows you to seamlessly incorporate the eSigning process into your existing systems and improve overall productivity.

-

What are the benefits of using airSlate SignNow for the Pueblo County excise tax form?

Using airSlate SignNow for the Pueblo County excise tax form brings multiple benefits, including improved efficiency and reduced turnaround time for document processing. The electronic signing feature allows for faster approvals and a secure exchange of sensitive information. Furthermore, it minimizes errors by allowing users to fill and review forms digitally.

-

Is airSlate SignNow compliant with regulations for the Pueblo County excise tax form?

Yes, airSlate SignNow ensures compliance with legal requirements for electronic signatures and document management, making it a reliable choice for completing the Pueblo County excise tax form. The platform adheres to industry standards and provides options for secure document storage. This compliance offers peace of mind for users managing sensitive transactions.

Get more for Pueblo Colorado Marijuana Excise Tax Form

- Hwi checklist for planning employee health risk appraisal implementation office on smoking and health cdc form

- Form sf lll disclosure of lobbying activities rurdev usda

- Fair debt collection dispute letter template form

- Job order contract template form

- Key holder contract template form

- Keynote speaker contract template form

- Kick off meet contract template form

- Kid contract template form

Find out other Pueblo Colorado Marijuana Excise Tax Form

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple