Pueblo County Excise Tax Form 2020-2026

Understanding the Pueblo County Excise Tax Form

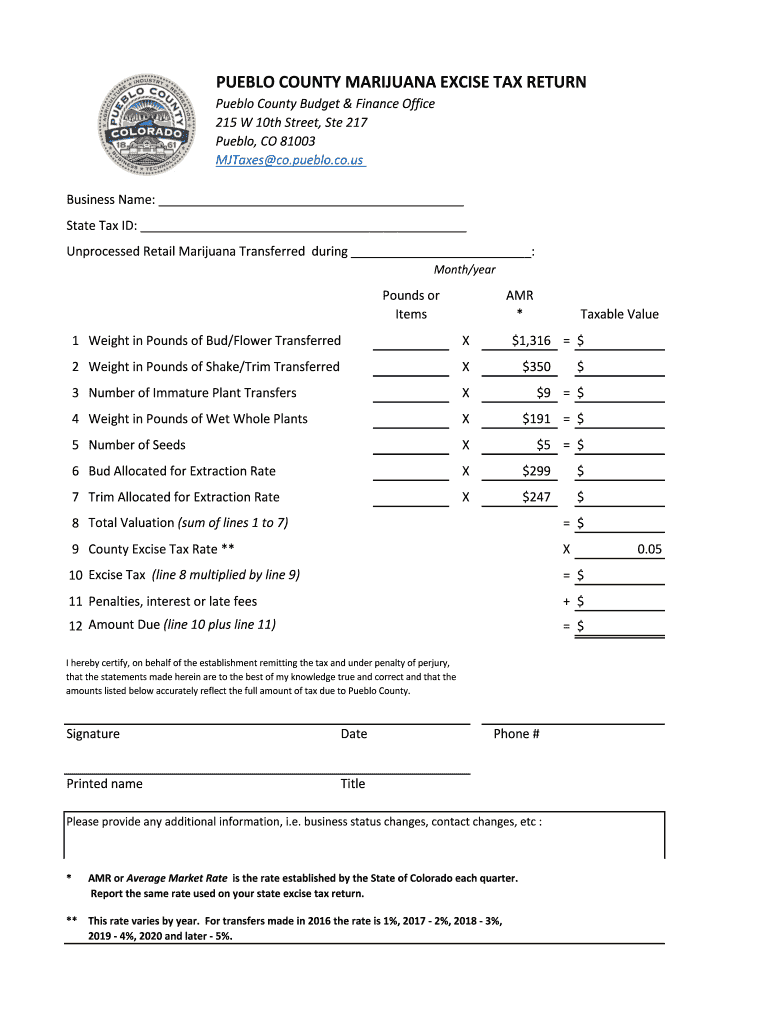

The Pueblo County excise tax form is a crucial document for businesses engaged in the marijuana industry within Pueblo County, Colorado. This form is designed to report and remit the excise tax levied on marijuana sales. It is essential for compliance with local tax regulations and ensures that businesses contribute to the community's revenue. Understanding the specific requirements of this form is vital for accurate reporting and avoiding potential penalties.

Steps to Complete the Pueblo County Excise Tax Form

Completing the Pueblo County excise tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales data and inventory reports. Next, accurately calculate the total excise tax owed based on the applicable rates. Fill out the form with precise information, ensuring all sections are completed. Finally, review the form for any errors before submission to avoid delays or penalties.

How to Obtain the Pueblo County Excise Tax Form

The Pueblo County excise tax form can be obtained through the official Pueblo County website or the local tax authority's office. It is often available as a downloadable PDF, which can be printed and filled out manually. Additionally, some businesses may have access to digital filing options that streamline the submission process. Ensuring you have the most current version of the form is important for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Pueblo County excise tax form are typically established by the local tax authority. It is essential to be aware of these dates to avoid late fees or penalties. Generally, businesses are required to file and remit their excise tax on a monthly or quarterly basis, depending on their sales volume. Keeping a calendar of these important dates can help ensure timely submissions.

Legal Use of the Pueblo County Excise Tax Form

The legal use of the Pueblo County excise tax form is governed by state and local tax laws. Businesses must ensure that they are using the correct form for their specific tax obligations. Failure to comply with legal requirements can result in significant penalties, including fines and potential legal action. Understanding the legal framework surrounding this form is crucial for maintaining compliance and protecting your business.

Penalties for Non-Compliance

Non-compliance with the Pueblo County excise tax requirements can lead to various penalties, including monetary fines and interest on unpaid taxes. Businesses may also face audits or increased scrutiny from tax authorities. It is essential to understand these potential consequences and take proactive steps to ensure timely and accurate filing of the excise tax form to avoid any legal repercussions.

Quick guide on how to complete 2 weight in pounds of shaketrim transferred

Prepare Pueblo County Excise Tax Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and eSign your documents swiftly without any delays. Manage Pueblo County Excise Tax Form on any platform using airSlate SignNow's Android or iOS applications and facilitate any document-related tasks today.

How to modify and eSign Pueblo County Excise Tax Form easily

- Locate Pueblo County Excise Tax Form and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Pueblo County Excise Tax Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2 weight in pounds of shaketrim transferred

Create this form in 5 minutes!

How to create an eSignature for the 2 weight in pounds of shaketrim transferred

How to make an eSignature for the 2 Weight In Pounds Of Shaketrim Transferred in the online mode

How to make an electronic signature for the 2 Weight In Pounds Of Shaketrim Transferred in Chrome

How to create an electronic signature for signing the 2 Weight In Pounds Of Shaketrim Transferred in Gmail

How to generate an electronic signature for the 2 Weight In Pounds Of Shaketrim Transferred right from your smartphone

How to create an electronic signature for the 2 Weight In Pounds Of Shaketrim Transferred on iOS devices

How to make an eSignature for the 2 Weight In Pounds Of Shaketrim Transferred on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to pueblo county tax?

airSlate SignNow is an electronic signature solution that allows users to send and eSign documents seamlessly. For residents and businesses in Pueblo County, utilizing airSlate SignNow can streamline processes that involve pueblo county tax forms and submissions, making compliance easier and more efficient.

-

How does airSlate SignNow simplify the processing of pueblo county tax documents?

By using airSlate SignNow, businesses can quickly prepare, send, and sign pueblo county tax documents online. This eliminates the need for printing and mailing, reducing turnaround times and ensuring that your tax submissions are timely and secure.

-

Is there a cost associated with using airSlate SignNow for pueblo county tax purposes?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While the cost may vary depending on the features you choose, investing in airSlate SignNow can save you time and resources when handling pueblo county tax documentation.

-

What features does airSlate SignNow offer for managing pueblo county tax information?

airSlate SignNow provides features such as templates for common pueblo county tax forms, real-time notifications, and secure cloud storage. These tools help ensure that all your tax-related documents are organized and easily accessible.

-

Can airSlate SignNow integrate with other platforms for pueblo county tax processing?

Absolutely! airSlate SignNow can integrate with various business applications and accounting software commonly used for pueblo county tax processing. This integration helps streamline your workflow by allowing you to manage all your documents in one place.

-

What benefits does airSlate SignNow provide for individuals handling pueblo county tax documents?

Individuals can benefit from airSlate SignNow's user-friendly interface, reduced processing times, and enhanced security measures for their pueblo county tax documents. This enables a stress-free experience when submitting important tax documents.

-

How does airSlate SignNow ensure the security of pueblo county tax documents?

airSlate SignNow prioritizes security by utilizing encryption and compliant practices to safeguard your pueblo county tax documents. This ensures that sensitive information remains protected during transmission and storage.

Get more for Pueblo County Excise Tax Form

- Primary care physician follow up of behavioral health this form is a sample template that can be used to promote communication

- Authorization to apply for medicaid on my behalf form

- Gv ni 80 form

- Media credential request chsaa form

- Small estate affidavit missouri probate information

- Fr44 form

- Career assessment form caf northampton community college catalog northampton

- Autorizaci n para empadronamiento en vivienda sede electr nica sede peniscola form

Find out other Pueblo County Excise Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors