Payroll Information Sheet

What is the Payroll Information Sheet

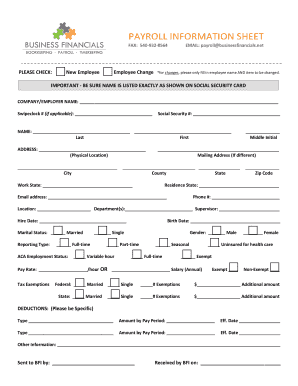

The payroll information sheet is a crucial document used by employers to collect and maintain essential details about their employees. This form typically includes personal identification information, such as the employee's name, address, Social Security number, and tax withholding preferences. It serves as a foundational tool for payroll processing, ensuring that employees are compensated accurately and in compliance with federal and state regulations.

Key elements of the Payroll Information Sheet

An employee payroll information sheet should include several key elements to ensure its effectiveness and legality. These elements typically encompass:

- Employee Information: Full name, address, Social Security number, and contact details.

- Tax Information: Tax filing status, exemptions, and any additional withholding preferences.

- Banking Details: Information for direct deposit, including bank name, account number, and routing number.

- Emergency Contact: Name and contact information of a person to reach in case of emergencies.

Steps to complete the Payroll Information Sheet

Completing the payroll information sheet involves several straightforward steps:

- Gather Necessary Information: Collect all required personal and financial information before starting the form.

- Fill Out the Form: Carefully enter the information in the appropriate fields, ensuring accuracy.

- Review for Errors: Double-check all entries for any mistakes or omissions.

- Sign and Date: Provide your signature and the date to validate the form.

Legal use of the Payroll Information Sheet

The legal use of a payroll information sheet is governed by various regulations, including the Fair Labor Standards Act (FLSA) and Internal Revenue Service (IRS) guidelines. It is essential that the information provided on the sheet is accurate and complete to comply with tax reporting requirements. Additionally, electronic signatures on the payroll information sheet are recognized as legally binding under the ESIGN Act and UETA, provided that specific criteria are met.

How to use the Payroll Information Sheet

Examples of using the Payroll Information Sheet

- New Employee Onboarding: Collecting essential information from new hires to set them up in the payroll system.

- Updating Employee Records: Ensuring that any changes to personal information, such as a name change or new banking details, are accurately reflected.

- Tax Preparation: Providing necessary information for tax reporting and compliance during the tax season.

Quick guide on how to complete payroll information sheet

Effortlessly Prepare Payroll Information Sheet on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources to create, modify, and electronically sign your documents swiftly without delays. Handle Payroll Information Sheet on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

The Easiest Way to Alter and eSign Payroll Information Sheet with Ease

- Obtain Payroll Information Sheet and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the concerns of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Payroll Information Sheet to ensure flawless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll information sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll information form?

A payroll information form is a document used by businesses to collect essential details from employees for payroll purposes. This form typically includes information such as social security numbers, tax withholding preferences, and banking details for direct deposits. Utilizing a digital solution like airSlate SignNow makes it easy to send, fill out, and eSign these forms securely.

-

How can airSlate SignNow help with payroll information forms?

airSlate SignNow streamlines the process of managing payroll information forms by enabling businesses to send and eSign them electronically. The solution ensures that forms are filled out correctly and securely stored, reducing the risk of errors and delays in payroll processing. With its user-friendly interface, it simplifies document management for HR departments.

-

Are there any costs associated with using airSlate SignNow for payroll information forms?

airSlate SignNow offers flexible pricing plans that are designed to accommodate businesses of all sizes. While there may be costs associated with using the platform, the investment can lead to signNow savings in time and resources spent managing payroll information forms. Exploring the pricing tiers can help you find the best option that fits your business needs.

-

What features does airSlate SignNow provide for payroll information forms?

airSlate SignNow provides various features that enhance the management of payroll information forms, including document templates, automated workflows, and secure eSigning capabilities. These features ensure that all payroll forms comply with legal standards and are easily accessible by both employees and HR staff. Additionally, the platform supports document tracking for better management oversight.

-

Is it secure to use airSlate SignNow for payroll information forms?

Yes, airSlate SignNow prioritizes the security of sensitive data by utilizing robust encryption and secure storage solutions. When handling payroll information forms, the platform ensures that all information is protected against unauthorized access. You can have peace of mind knowing that employee data is treated with the highest level of security.

-

Can I integrate airSlate SignNow with other software for managing payroll information forms?

Absolutely! airSlate SignNow offers integrations with various HR and payroll management software solutions. This allows businesses to seamlessly transfer data between platforms, enhancing the efficiency of payroll processes and ensuring that your payroll information forms are up-to-date and accurately reflected across systems.

-

How does airSlate SignNow improve the efficiency of payroll management?

By digitizing payroll information forms, airSlate SignNow signNowly reduces the time and effort required for document handling. The platform's automation features minimize manual tasks, allowing HR teams to focus on more strategic activities. This efficiency ensures timely payroll processing and improves employee satisfaction by making procedures smoother.

Get more for Payroll Information Sheet

Find out other Payroll Information Sheet

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free