Mass Form M 1310 Instructions 2019

What is the Mass Form M 1310 Instructions

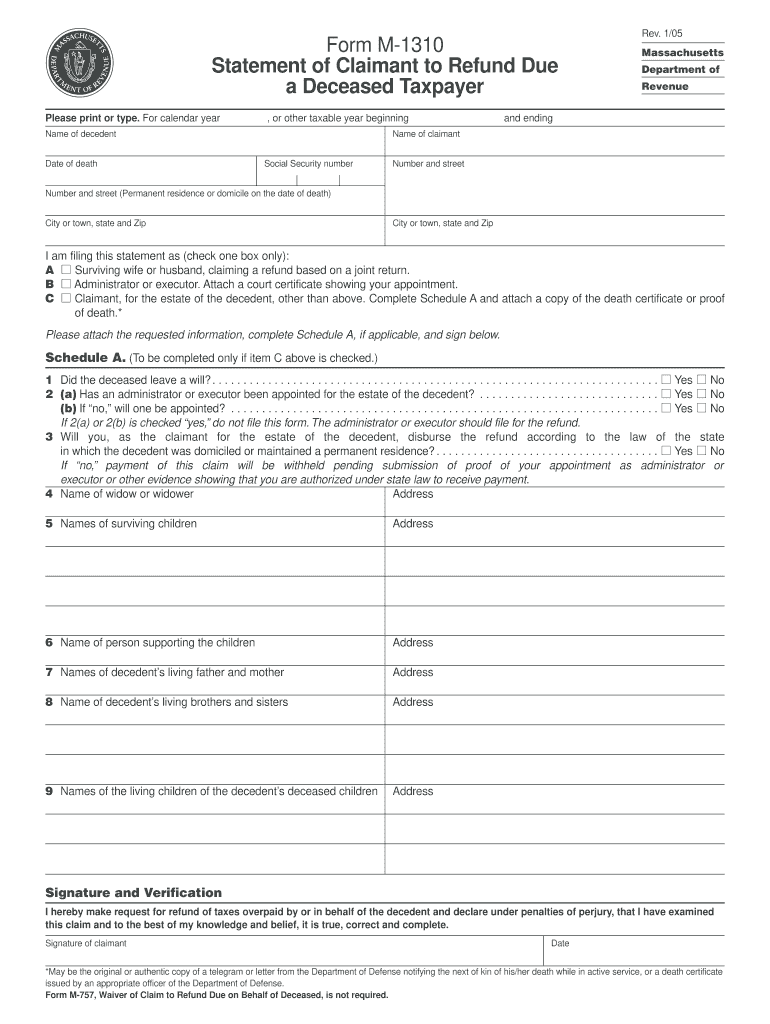

The Mass Form M 1310 Instructions provide essential guidelines for individuals seeking to claim a refund of overpaid Massachusetts income taxes. This form is primarily utilized by taxpayers who need to correct their tax filings or request refunds for various reasons, including errors in previous submissions or changes in financial circumstances. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax regulations.

How to use the Mass Form M 1310 Instructions

Using the Mass Form M 1310 Instructions involves several key steps to ensure accurate completion. First, gather all necessary documentation, including prior tax returns and any supporting evidence for your refund claim. Next, carefully follow the instructions provided on the form, ensuring that all required fields are filled out completely. It is important to double-check your entries for accuracy before submission to avoid delays in processing your refund.

Steps to complete the Mass Form M 1310 Instructions

Completing the Mass Form M 1310 Instructions requires a systematic approach:

- Begin by downloading the form from the Massachusetts Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail the reason for your refund request, providing any necessary explanations or documentation.

- Calculate the amount of refund you are claiming, ensuring all calculations are accurate.

- Review the completed form for any errors or omissions.

- Submit the form via the designated method, either online, by mail, or in person, depending on your preference.

Legal use of the Mass Form M 1310 Instructions

The legal use of the Mass Form M 1310 Instructions is governed by Massachusetts tax laws. This form must be used in accordance with state regulations, ensuring that all information provided is truthful and accurate. Misuse of the form or submission of false information can result in penalties, including fines or legal action. Therefore, it is essential to adhere strictly to the guidelines outlined in the instructions.

Required Documents

When completing the Mass Form M 1310 Instructions, certain documents are required to support your claim. These may include:

- Previous tax returns for the years in question.

- W-2 forms or 1099s that reflect income earned during the relevant tax year.

- Any correspondence from the Massachusetts Department of Revenue regarding your tax filings.

- Proof of payment for any taxes previously filed.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Mass Form M 1310 Instructions. Generally, the form must be submitted within three years from the original filing date of the tax return for which you are claiming a refund. Keeping track of these deadlines helps ensure that your claim is processed in a timely manner and that you do not miss out on any potential refunds.

Quick guide on how to complete mass form m 1310 instructions 2005

Finalize Mass Form M 1310 Instructions effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Mass Form M 1310 Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to edit and electronically sign Mass Form M 1310 Instructions with ease

- Obtain Mass Form M 1310 Instructions and click on Get Form to commence.

- Use the tools we provide to fill out your form.

- Emphasize pertinent portions of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your edits.

- Select how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Mass Form M 1310 Instructions and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mass form m 1310 instructions 2005

Create this form in 5 minutes!

How to create an eSignature for the mass form m 1310 instructions 2005

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What are Mass Form M 1310 Instructions and why are they important?

Mass Form M 1310 Instructions provide critical guidance on how to properly fill out and submit the form, which is necessary for claiming a tax refund for filers who haven't submitted federal tax returns. Understanding these instructions can help ensure the accuracy of your submission and avoid delays in processing.

-

How can airSlate SignNow help with Mass Form M 1310 Instructions?

airSlate SignNow simplifies the process of signing and submitting documents associated with Mass Form M 1310 Instructions. Our intuitive platform allows users to easily upload, edit, and eSign the required forms, ensuring compliance with the instructions.

-

Are there any costs associated with using airSlate SignNow for Mass Form M 1310 Instructions?

Yes, airSlate SignNow offers a variety of pricing plans to meet different business needs, including options for individual and enterprise users. The cost provides you access to features that aid in following the Mass Form M 1310 Instructions efficiently.

-

What features does airSlate SignNow offer for managing Mass Form M 1310 Instructions?

airSlate SignNow provides features such as drag-and-drop document creation, easy eSigning, and automatic reminders to keep you on track with your submissions. These features are tailored to help users effectively navigate the Mass Form M 1310 Instructions process.

-

Can I integrate airSlate SignNow with other tools for Mass Form M 1310 Instructions?

Yes, airSlate SignNow can be integrated with various third-party applications, including cloud storage solutions and CRM platforms. This integration allows you to streamline your workflow and easily access documents related to Mass Form M 1310 Instructions.

-

How secure is airSlate SignNow when handling Mass Form M 1310 Instructions?

airSlate SignNow employs industry-standard security measures, including encryption and secure cloud storage, to protect all documents, including those pertaining to Mass Form M 1310 Instructions. You can trust that your sensitive information is safe when using our platform.

-

What are the benefits of using airSlate SignNow for Mass Form M 1310 Instructions?

The benefits of using airSlate SignNow include increased efficiency in document management, ease of use in eSigning, and compliance with Mass Form M 1310 Instructions. These advantages contribute to faster processing times and reduce the likelihood of errors.

Get more for Mass Form M 1310 Instructions

- Domanda messa a disposizione no no download needed needed form

- Covalent bond practice answer key form

- Virginia cna reciprocity form

- Global entry application form pdf

- International legal english second edition pdf form

- Medium of instruction certificate pdf form

- Schwab gift stock form

- Liability claim against the city of bakersfield form

Find out other Mass Form M 1310 Instructions

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template