Consent to Disclosure of Tax Return Information Template

Understanding the Consent to Disclosure of Tax Return Information Template

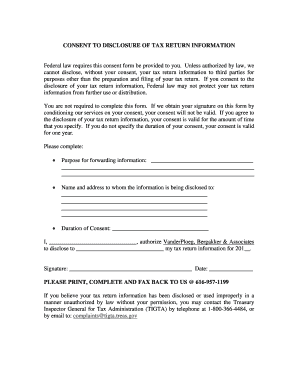

The Consent to Disclosure of Tax Return Information template is a crucial document that allows taxpayers to authorize the release of their tax return information to third parties. This template is essential for situations where a taxpayer needs to share their tax details with financial institutions, legal representatives, or other entities requiring access to this information. The form ensures that the taxpayer's privacy is respected while complying with legal requirements for information disclosure.

Steps to Complete the Consent to Disclosure of Tax Return Information Template

Completing the Consent to Disclosure of Tax Return Information template involves several key steps to ensure accuracy and compliance. First, the taxpayer must provide their personal information, including name, address, and Social Security number. Next, they should specify the third party to whom the information will be disclosed. It is important to clearly outline the purpose of the disclosure and the specific tax years involved. Finally, the taxpayer must sign and date the form to validate their consent. Ensuring all fields are correctly filled out will help prevent delays in processing.

Legal Use of the Consent to Disclosure of Tax Return Information Template

The legal use of the Consent to Disclosure of Tax Return Information template is governed by regulations set forth by the Internal Revenue Service (IRS). This template must comply with the requirements of the Internal Revenue Code, which mandates that taxpayers provide explicit consent for their tax return information to be shared. Failure to adhere to these regulations can result in penalties or legal repercussions for both the taxpayer and the third party involved. Therefore, it is essential to use the template correctly and ensure it meets all legal standards.

Key Elements of the Consent to Disclosure of Tax Return Information Template

Several key elements make up the Consent to Disclosure of Tax Return Information template. These include:

- Taxpayer Information: Full name, address, and Social Security number.

- Recipient Information: Name and contact details of the third party receiving the information.

- Purpose of Disclosure: A clear statement outlining why the information is being shared.

- Tax Years Covered: Specific years of tax returns that are authorized for disclosure.

- Signature and Date: The taxpayer's signature and the date of signing to validate the consent.

IRS Guidelines for the Consent to Disclosure of Tax Return Information

The IRS provides specific guidelines regarding the use of the Consent to Disclosure of Tax Return Information template. Taxpayers must ensure that the consent form is signed voluntarily and that the information shared is limited to what is necessary for the stated purpose. The IRS also emphasizes the importance of safeguarding taxpayer information and adhering to confidentiality requirements. Understanding these guidelines helps taxpayers navigate the disclosure process while maintaining compliance with federal regulations.

Examples of Using the Consent to Disclosure of Tax Return Information Template

There are various scenarios in which the Consent to Disclosure of Tax Return Information template may be utilized. For instance, a taxpayer may need to provide their tax return information to a mortgage lender when applying for a home loan. Similarly, a legal representative may require access to a taxpayer's information to assist with a legal matter. In both cases, using the consent template ensures that the taxpayer's rights are protected while allowing necessary information to be shared with authorized parties.

Quick guide on how to complete consent to disclosure of tax return information template

Complete Consent To Disclosure Of Tax Return Information Template effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without any delays. Manage Consent To Disclosure Of Tax Return Information Template on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and eSign Consent To Disclosure Of Tax Return Information Template with minimal effort

- Obtain Consent To Disclosure Of Tax Return Information Template and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to deliver your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Consent To Disclosure Of Tax Return Information Template and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consent to disclosure of tax return information template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax return consent information and why is it important?

Tax return consent information is a written authorization that enables tax professionals to access and share your tax return information. It is important because it ensures compliance with IRS regulations and protects your data privacy. By having clear consent, you facilitate smoother communication with your tax advisors.

-

How can airSlate SignNow help me collect tax return consent information?

airSlate SignNow offers a streamlined eSigning solution that allows you to easily gather tax return consent information from clients. With customizable templates, you can create a consent form that clients can sign electronically, saving time and ensuring that all necessary data is captured quickly and securely.

-

What are the pricing options for using airSlate SignNow for tax return consent information collection?

airSlate SignNow offers flexible pricing plans tailored to various needs, including options for individuals, small businesses, and larger organizations. By choosing the right plan, you can efficiently manage the collection of tax return consent information while maximizing cost-effectiveness.

-

Are there any features specifically designed for managing tax return consent information?

Yes, airSlate SignNow includes features such as customizable templates and automated reminders to help manage tax return consent information. These tools streamline the process of gathering consent, making it easy for clients to sign and return documents in a timely manner.

-

What are the benefits of using airSlate SignNow for tax return consent information?

Using airSlate SignNow for tax return consent information provides several benefits, including improved efficiency, enhanced security, and reduced paperwork. The platform also enables you to keep your documents organized and accessible, simplifying your workflow and client interactions.

-

Can I integrate airSlate SignNow with other tools for tax return consent information?

Absolutely! airSlate SignNow integrates seamlessly with various tools like CRM systems and accounting software, allowing you to manage tax return consent information effectively. This integration ensures a smooth workflow and enhances your overall productivity.

-

Is airSlate SignNow compliant with regulations for handling tax return consent information?

Yes, airSlate SignNow adheres to strict security protocols and compliance standards to protect sensitive information like tax return consent information. The platform is designed to meet legal and regulatory requirements, ensuring your data remains secure and confidential.

Get more for Consent To Disclosure Of Tax Return Information Template

- Bureau of family assistance bfa form

- Application casac form

- Form 74 221 tax refund direct deposit authorization

- Application birth form

- Application for authority certificate of authority form

- Georgia advance directive for health care division of aging form

- T 8 limited power of attorneymotor vehicle transactions form

- Drs ip 989 q ampamp a attorneys occupational tax ctgov form

Find out other Consent To Disclosure Of Tax Return Information Template

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed