Ustaxcourt Gov Form

What is the Ustaxcourt Gov

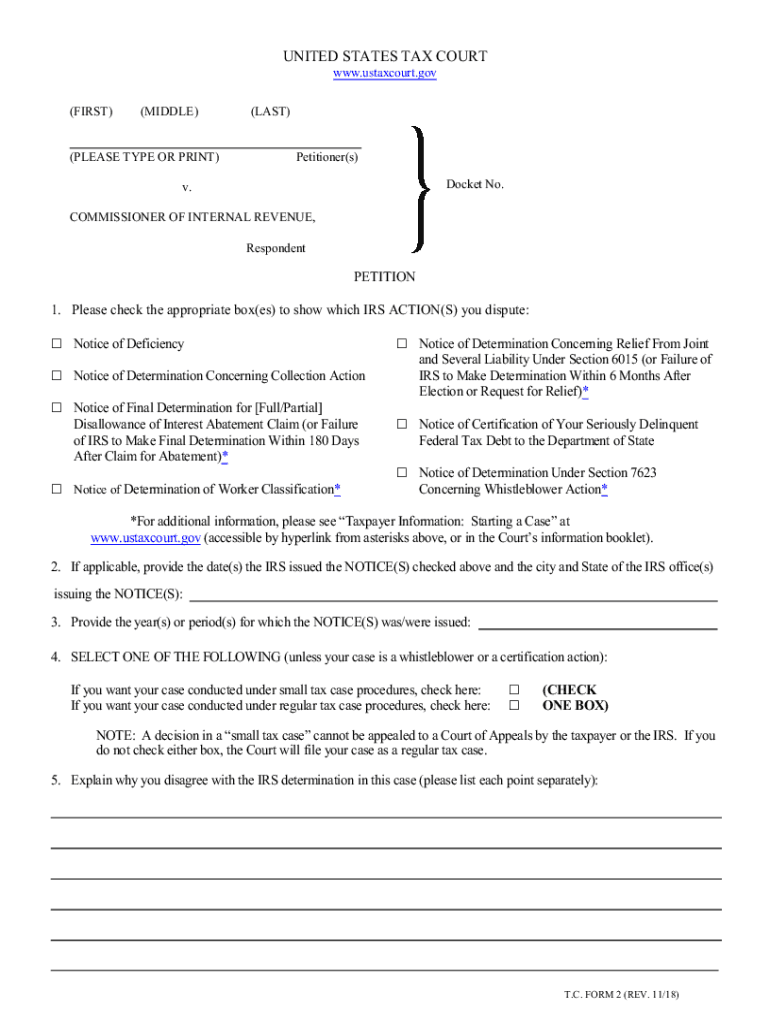

The Ustaxcourt Gov is the official website for the United States Tax Court, a federal court that hears disputes between taxpayers and the Internal Revenue Service (IRS). It provides a platform for taxpayers to file petitions regarding tax deficiencies, disputes, or other issues related to federal taxes. The court operates independently from the IRS, ensuring that taxpayers have a fair chance to contest the IRS's determinations. The Ustaxcourt Gov serves as a resource for individuals seeking information about their rights, the petition process, and court procedures.

How to use the Ustaxcourt Gov

Using the Ustaxcourt Gov involves navigating through its various sections to find relevant information and resources. Taxpayers can access forms, guidelines, and instructions needed to file a petition. The website provides detailed explanations of the filing process, including eligibility criteria and required documentation. Users can also find information on upcoming hearings, court rules, and procedures to ensure they comply with all necessary regulations. It is important to familiarize oneself with the website's layout to efficiently locate the needed resources.

Steps to complete the Ustaxcourt Gov

Completing the Ustaxcourt Gov petition process involves several key steps:

- Determine eligibility: Ensure that your case qualifies for submission to the United States Tax Court.

- Gather necessary documents: Collect all relevant tax documents, notices from the IRS, and any supporting evidence.

- Complete the petition form: Fill out the appropriate IRS petition tax court form, ensuring all information is accurate and complete.

- File your petition: Submit your completed petition either electronically through the Ustaxcourt Gov or by mailing it to the appropriate court address.

- Await confirmation: After submission, monitor for confirmation of receipt and any further instructions from the court.

Required Documents

When filing a petition with the Ustaxcourt Gov, certain documents are essential to support your case. These typically include:

- The completed IRS petition tax court form.

- Copies of any notices or determinations issued by the IRS that you are contesting.

- Supporting documentation that substantiates your claims, such as receipts, tax returns, and correspondence with the IRS.

Ensuring that all required documents are included will help facilitate the processing of your petition and improve your chances of a favorable outcome.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for a successful petition to the Ustaxcourt Gov. Generally, taxpayers must file their petition within ninety days of receiving a notice of deficiency from the IRS. Missing this deadline can result in the loss of the right to contest the IRS's determination. It is advisable to check the Ustaxcourt Gov for any specific dates related to your case and to keep track of any additional deadlines that may apply.

IRS Guidelines

The IRS provides specific guidelines for taxpayers looking to file a petition with the Ustaxcourt Gov. These guidelines outline the types of cases that can be brought before the court, the procedural rules for filing, and the expectations for both taxpayers and the IRS during the process. Familiarizing yourself with these guidelines can help ensure that your petition is properly submitted and that you understand the legal framework surrounding your case.

Quick guide on how to complete ustaxcourt gov

Complete Ustaxcourt Gov effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Ustaxcourt Gov on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Ustaxcourt Gov without hassle

- Find Ustaxcourt Gov and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you choose. Edit and electronically sign Ustaxcourt Gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ustaxcourt gov

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow's role in the irs tax court process?

airSlate SignNow streamlines the document management process for taxpayers involved in the irs tax court. Our platform enables seamless electronic signing of essential documents, ensuring that all submissions are completed quickly and securely without the hassles of paper. This efficiency can signNowly improve your chances of a favorable outcome in your tax court dealings.

-

How does airSlate SignNow ensure compliance with irs tax court requirements?

airSlate SignNow is designed with compliance in mind, adhering to the regulations set forth by the irs tax court. Our eSignature platform is legally binding and ensures that all signed documents maintain a complete audit trail. This feature is critical for those preparing to present cases in the irs tax court.

-

What are the pricing options for airSlate SignNow to use for irs tax court documents?

airSlate SignNow offers flexible pricing plans to accommodate various needs, whether you are an individual or a business preparing for the irs tax court. Our pricing is tiered based on features and usage, allowing you to select a plan that fits your budget while still providing high-quality document eSigning. Visit our pricing page for the latest offers.

-

Can I integrate airSlate SignNow with my existing tax software for irs tax court documentation?

Yes, airSlate SignNow offers various integrations with popular tax software that can streamline your documentation process for the irs tax court. Our API allows seamless connectivity, enabling you to send and eSign documents directly from your tax software. This integration saves time and reduces errors when preparing for court proceedings.

-

What features of airSlate SignNow are most beneficial for preparing for the irs tax court?

The most beneficial features of airSlate SignNow for irs tax court preparation include our secure eSignature capabilities, document templates, and real-time tracking. These tools ensure that your documents are completed on time and are securely transmitted. Our platform enhances collaboration among stakeholders involved in your tax court case.

-

Is airSlate SignNow suitable for businesses dealing with complex irs tax court cases?

Absolutely! airSlate SignNow is well-suited for businesses facing complex cases in the irs tax court. Our platform provides advanced features such as team collaboration tools and document management, allowing multiple users to work together efficiently. This functionality is essential for handling intricate tax matters effectively.

-

How can airSlate SignNow help speed up the irs tax court documentation process?

airSlate SignNow speeds up the documentation process for the irs tax court by facilitating quick and efficient electronic signatures and document sharing. Users can send documents for signature in mere minutes and receive signed copies instantly. This rapid workflow ensures that you meet deadlines and can focus more on your case.

Get more for Ustaxcourt Gov

- Offer letter sample bahrain form

- Visa application form of the peoples republic of china 100070907

- Tupperware forms

- Cresta card form

- Rx3 form

- Isdb scholarship application form

- Pythagorean theorem worksheet for each triangle find the missing length answer key form

- Proof of death form unified life insurance company

Find out other Ustaxcourt Gov

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online