Form 8903 Instructions

What is the Form 8903 Instructions

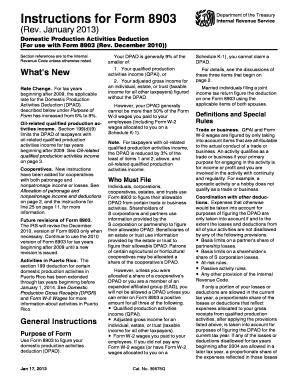

The Form 8903 instructions provide guidance for taxpayers who need to report certain tax credits related to the domestic production activities deduction. This form is particularly relevant for businesses engaged in manufacturing, producing, or extracting goods within the United States. Understanding these instructions is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to complete the Form 8903 Instructions

Completing the Form 8903 involves several key steps that must be followed carefully:

- Gather necessary financial documents, including income statements and records of production activities.

- Review the Form 8903 instructions thoroughly to understand the specific requirements for your situation.

- Fill out the form accurately, ensuring that all calculations reflect your business's actual production activities.

- Double-check the information for accuracy to prevent errors that could lead to penalties.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Form 8903 Instructions

Using the Form 8903 instructions legally entails adhering to IRS guidelines regarding the reporting of domestic production activities. This includes ensuring that all information provided is truthful and accurate. Falsifying information or failing to comply with the instructions can result in significant penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the Form 8903 is essential to avoid penalties. The typical deadline for submitting this form coincides with the standard tax filing deadline, which is usually April fifteenth for individual taxpayers. However, businesses may have different deadlines based on their fiscal year. It is important to verify specific dates each year to ensure compliance.

How to obtain the Form 8903 Instructions

The Form 8903 instructions can be obtained directly from the IRS website or through various tax preparation software. It is advisable to access the most current version of the instructions to ensure that you are following the latest guidelines. Additionally, tax professionals can provide assistance in obtaining and interpreting the instructions.

Key elements of the Form 8903 Instructions

Key elements of the Form 8903 instructions include:

- Eligibility criteria for claiming the domestic production activities deduction.

- Detailed explanations of the types of activities that qualify.

- Instructions for calculating the deduction accurately.

- Information on required documentation to support claims.

Examples of using the Form 8903 Instructions

Examples of using the Form 8903 instructions can clarify how different types of businesses might apply the guidelines. For instance, a manufacturing company may use the form to report income from products made in the U.S., while a construction firm could report income from building projects. Each example highlights the importance of accurately documenting production activities to maximize tax benefits.

Quick guide on how to complete form 8903 instructions

Complete Form 8903 Instructions seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8903 Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 8903 Instructions effortlessly

- Find Form 8903 Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 8903 Instructions and guarantee excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8903 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 8903 instructions for completing the application?

The form 8903 instructions provide detailed guidance on how to fill out the form accurately. It outlines the necessary information required, including calculations for tax deductions related to foreign income. Following these instructions carefully will ensure compliance and maximize your tax benefits.

-

How can airSlate SignNow help me with form 8903 instructions?

AirSlate SignNow streamlines the process of completing form 8903 instructions by allowing you to easily fill out and eSign documents electronically. Our platform ensures that you can access the form and its instructions anytime and anywhere, making it simple to stay organized and compliant. Additionally, you can save time with automated workflows.

-

Are there any costs associated with using airSlate SignNow for form 8903 instructions?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for individuals and teams. Each plan provides access to essential features that will help you manage your documents, including the form 8903 instructions. We encourage prospective customers to review our pricing page to find the best fit.

-

What features does airSlate SignNow offer for filling out tax forms like form 8903?

AirSlate SignNow offers features such as document templates, cloud storage, and secure signing to effortlessly manage tax forms like form 8903. With customizable workflows and integration capabilities, you can easily collaborate with your team while ensuring that every step aligns with the form 8903 instructions. Our platform is designed for efficiency and compliance.

-

Can I integrate airSlate SignNow with other applications while using form 8903 instructions?

Yes, airSlate SignNow integrates seamlessly with numerous applications, enhancing your ability to manage form 8903 instructions. You can connect with popular platforms such as Google Drive, Dropbox, and CRM systems to streamline your workflows. This integration helps centralize your document management process and minimizes duplications.

-

What are the benefits of using airSlate SignNow for form 8903 instructions?

Using airSlate SignNow for form 8903 instructions provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the completion of tax forms by allowing you to electronically sign and store documents safely. This saves you valuable time while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for those unfamiliar with form 8903 instructions?

Absolutely! AirSlate SignNow is designed with a user-friendly interface that makes it easy for anyone, regardless of technical expertise, to navigate the form 8903 instructions. Detailed guidance and tips are provided throughout the process, ensuring that you can complete your forms without confusion. Our support team is also available to assist you with any questions.

Get more for Form 8903 Instructions

Find out other Form 8903 Instructions

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now