W9 Form 2018

What is the W-9 Form?

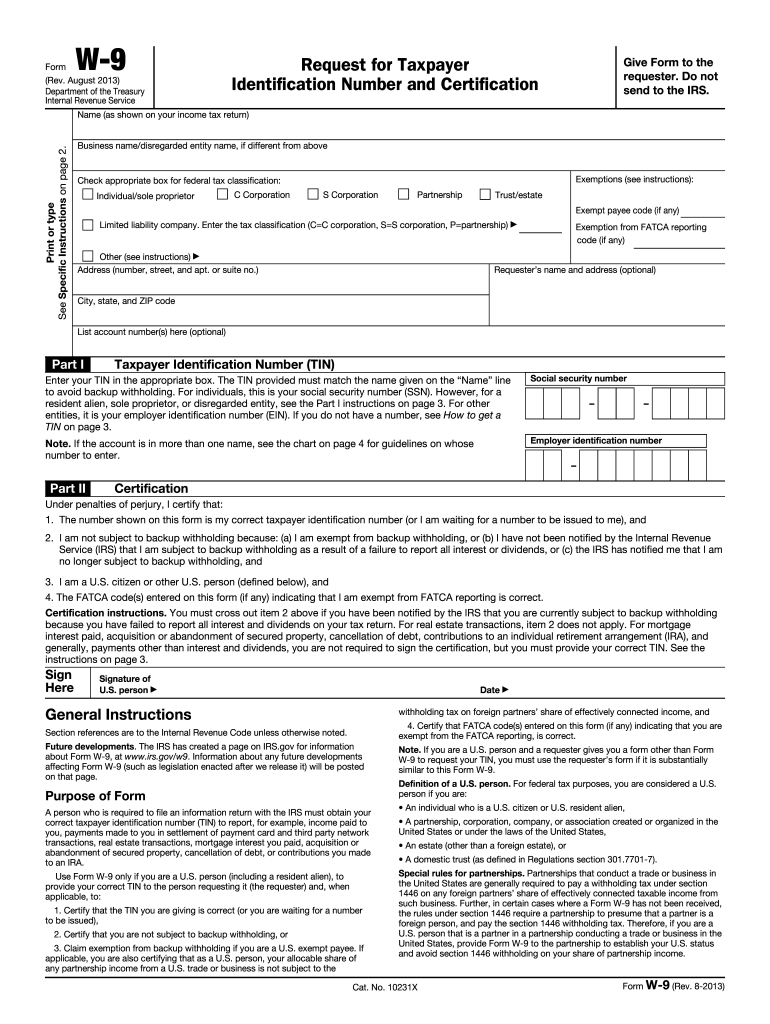

The W-9 form is an IRS document used by individuals and businesses in the United States to provide their taxpayer identification information to entities that are required to report certain payments to the IRS. This form is crucial for freelancers, contractors, and other self-employed individuals who receive income from clients. The W-9 form helps ensure accurate tax reporting and is often requested by clients before they issue payments. It includes essential details such as the name, business name (if applicable), address, and taxpayer identification number (TIN).

How to Use the W-9 Form

Using the W-9 form involves a straightforward process. First, individuals or entities must fill out the form with accurate information. Once completed, the form should be submitted to the requesting party, typically a client or employer. It is important to keep a copy for personal records. The W-9 does not get submitted to the IRS directly; instead, it is used by the requester to prepare forms such as the 1099, which report income to the IRS. This ensures that all income is properly documented and reported for tax purposes.

Steps to Complete the W-9 Form

Completing the W-9 form requires careful attention to detail. Here are the steps to follow:

- Download the W-9 form from the IRS website or obtain it from the requesting party.

- Fill in your name as it appears on your tax return.

- If applicable, enter your business name.

- Provide your address, including city, state, and ZIP code.

- Enter your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9 Form

The W-9 form is legally binding and must be completed accurately to avoid penalties. It is used to verify the taxpayer's identity and ensure compliance with IRS regulations. Providing false information on the W-9 can lead to significant repercussions, including fines and legal issues. It is essential for both the individual completing the form and the entity requesting it to understand the legal implications of the information provided.

IRS Guidelines

The IRS has specific guidelines regarding the use of the W-9 form. It is important to refer to the latest IRS instructions to ensure compliance. The form must be filled out completely and accurately to avoid delays in processing payments. Additionally, the IRS requires that the W-9 be updated whenever there is a change in the taxpayer's information, such as a name change or change in tax status. Understanding these guidelines helps individuals and businesses maintain compliance and avoid potential tax issues.

Filing Deadlines / Important Dates

While the W-9 form itself does not have a specific filing deadline, it is important to submit it promptly upon request to ensure timely processing of payments. Clients typically need the W-9 to prepare 1099 forms by January 31 of the following year. Therefore, submitting the W-9 well in advance of this deadline can help prevent delays in receiving payment. Keeping track of important dates related to tax reporting can aid in maintaining compliance and ensuring smooth financial transactions.

Quick guide on how to complete w9 2013 form

Prepare W9 Form effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Manage W9 Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign W9 Form with ease

- Obtain W9 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or hide sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any chosen device. Modify and electronically sign W9 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w9 2013 form

Create this form in 5 minutes!

How to create an eSignature for the w9 2013 form

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is a W-9 form 2024?

The W-9 form 2024 is an IRS document used by individuals and businesses to provide taxpayer identification information. It is essential for reporting income and is typically required when you're hired as an independent contractor or freelancer. Understanding what is W-9 form 2024 helps ensure compliance with tax regulations.

-

How can airSlate SignNow help with W-9 forms in 2024?

AirSlate SignNow simplifies the process of filling out and electronically signing W-9 forms. Our platform enables you to easily manage and store your W-9 documents securely, making it a breeze to provide the necessary information to your clients and vendors. With airSlate SignNow, you can streamline your workflows related to what is W-9 form 2024.

-

Is there a cost associated with using airSlate SignNow for W-9 forms?

AirSlate SignNow offers various pricing plans tailored to meet different business needs, including affordable options for managing W-9 forms. Our cost-effective solution allows businesses to send, sign, and manage documents electronically without hidden fees. Discover how our pricing aligns with your requirements for what is W-9 form 2024.

-

What features does airSlate SignNow offer for W-9 form management?

AirSlate SignNow includes features such as customizable templates, secure e-signatures, and document tracking for efficient W-9 form management. These tools ensure that you can automate your processes and maintain compliance with what is W-9 form 2024 requirements effortlessly. Experience enhanced productivity with our user-friendly interface.

-

Can I integrate airSlate SignNow with other apps for W-9 form handling in 2024?

Yes, airSlate SignNow supports integrations with popular business applications to streamline your W-9 form handling. Whether you're using project management tools, CRMs, or accounting software, our platform can work seamlessly with them. This capability allows for further simplification of processes relating to what is W-9 form 2024.

-

What benefits do I get from using airSlate SignNow for W-9 forms?

Using airSlate SignNow for W-9 forms offers signNow benefits, including time savings and improved accuracy. Our electronic signature solution reduces the need for paper, minimizing errors and delays in document processing. These advantages support your understanding of what is W-9 form 2024 while enhancing overall efficiency.

-

How do I ensure compliance when using airSlate SignNow for W-9 forms?

To ensure compliance with what is W-9 form 2024 guidelines, airSlate SignNow provides secure storage and audit trails for all your documents. Our platform includes features that help you meet IRS requirements for maintaining W-9 form records. Trust us to keep your information secure and compliant.

Get more for W9 Form

- Shipito 1583 form

- Ghost of the lagoon pdf form

- Ctr form pdf

- Esl parents night invitation b2015b parklandsd form

- Electrical inspection report form

- Self certification form printable

- Letter of protection for doctor template 56389609 form

- Form 8960 net investment income taxindividuals estates and trusts

Find out other W9 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors