W 9 Form 2018

What is the W-9 Form

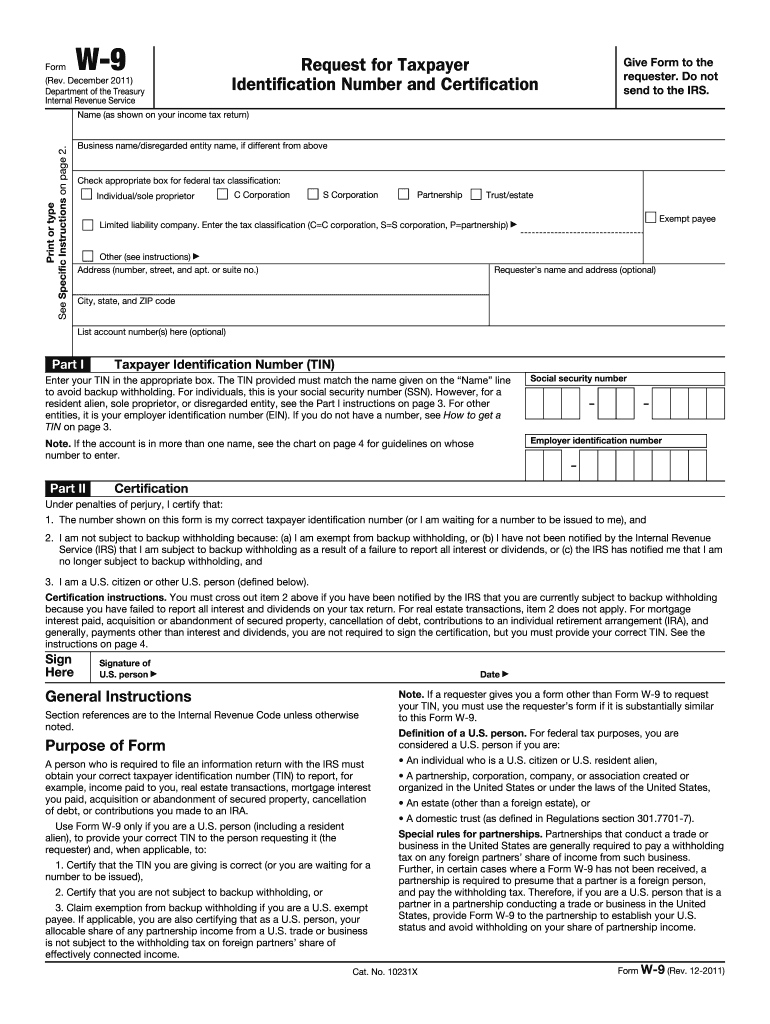

The W-9 form, officially titled "Request for Taxpayer Identification Number and Certification," is a crucial document used in the United States. It is primarily utilized by businesses to collect information from individuals or entities that provide services. This form helps the requester obtain the correct taxpayer identification number (TIN) of the payee, which can be an individual, corporation, partnership, or other business entity. The W-9 is essential for tax reporting purposes, ensuring that income is accurately reported to the Internal Revenue Service (IRS).

How to Use the W-9 Form

Using the W-9 form is straightforward. When a business or individual requests a W-9, the payee must complete the form by providing their name, business name (if applicable), address, and TIN. After filling out the form, the payee returns it to the requester, not to the IRS. The requester then uses the information provided to report payments made to the payee on forms such as the 1099. It is important to ensure that the information is accurate to avoid penalties or issues with the IRS.

Steps to Complete the W-9 Form

Completing the W-9 form involves several key steps:

- Download the W-9 form from the IRS website or request a copy from the requester.

- Fill in your name as it appears on your tax return.

- If applicable, provide your business name.

- Enter your address, including city, state, and ZIP code.

- Provide your taxpayer identification number, which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Certify that the information provided is correct by signing and dating the form.

Legal Use of the W-9 Form

The W-9 form is legally binding once it is signed by the payee. By signing the form, the payee certifies that the TIN provided is correct and that they are not subject to backup withholding. The form must be completed accurately to comply with IRS regulations. If the information is incorrect or if the payee fails to provide a W-9 when requested, the requester may be required to withhold taxes from payments made to the payee.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form. It is essential for payees to understand their responsibilities when completing the form. The IRS requires that the W-9 be filled out completely and accurately to avoid delays in processing and potential penalties. Additionally, the form should be updated whenever there is a change in the payee's information, such as a name change or change in business structure.

Form Submission Methods

The completed W-9 form should be submitted directly to the requester, not the IRS. Submission can be done in several ways:

- Email: The form can be scanned and emailed to the requester.

- Mail: The physical form can be mailed to the requester's address.

- Fax: Some requesters may accept faxed copies of the completed form.

It is important to confirm the preferred submission method with the requester to ensure timely processing.

Quick guide on how to complete w 9 form 2011

Complete W 9 Form seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without delays. Manage W 9 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign W 9 Form with ease

- Obtain W 9 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight essential sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal weight as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate lost or misplaced files, tedious form searching, or mistakes that require printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign W 9 Form and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 9 form 2011

Create this form in 5 minutes!

How to create an eSignature for the w 9 form 2011

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is a 2011 W 9 form?

The 2011 W 9 form is a tax document used by businesses to request the Taxpayer Identification Number (TIN) of contractors and freelancers. This form helps ensure correct information is reported to the IRS. It’s essential for effective tax compliance, especially for small business owners.

-

How can I fill out the 2011 W 9 form using airSlate SignNow?

With airSlate SignNow, filling out the 2011 W 9 form is simple and efficient. Just upload the form, fill in the required fields, and you can sign electronically. Our platform provides a user-friendly interface that guides you through the process.

-

Is airSlate SignNow secure for sending the 2011 W 9 form?

Yes, airSlate SignNow takes security seriously. All documents, including the 2011 W 9 form, are encrypted, ensuring that your sensitive information is protected during transmission. Our platform complies with industry standards to guarantee the privacy of your data.

-

What are the pricing options for using airSlate SignNow for the 2011 W 9 form?

airSlate SignNow offers various pricing plans that cater to different business needs, starting from affordable monthly subscriptions. You can choose a plan based on the volume of documents you manage, including the 2011 W 9 form. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for handling the 2011 W 9 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, such as CRM systems and accounting software. This integration streamlines your workflow when managing the 2011 W 9 form and other documents, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for the 2011 W 9 form?

Using airSlate SignNow for the 2011 W 9 form offers numerous benefits, including speed, convenience, and reduced paper usage. Electronic signatures allow for quick approvals and less hassle compared to traditional methods. Additionally, it helps you stay organized with easy access to all signed documents.

-

Can I track the status of my 2011 W 9 form sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking features for documents, including the 2011 W 9 form. You can easily see when the form is viewed, signed, or completed, giving you full visibility of the signing process and improving your ability to manage document workflows.

Get more for W 9 Form

- Ghost of the lagoon pdf form

- Ctr form pdf

- Esl parents night invitation b2015b parklandsd form

- Electrical inspection report form

- Self certification form printable

- Letter of protection for doctor template 56389609 form

- Form 8960 net investment income taxindividuals estates and trusts

- Form irs instruction 1065 schedule k 1 fill

Find out other W 9 Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT