Form D1040NR Detroit Non Resident City of Detroit Ci Detroit Mi

What is the Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi

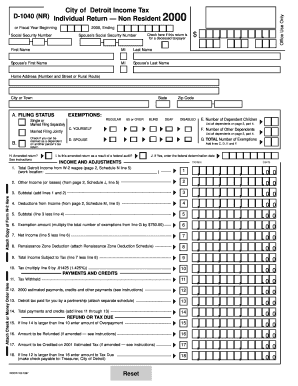

The Form D1040NR is a tax document specifically designed for non-residents of Detroit who earn income within the city. This form is essential for individuals who do not reside in Detroit but have taxable income sourced from the city. Completing this form accurately ensures compliance with local tax regulations and helps determine the amount of tax owed to the City of Detroit. Understanding the purpose of the D1040NR is crucial for non-residents to fulfill their tax obligations and avoid potential penalties.

How to use the Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi

Using the Form D1040NR involves several key steps to ensure proper completion. Non-residents should first gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, individuals must fill out the form with accurate information regarding their income, deductions, and credits applicable to non-residents. After completing the form, it is essential to review all entries for accuracy before submission. This process helps to ensure compliance with local tax laws and minimizes the risk of errors that could lead to delays or penalties.

Steps to complete the Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi

Completing the Form D1040NR involves a systematic approach to ensure all required information is accurately reported. The steps include:

- Gather necessary documents such as income statements and previous tax returns.

- Fill in personal information, including name, address, and Social Security number.

- Report all income earned in Detroit, including wages, salaries, and other sources.

- Claim applicable deductions and credits that apply to non-residents.

- Calculate the total tax owed based on the income reported.

- Sign and date the form, certifying that all information is true and accurate.

Legal use of the Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi

The legal use of the Form D1040NR is grounded in compliance with the tax regulations set forth by the City of Detroit. Non-residents are required to file this form to report any income earned within the city limits. Proper completion and timely submission of the form are crucial to avoid legal repercussions, including fines or penalties. Additionally, the form serves as a formal declaration of income, which is necessary for maintaining good standing with local tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form D1040NR are critical for non-residents to adhere to in order to avoid penalties. Typically, the form is due on April fifteenth of each year, coinciding with the federal tax filing deadline. However, it is advisable to check for any updates or changes to deadlines, as local regulations may vary. Filing on time ensures compliance and helps maintain a good relationship with the City of Detroit's tax authorities.

Required Documents

To successfully complete the Form D1040NR, certain documents are required. These include:

- W-2 forms from employers indicating wages earned in Detroit.

- 1099 forms for any freelance or contract work completed within the city.

- Documentation of any deductions or credits claimed on the form.

- Previous tax returns for reference, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting income and taxes owed.

Quick guide on how to complete form d1040nr detroit non resident city of detroit ci detroit mi

Effortlessly Prepare Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest method to modify and eSign Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi with ease

- Locate Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form—email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced records, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi and facilitate clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form d1040nr detroit non resident city of detroit ci detroit mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form D1040NR for non-residents in Detroit?

Form D1040NR is the tax form that non-residents must file with the City of Detroit for income earned within the city. If you're a non-resident taxpayer or work in Detroit, it's essential to correctly fill out and submit Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi to comply with local tax regulations.

-

How can airSlate SignNow help with Form D1040NR submissions?

airSlate SignNow streamlines the process of completing and eSigning Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi. With our user-friendly platform, you can easily upload documents, fill in necessary details, and securely sign the form online, ensuring your submission is both efficient and compliant.

-

What are the costs involved in using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. Our services are cost-effective, making it easy to access essential features for completing documents like Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi without breaking the bank.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with popular software platforms such as Google Drive, Dropbox, and more. This allows you to directly access and manage your documents, including Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi, within your existing workflows.

-

What features does airSlate SignNow offer that are beneficial for non-residents?

airSlate SignNow provides features such as electronic signatures, document templates, and automated workflows, all of which are beneficial for non-residents dealing with tax forms. These tools simplify the process of managing and submitting Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi, saving you time and hassle.

-

Can I access airSlate SignNow from mobile devices?

Yes, airSlate SignNow is accessible from all mobile devices, allowing you to complete and eSign documents like Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi on the go. Our mobile-friendly platform ensures that you can manage your documents anytime and anywhere with ease.

-

Is my data secure when using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes your data security with advanced encryption and compliance with industry standards. When filling out and submitting Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi, you can rest assured that your personal information is safe and protected.

Get more for Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi

- Civ135 form

- Motion respond motion for fees form

- Cr 316 application change form

- Alaska answering form

- Alaska driving under influence form

- Alaska sc 9 form

- Instructions for administrative agencies preparation of agency record 1 form

- Dr 351 instructions for requesting reimbursemet domestic relations form

Find out other Form D1040NR Detroit Non Resident City Of Detroit Ci Detroit Mi

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online