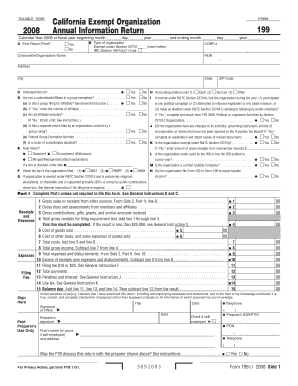

California Exempt Organization Annual Information Return

What is the California Exempt Organization Annual Information Return

The California Exempt Organization Annual Information Return is a crucial document for non-profit organizations operating within the state. This form, often referred to as the Form 199, is designed to provide the California Franchise Tax Board with essential information about the organization's activities, finances, and governance. It ensures transparency and accountability, allowing the state to monitor compliance with tax-exempt status requirements. Organizations must file this return annually to maintain their exempt status and avoid penalties.

Steps to complete the California Exempt Organization Annual Information Return

Completing the California Exempt Organization Annual Information Return involves several key steps. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form accurately, ensuring that all sections are completed, such as organizational information and financial data. It's important to review the return for accuracy before submission. Finally, submit the completed form by the designated deadline, either electronically or by mail, depending on your preference.

Filing Deadlines / Important Dates

Timely filing of the California Exempt Organization Annual Information Return is essential to avoid penalties. The deadline for submitting this form is typically the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year basis, this means the due date is May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations should mark their calendars to ensure compliance.

Legal use of the California Exempt Organization Annual Information Return

The legal use of the California Exempt Organization Annual Information Return is governed by state regulations. This form must be filled out and submitted in accordance with the California Revenue and Taxation Code. It is essential for maintaining the organization’s tax-exempt status and must be completed accurately to avoid legal repercussions. Organizations should ensure that their filings comply with both state and federal laws regarding non-profit operations.

Required Documents

To complete the California Exempt Organization Annual Information Return, organizations must prepare several required documents. These typically include financial statements, such as income statements and balance sheets, along with a list of officers and directors. Additionally, organizations may need to provide documentation of their exempt purpose and any changes in governance or operations during the year. Having these documents ready will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

Organizations have multiple options for submitting the California Exempt Organization Annual Information Return. The form can be filed online through the California Franchise Tax Board's website, which is often the quickest method. Alternatively, organizations may choose to mail the completed form to the appropriate address provided by the Franchise Tax Board. In-person submissions are generally not recommended but may be possible at certain locations. It is important to choose the method that best fits the organization’s needs while ensuring compliance with submission guidelines.

Quick guide on how to complete california exempt organization annual information return

Execute California Exempt Organization Annual Information Return seamlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documentation, allowing you to access the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage California Exempt Organization Annual Information Return on any device with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign California Exempt Organization Annual Information Return easily

- Find California Exempt Organization Annual Information Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign California Exempt Organization Annual Information Return and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california exempt organization annual information return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California Exempt Organization Annual Information Return?

The California Exempt Organization Annual Information Return is a mandatory filing for certain organizations that are exempt from federal income tax in California. This return provides essential financial information to the California Franchise Tax Board. It ensures compliance with state regulations and helps maintain your exempt status.

-

Why do I need to file a California Exempt Organization Annual Information Return?

Filing a California Exempt Organization Annual Information Return is crucial for maintaining compliance with state laws. It allows your organization to confirm its tax-exempt status and provide transparency about its operations. Additional benefits include avoiding penalties and ensuring that donors can still receive tax-deductible contributions.

-

How does airSlate SignNow assist with the California Exempt Organization Annual Information Return?

airSlate SignNow simplifies the process of preparing and submitting the California Exempt Organization Annual Information Return. Our user-friendly platform enables organizations to easily eSign documents and manage submissions efficiently. This reduces the hassle and potential errors associated with traditional paperwork.

-

What features are included in airSlate SignNow for managing annual information returns?

airSlate SignNow offers a range of features to help manage the California Exempt Organization Annual Information Return effectively. These include document templates, secure e-signature capabilities, and cloud storage for easy access to your organizational documents. These tools streamline your compliance process and enhance productivity.

-

Is airSlate SignNow affordable for small organizations filing the California Exempt Organization Annual Information Return?

Yes, airSlate SignNow provides a cost-effective solution for small organizations needing to file the California Exempt Organization Annual Information Return. Our competitive pricing plans are designed to accommodate various budgets while ensuring access to essential features. You can maximize productivity without breaking the bank.

-

Can airSlate SignNow integrate with other software for managing the California Exempt Organization Annual Information Return?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and management software, streamlining your workflow for the California Exempt Organization Annual Information Return. These integrations facilitate easier data transfer and create a cohesive system for managing your organization's documentation processes.

-

What benefits can I expect from using airSlate SignNow for my annual information return?

Using airSlate SignNow for your California Exempt Organization Annual Information Return offers numerous benefits, including increased efficiency, reduced paperwork, and a lower risk of errors. Our platform ensures that your documents are secure and easily accessible, allowing you to focus on your organization’s mission rather than administrative tasks. Additionally, eSigning facilitates faster approval processes.

Get more for California Exempt Organization Annual Information Return

- Grade change authorization pgcps form

- Health inventory form pgcps

- Mcps termination form

- Public water and or sewer connection permit applicationxlsx form

- Bcps bullying form

- Mcps form 480 4 notice of termination of employment from montgomeryschoolsmd

- Pgcps field trip forms

- Exploring periodic trends answer key form

Find out other California Exempt Organization Annual Information Return

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form