NC 584 S3 Amazonaws Com Form

Understanding the County Nassau Transfer Tax

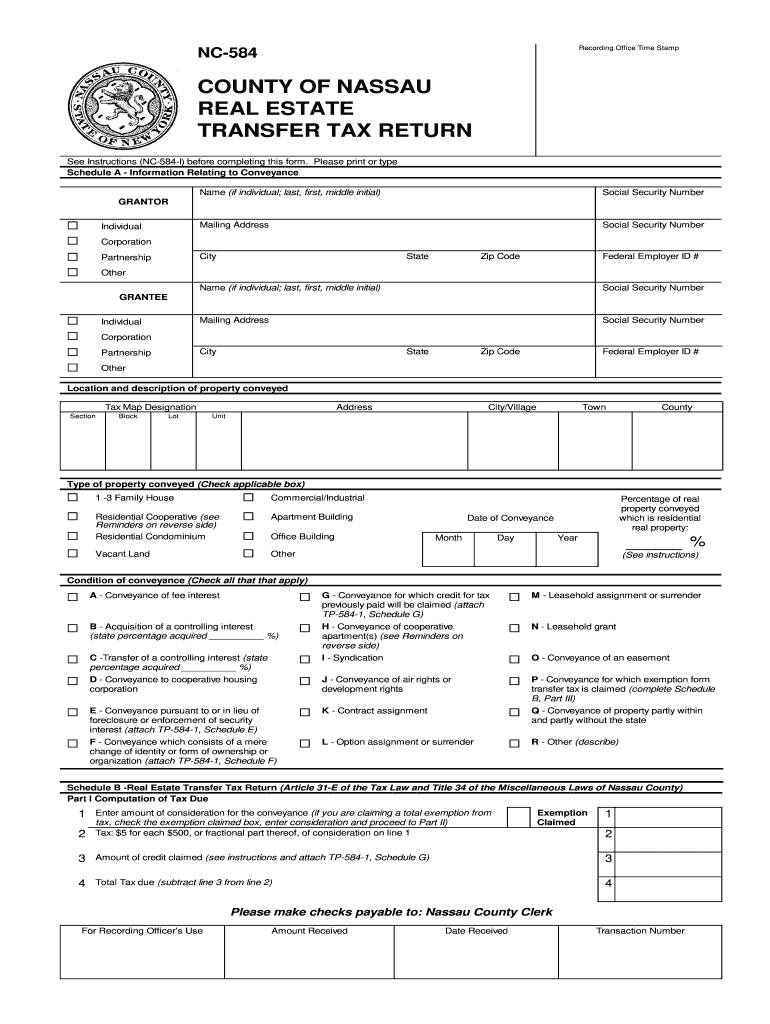

The county Nassau transfer tax is a fee imposed on the transfer of real property within Nassau County, New York. This tax is typically calculated as a percentage of the sale price of the property. Understanding the specifics of this tax is essential for both buyers and sellers involved in real estate transactions. The tax applies to various types of property transfers, including residential, commercial, and industrial properties. Knowing the applicable rates and regulations can help individuals plan their finances better when engaging in property transactions.

Steps to Complete the County Nassau Transfer Tax Form

Completing the county Nassau transfer tax form involves several key steps. First, gather all necessary information, including the property address, sale price, and details about the buyer and seller. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to double-check the calculations for the transfer tax amount to avoid errors. After completing the form, you can sign it electronically using a reliable eSignature solution, which enhances security and compliance. Finally, submit the form along with any required payment to the appropriate county office.

Required Documents for Filing

When filing the county Nassau transfer tax form, several documents are typically required. These may include the executed purchase agreement, proof of payment for the transfer tax, and identification for both the buyer and seller. Additionally, any prior deeds or property tax statements may be needed to verify ownership and ensure accurate tax calculation. Having these documents ready can streamline the filing process and help avoid delays.

Filing Methods for the County Nassau Transfer Tax

The county Nassau transfer tax form can be submitted through various methods, including online, by mail, or in person. Filing online is often the most efficient option, as it allows for immediate processing and confirmation of submission. If choosing to file by mail, ensure that the form is sent to the correct county office and that it is postmarked by the filing deadline. In-person submissions may be made at designated county offices, where assistance is available if needed.

Penalties for Non-Compliance

Failing to comply with the county Nassau transfer tax requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for both buyers and sellers to understand their obligations regarding this tax to avoid these consequences. Timely filing and payment are essential to maintain compliance and ensure a smooth property transfer process.

Digital vs. Paper Version of the Form

When considering the county Nassau transfer tax form, users have the option to complete it digitally or on paper. The digital version offers several advantages, including ease of access, the ability to eSign documents, and reduced risk of loss or damage. Additionally, electronic submissions often lead to faster processing times. However, some individuals may prefer the traditional paper method for various reasons, including familiarity or lack of access to digital tools. Understanding the benefits of each method can help users choose the best option for their needs.

Quick guide on how to complete nc 584 s3amazonawscom

Your assistance manual on preparing your NC 584 S3 amazonaws com

If you're wondering how to generate and forward your NC 584 S3 amazonaws com, here are some quick tips to simplify tax processing signNowly.

To get started, you simply need to set up your airSlate SignNow account to transform your management of documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to amend data as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and intuitive sharing options.

Adhere to the steps below to complete your NC 584 S3 amazonaws com in just a few minutes:

- Create your account and start working on PDFs in a matter of minutes.

- Utilize our directory to find any IRS tax form; examine various versions and schedules.

- Click Obtain form to access your NC 584 S3 amazonaws com in our editor.

- Complete the essential fillable fields with your details (text, numbers, check marks).

- Employ the Signing Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any discrepancies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be mindful that submitting hard copies can lead to return errors and postpone reimbursements. Of course, before e-filing your taxes, confirm the IRS website for filing guidelines applicable in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the nc 584 s3amazonawscom

How to create an eSignature for your Nc 584 S3amazonawscom online

How to make an electronic signature for your Nc 584 S3amazonawscom in Chrome

How to generate an electronic signature for putting it on the Nc 584 S3amazonawscom in Gmail

How to generate an electronic signature for the Nc 584 S3amazonawscom right from your smartphone

How to make an electronic signature for the Nc 584 S3amazonawscom on iOS devices

How to create an electronic signature for the Nc 584 S3amazonawscom on Android

People also ask

-

What is NC 584 S3 amazonaws com and how does it relate to airSlate SignNow?

NC 584 S3 amazonaws com is a secure cloud storage solution that airSlate SignNow uses to store and manage your signed documents. This integration ensures that your documents are not only easily accessible but also protected with top-notch security measures.

-

How does airSlate SignNow enhance document signing using NC 584 S3 amazonaws com?

airSlate SignNow leverages NC 584 S3 amazonaws com to provide a seamless eSigning experience. With this integration, users can quickly upload, send, and store documents securely, ensuring a streamlined workflow from start to finish.

-

Is there a cost associated with using NC 584 S3 amazonaws com through airSlate SignNow?

While NC 584 S3 amazonaws com is integrated into airSlate SignNow, the pricing structure is based on airSlate SignNow's subscription plans. Users can choose from various plans that best fit their needs, providing a cost-effective way to manage document signing.

-

What features does airSlate SignNow offer when using NC 584 S3 amazonaws com?

When utilizing NC 584 S3 amazonaws com, airSlate SignNow offers key features such as real-time document tracking, customizable templates, and automated reminders. These features work together to simplify the eSigning process and enhance productivity.

-

Can I integrate airSlate SignNow with other applications while using NC 584 S3 amazonaws com?

Yes, airSlate SignNow allows integration with various applications while leveraging NC 584 S3 amazonaws com for document storage. This flexibility ensures that you can connect with your favorite tools, increasing efficiency in your workflow.

-

What benefits can I expect from using airSlate SignNow with NC 584 S3 amazonaws com?

By using airSlate SignNow in conjunction with NC 584 S3 amazonaws com, you can expect enhanced security, ease of access, and improved collaboration on documents. These benefits help streamline your signing process and ensure that your documents are always protected.

-

Is technical support available for issues related to NC 584 S3 amazonaws com in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive technical support for all users, including those utilizing NC 584 S3 amazonaws com. Our support team is available to assist with any questions or issues you may encounter, ensuring a smooth user experience.

Get more for NC 584 S3 amazonaws com

Find out other NC 584 S3 amazonaws com

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document