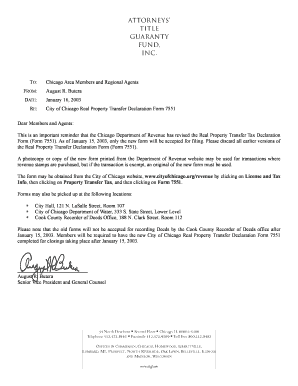

Real Property Transfer Tax Declaration Form 7551

What is the Real Property Transfer Tax Declaration Form 7551

The Real Property Transfer Tax Declaration Form 7551 is a crucial document used in the United States to report the transfer of real property. This form is typically required by state and local governments to assess the appropriate transfer tax owed when property changes hands. It includes essential information about the property, the buyer, and the seller, ensuring compliance with local tax laws. Understanding this form is vital for anyone involved in real estate transactions, as it helps facilitate the legal transfer of property while adhering to tax obligations.

How to use the Real Property Transfer Tax Declaration Form 7551

Using the Real Property Transfer Tax Declaration Form 7551 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the property, including its legal description, sale price, and details of the parties involved in the transaction. Next, complete the form by accurately filling in each section, ensuring that all required fields are addressed. Once the form is completed, it must be submitted to the appropriate local tax authority, either online or via mail, depending on the jurisdiction's requirements. It is important to keep a copy for your records, as this serves as proof of compliance with transfer tax regulations.

Steps to complete the Real Property Transfer Tax Declaration Form 7551

Completing the Real Property Transfer Tax Declaration Form 7551 involves a systematic approach to ensure all information is correctly provided. Follow these steps:

- Gather necessary documents, including the property deed and sale agreement.

- Provide details of the property, such as its address and legal description.

- Fill in the names and addresses of the buyer and seller.

- Indicate the sale price and any applicable exemptions.

- Review the form for accuracy and completeness.

- Submit the form to the local tax authority, ensuring you adhere to any specific submission guidelines.

Legal use of the Real Property Transfer Tax Declaration Form 7551

The Real Property Transfer Tax Declaration Form 7551 is legally binding once completed and submitted in accordance with state laws. It serves as an official record of the property transfer and the associated tax obligations. To ensure its legal standing, it is crucial to provide accurate and truthful information. Additionally, the form must be submitted within the timeframe established by local regulations to avoid penalties. Understanding the legal implications of this form can help prevent disputes and ensure a smooth property transfer process.

Key elements of the Real Property Transfer Tax Declaration Form 7551

Several key elements are essential for the completion of the Real Property Transfer Tax Declaration Form 7551. These include:

- Property Information: Legal description, address, and sale price.

- Buyer and Seller Details: Names, addresses, and contact information.

- Exemptions: Information on any applicable exemptions from transfer tax.

- Signature: Required signatures of both parties to validate the form.

Form Submission Methods (Online / Mail / In-Person)

The Real Property Transfer Tax Declaration Form 7551 can be submitted through various methods, depending on the local jurisdiction. Common submission methods include:

- Online: Many jurisdictions offer electronic submission options through their official websites.

- Mail: Completed forms can be sent via postal service to the designated tax authority.

- In-Person: Some local offices allow for in-person submissions, providing an opportunity to ask questions or clarify any concerns.

Quick guide on how to complete real property transfer tax declaration form 7551

Complete Real Property Transfer Tax Declaration Form 7551 effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Real Property Transfer Tax Declaration Form 7551 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Real Property Transfer Tax Declaration Form 7551 without any hassle

- Find Real Property Transfer Tax Declaration Form 7551 and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Real Property Transfer Tax Declaration Form 7551 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the real property transfer tax declaration form 7551

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Real Property Transfer Tax Declaration Form 7551?

The Real Property Transfer Tax Declaration Form 7551 is a document used to report the transfer of real property for tax purposes. It ensures compliance with local tax regulations and provides essential information about property transactions. Understanding this form is crucial for both buyers and sellers involved in real estate.

-

How can airSlate SignNow help with the Real Property Transfer Tax Declaration Form 7551?

airSlate SignNow streamlines the process of completing and signing the Real Property Transfer Tax Declaration Form 7551. Our platform allows users to easily eSign documents and manage transactions securely, saving time and reducing mistakes. You can efficiently handle all your property transfer paperwork online.

-

Is there a cost associated with using airSlate SignNow for the Real Property Transfer Tax Declaration Form 7551?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, including a cost-effective solution for processing the Real Property Transfer Tax Declaration Form 7551. You can choose a plan that fits your budget while enjoying full access to our eSigning features. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for handling the Real Property Transfer Tax Declaration Form 7551?

airSlate SignNow provides several features that enhance the handling of the Real Property Transfer Tax Declaration Form 7551. These include secure eSignature functionality, document templates, and real-time tracking of document status. With our user-friendly interface, managing your forms becomes a hassle-free experience.

-

Are there any benefits of using airSlate SignNow for the Real Property Transfer Tax Declaration Form 7551?

Using airSlate SignNow for the Real Property Transfer Tax Declaration Form 7551 offers multiple benefits, including increased efficiency and improved accuracy. Our platform minimizes paperwork, reduces delays in document processing, and enhances collaboration among all parties involved. Additionally, it ensures that all necessary signatures are collected promptly.

-

Can I integrate airSlate SignNow with other applications for the Real Property Transfer Tax Declaration Form 7551?

Yes, airSlate SignNow supports integrations with various applications to facilitate the handling of the Real Property Transfer Tax Declaration Form 7551. Whether you need to connect with CRM systems, cloud storage, or other tools, our platform allows seamless integration for enhanced productivity and workflow management.

-

How secure is the airSlate SignNow platform for the Real Property Transfer Tax Declaration Form 7551?

Security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption and authentication measures to ensure that all documents, including the Real Property Transfer Tax Declaration Form 7551, are securely managed. You can trust that your sensitive information is protected throughout the signing process.

Get more for Real Property Transfer Tax Declaration Form 7551

Find out other Real Property Transfer Tax Declaration Form 7551

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors