Maryland Met 1 Instructions 2019

What is the Maryland Met 1 Instructions

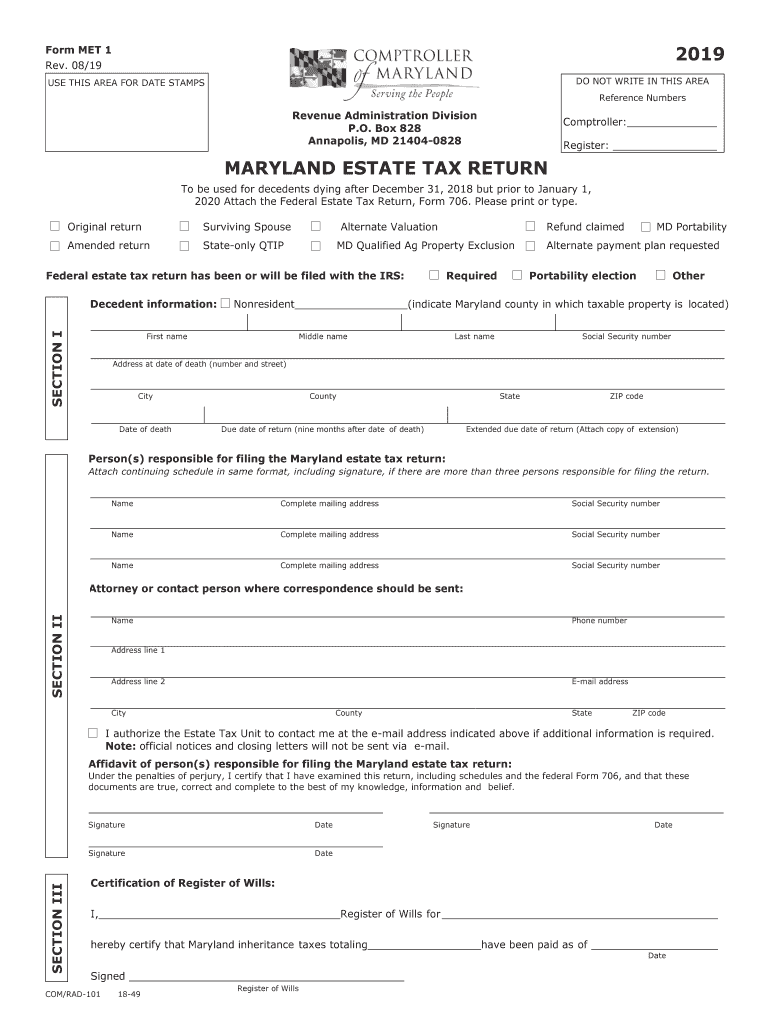

The Maryland Met 1 Instructions provide essential guidance for completing the Maryland estate tax return, specifically the Maryland Form MET-1. This form is necessary for reporting the estate tax due on the transfer of assets following a person's death. The instructions outline the requirements for filing, including the necessary information about the decedent's estate, assets, and liabilities. Understanding these instructions is crucial for ensuring compliance with state tax laws and avoiding potential penalties.

Steps to complete the Maryland Met 1 Instructions

Completing the Maryland Met 1 requires careful attention to detail. Here are the key steps involved:

- Gather all necessary documents, including the death certificate, asset valuations, and any relevant financial statements.

- Fill out the Maryland Form MET-1, ensuring that all sections are completed accurately.

- Calculate the total estate value and any applicable deductions, as outlined in the instructions.

- Review the form for accuracy and completeness before submission.

- Submit the completed form by the specified deadline, either electronically or by mail.

Legal use of the Maryland Met 1 Instructions

The Maryland Met 1 Instructions serve a legal purpose by providing the framework for filing estate tax returns in compliance with Maryland state law. Adhering to these instructions ensures that the estate is properly reported and that all tax obligations are met. Failure to follow the legal guidelines can result in penalties or disputes with the Maryland State Comptroller's office.

Required Documents

To successfully complete the Maryland Met 1, several documents are required:

- Death certificate of the decedent.

- List of all assets owned by the decedent at the time of death.

- Valuations for real estate, bank accounts, and other financial assets.

- Documentation of any debts or liabilities that may affect the estate's value.

Filing Deadlines / Important Dates

Timeliness is crucial when filing the Maryland Met 1. The estate tax return must be filed within nine months of the decedent's date of death. If the deadline is missed, penalties may apply. It is important to keep track of these dates to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

The Maryland Met 1 can be submitted through various methods:

- Online submission via the Maryland Comptroller's website, which allows for electronic filing.

- Mailing the completed form to the appropriate office, ensuring it is postmarked by the deadline.

- In-person submission at designated state offices, if preferred.

Quick guide on how to complete filing the estate tax return maryland taxes comptroller of

Complete Maryland Met 1 Instructions effortlessly on any device

Digital document management has surged in popularity among companies and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage Maryland Met 1 Instructions on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

How to modify and eSign Maryland Met 1 Instructions with ease

- Locate Maryland Met 1 Instructions and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Maryland Met 1 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing the estate tax return maryland taxes comptroller of

Create this form in 5 minutes!

How to create an eSignature for the filing the estate tax return maryland taxes comptroller of

How to make an eSignature for your Filing The Estate Tax Return Maryland Taxes Comptroller Of in the online mode

How to make an electronic signature for your Filing The Estate Tax Return Maryland Taxes Comptroller Of in Chrome

How to generate an eSignature for signing the Filing The Estate Tax Return Maryland Taxes Comptroller Of in Gmail

How to generate an eSignature for the Filing The Estate Tax Return Maryland Taxes Comptroller Of from your smart phone

How to make an electronic signature for the Filing The Estate Tax Return Maryland Taxes Comptroller Of on iOS

How to generate an electronic signature for the Filing The Estate Tax Return Maryland Taxes Comptroller Of on Android devices

People also ask

-

What is Maryland Met 1 and how does airSlate SignNow work with it?

Maryland Met 1 is a regulatory framework in Maryland that integrates technology with business practices. airSlate SignNow can help businesses comply with Maryland Met 1 by providing a secure and efficient way to send and eSign documents, ensuring all signatures are legally binding and compliant.

-

How much does airSlate SignNow cost for businesses in Maryland?

Pricing for airSlate SignNow varies based on the plan selected, making it a cost-effective solution for businesses in Maryland. Companies can choose from several tiers, tailored to different needs, ensuring you pay only for what you require. Contact sales for specific pricing related to your Maryland Met 1 compliance needs.

-

What features does airSlate SignNow offer to assist with Maryland Met 1 compliance?

airSlate SignNow offers features such as secure document storage, customizable templates, and automated workflows that are essential for compliance with Maryland Met 1. These features streamline the signing process while ensuring that all documents adhere to necessary regulatory standards.

-

Can airSlate SignNow integrate with other software I use in my Maryland business?

Yes, airSlate SignNow provides seamless integrations with a variety of business applications, enhancing your operational efficiency. This includes CRM systems, project management tools, and cloud storage services. These integrations help ensure that you maintain compliance with Maryland Met 1 while optimizing your workflows.

-

Is airSlate SignNow secure for handling sensitive information in Maryland?

Absolutely! airSlate SignNow employs industry-standard security measures, including data encryption and compliance with international security regulations. This ensures that sensitive information remains protected while meeting Maryland Met 1 compliance requirements.

-

How can airSlate SignNow benefit my Maryland business in the long term?

By using airSlate SignNow, your Maryland business can reduce paperwork, save time, and improve efficiency, leading to overall cost savings. Implementing an electronic signature solution not only enhances productivity but also aligns with Maryland Met 1 by facilitating easier document management and compliance adherence.

-

What support does airSlate SignNow provide for Maryland Met 1 users?

airSlate SignNow offers comprehensive customer support, including tutorials, live chat, and detailed documentation to assist Maryland Met 1 users. Our support team is dedicated to helping you effectively use the platform to meet compliance needs and maximize your subscription's value.

Get more for Maryland Met 1 Instructions

- Air conditioning contractor license texas form

- Registration of farm names application tngov tn form

- F212 051 000 supplemental quarterly report for the drywall industry if family members work for you know your obligations lni wa form

- F245 037 000 transfer of care card washington department of form

- Form 815 application for a real estate business entity license dsps wi

- State of wisconsin application for review petition for variance dsps wi form

- Sjc subdivision as built drawing requirements st johns county co st johns fl form

- City of centerville permanent sign permit application form

Find out other Maryland Met 1 Instructions

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF