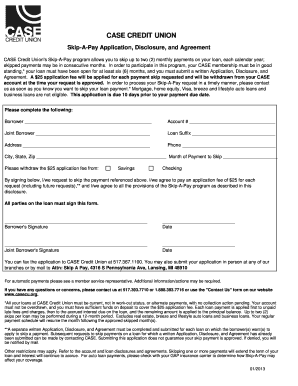

Case Credit Union Skip a Payment Form

What is the Case Credit Union Skip A Payment

The Case Credit Union skip a payment option allows members to temporarily defer a loan payment without incurring penalties. This program is designed to provide financial relief during unexpected circumstances, such as job loss or medical emergencies. Members can take advantage of this option once or twice a year, depending on the specific terms outlined by the credit union. It is essential to understand the implications of skipping a payment, including any potential impact on interest accrual and loan terms.

How to use the Case Credit Union Skip A Payment

Using the Case Credit Union skip a payment option involves a straightforward process. Members typically need to fill out a specific form, which can be accessed through the credit union's website or in person at a branch. After completing the form, members should submit it for approval. It is advisable to review the terms and conditions associated with the skip payment option before proceeding. Additionally, members should ensure they meet any eligibility criteria set forth by the credit union.

Steps to complete the Case Credit Union Skip A Payment

Completing the Case Credit Union skip a payment form requires several key steps:

- Access the skip a payment form through the Case Credit Union website or visit a local branch.

- Fill out the form with accurate information, including your loan details and personal information.

- Review the terms and conditions associated with skipping a payment.

- Submit the completed form either online or in person, depending on your preference.

- Await confirmation from the credit union regarding the approval of your request.

Legal use of the Case Credit Union Skip A Payment

The legal use of the Case Credit Union skip a payment form hinges on compliance with federal and state regulations governing loan agreements. The credit union must ensure that members are informed about the consequences of skipping a payment, including any changes to the loan's interest rate or repayment schedule. Additionally, the electronic submission of the form must adhere to the standards set by the ESIGN Act and UETA, ensuring that eSignatures are legally binding.

Eligibility Criteria

To qualify for the Case Credit Union skip a payment program, members must meet specific eligibility criteria. Typically, this includes being in good standing with the credit union, having a loan account that is not delinquent, and providing a valid reason for the request. Some credit unions may also require members to have made a certain number of consecutive payments before they can utilize the skip option. It is essential for members to check the specific requirements with their credit union.

Key elements of the Case Credit Union Skip A Payment

Several key elements define the Case Credit Union skip a payment option:

- Frequency: Members may be allowed to skip one or two payments per year.

- Eligibility: Must be in good standing and meet specific criteria.

- Impact: Understand how skipping a payment affects interest and loan terms.

- Submission: Complete and submit the designated form for approval.

Quick guide on how to complete case credit union skip a payment

Prepare Case Credit Union Skip A Payment effortlessly on any device

Web-based document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Case Credit Union Skip A Payment on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Case Credit Union Skip A Payment effortlessly

- Find Case Credit Union Skip A Payment and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, laborious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Case Credit Union Skip A Payment and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the case credit union skip a payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to case credit union skip a payment?

To case credit union skip a payment, you typically need to contact your loan officer or customer service at your credit union. They will guide you through the necessary steps and determine your eligibility for skipping a payment. Make sure to have your account details ready for a smooth process.

-

Are there any fees associated with case credit union skip a payment?

Fees for case credit union skip a payment can vary by institution. Some credit unions may allow you to skip a payment without any fee, while others might charge a small processing fee. It's essential to review your credit union’s specific policy before proceeding.

-

How does case credit union skip a payment affect my loan balance?

When you case credit union skip a payment, your loan balance typically remains the same, but interest may continue to accrue. This means that while you get short-term relief, the overall cost of your loan may increase slightly. Always ask your credit union for detailed information.

-

Can I case credit union skip a payment on multiple loans?

Most credit unions will allow you to case credit union skip a payment for multiple loans, but conditions may apply. You need to check with your specific credit union to understand their policy on skipping payments for various loans. They will inform you of your eligibility and any potential implications.

-

Does case credit union skip a payment impact my credit score?

Case credit union skip a payment typically does not directly affect your credit score if the payment is officially skipped with the credit union’s approval. However, if skipped payments are reported as delinquencies, it could harm your credit score. Always confirm with your institution about how they report skipped payments.

-

What are the benefits of case credit union skip a payment?

The main benefit of case credit union skip a payment is financial flexibility. It allows you to free up funds for emergency expenses without negatively impacting your loan standing. This can be a helpful option during unexpected financial hardships.

-

How can I integrate case credit union skip a payment with my financial planning?

You can integrate case credit union skip a payment into your financial planning by using the saved funds for essential expenses or to build an emergency fund. Ensure that you plan for future payments to avoid any defaults and maintain financial stability. Effective budgeting will help you manage post-skip payments smoothly.

Get more for Case Credit Union Skip A Payment

Find out other Case Credit Union Skip A Payment

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors