SATISFACTION of PREFERRED MORTAGE Jackson Marine Form

What is the SATISFACTION OF PREFERRED MORTAGE Jackson Marine

The SATISFACTION OF PREFERRED MORTAGE Jackson Marine is a legal document that signifies the fulfillment of obligations under a mortgage agreement. It serves as a formal acknowledgment that the borrower has met all terms and conditions, thereby releasing any claims the lender may have on the property. This document is crucial for homeowners as it clears their title, allowing them to sell or refinance their property without encumbrances related to the mortgage.

Steps to complete the SATISFACTION OF PREFERRED MORTAGE Jackson Marine

Completing the SATISFACTION OF PREFERRED MORTAGE Jackson Marine involves several important steps. First, ensure that all mortgage payments have been made in full and on time. Next, obtain the necessary forms from your lender or legal representative. Fill out the form accurately, including details such as the mortgage number, property address, and borrower information. Once completed, the document must be signed by the lender, which may require notarization. Finally, file the signed document with the appropriate county recorder's office to make it official.

Legal use of the SATISFACTION OF PREFERRED MORTAGE Jackson Marine

The legal use of the SATISFACTION OF PREFERRED MORTAGE Jackson Marine is essential for maintaining clear property titles. This document is recognized under U.S. law as a means to officially release a mortgage lien. To ensure its legal validity, it must be executed according to state-specific regulations, which may include notarization and proper filing with local authorities. Failure to properly execute and file this document can result in potential legal disputes regarding property ownership.

How to obtain the SATISFACTION OF PREFERRED MORTAGE Jackson Marine

To obtain the SATISFACTION OF PREFERRED MORTAGE Jackson Marine, start by contacting your mortgage lender. They can provide you with the necessary forms and guidance on the process. If the lender is no longer in business, you may need to consult with a legal professional to draft the document. It is important to gather all relevant information, including your mortgage account number and property details, to facilitate the process.

Key elements of the SATISFACTION OF PREFERRED MORTAGE Jackson Marine

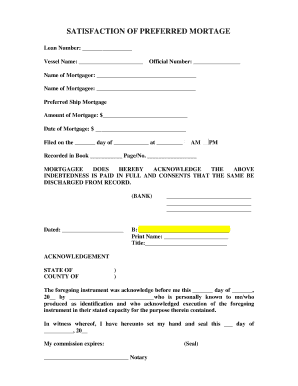

Key elements of the SATISFACTION OF PREFERRED MORTAGE Jackson Marine include the names of the borrower and lender, the mortgage account number, the property address, and the date of satisfaction. Additionally, the document should include a statement confirming that all obligations under the mortgage have been fulfilled. Proper signatures and, if required, notarization are also necessary to validate the document.

State-specific rules for the SATISFACTION OF PREFERRED MORTAGE Jackson Marine

State-specific rules for the SATISFACTION OF PREFERRED MORTAGE Jackson Marine can vary significantly. Each state may have different requirements regarding notarization, filing procedures, and timelines for submitting the document to the county recorder's office. It is essential to review your state's regulations to ensure compliance and avoid any delays in the process. Consulting with a local attorney or real estate professional can provide additional clarity on these requirements.

Quick guide on how to complete satisfaction of preferred mortage jackson marine

Effortlessly Prepare SATISFACTION OF PREFERRED MORTAGE Jackson Marine on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and electronically sign your documents promptly without any delays. Manage SATISFACTION OF PREFERRED MORTAGE Jackson Marine on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

The Easiest Way to Edit and Electronically Sign SATISFACTION OF PREFERRED MORTAGE Jackson Marine with Ease

- Obtain SATISFACTION OF PREFERRED MORTAGE Jackson Marine and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate the worries of lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements within a few clicks from any device you prefer. Edit and electronically sign SATISFACTION OF PREFERRED MORTAGE Jackson Marine to guarantee excellent communication throughout every phase of your form crafting process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the satisfaction of preferred mortage jackson marine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SATISFACTION OF PREFERRED MORTAGE Jackson Marine?

The SATISFACTION OF PREFERRED MORTAGE Jackson Marine refers to the assurance and contentment customers feel when engaging with quality mortgage services. This concept revolves around providing transparent terms, excellent customer service, and favorable loan conditions that align with the needs of borrowers.

-

How does airSlate SignNow enhance the SATISFACTION OF PREFERRED MORTAGE Jackson Marine?

airSlate SignNow streamlines the document signing process, signNowly contributing to the SATISFACTION OF PREFERRED MORTAGE Jackson Marine. With its easy-to-use interface, users can quickly sign and send documents, reducing the time and stress often associated with mortgage transactions.

-

What are the pricing options for utilizing airSlate SignNow services?

airSlate SignNow offers various pricing tiers to cater to different business needs, which can enhance the SATISFACTION OF PREFERRED MORTAGE Jackson Marine. These flexible plans provide cost-effective solutions, allowing customers to choose a package that best fits their budget for document management and eSigning.

-

What features does airSlate SignNow offer to support the SATISFACTION OF PREFERRED MORTAGE Jackson Marine?

Key features of airSlate SignNow that elevate the SATISFACTION OF PREFERRED MORTAGE Jackson Marine include secure document storage, customizable templates, and mobile accessibility. These functionalities ensure a seamless experience for businesses and clients alike in managing mortgage-related documents.

-

Can airSlate SignNow integrate with other mortgage management tools?

Yes, airSlate SignNow provides powerful integrations with various mortgage management tools, enhancing the SATISFACTION OF PREFERRED MORTAGE Jackson Marine. Integrating with existing platforms allows for a more cohesive workflow, enabling users to efficiently manage their mortgage processes in one place.

-

What benefits can customers expect from using airSlate SignNow in relation to their mortgages?

Customers can expect numerous benefits when using airSlate SignNow for their mortgages, notably improved efficiency, enhanced security, and greater flexibility. These advantages contribute to the overall SATISFACTION OF PREFERRED MORTAGE Jackson Marine, making the mortgage process smoother and more reliable.

-

How secure is the eSigning process with airSlate SignNow for mortgage documents?

The eSigning process with airSlate SignNow is highly secure, employing advanced encryption methods and authentication protocols that ensure the SATISFACTION OF PREFERRED MORTAGE Jackson Marine. This commitment to security allows customers to confidently sign and share sensitive mortgage documents without worries about data bsignNowes.

Get more for SATISFACTION OF PREFERRED MORTAGE Jackson Marine

- Ccpd form

- Over axle and over gross weight tolerance permit application txdmv form

- Behind the wheel instruction log 396693709 form

- Vehicle insurance certification form dts 005

- Va trip hauling permit form

- Customers fax this form to dmv for payment authorization

- Vsa 153 form

- Virginia hauling permits 2013 form

Find out other SATISFACTION OF PREFERRED MORTAGE Jackson Marine

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation