Pt 401 Instructions and Form

What is the Pt 401 Instructions And Form

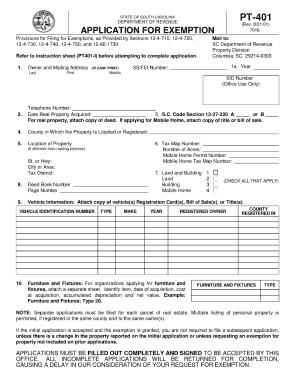

The Pt 401 Instructions and Form is a crucial document used primarily for tax purposes in the United States. It provides detailed guidelines on how to report specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. Understanding its purpose and requirements can help taxpayers accurately complete their filings and avoid potential penalties.

How to use the Pt 401 Instructions And Form

Using the Pt 401 Instructions and Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and expense records. Next, carefully read the instructions provided with the form to understand the information required. Fill out the form by entering your details in the designated sections, ensuring that all information is accurate and complete. Finally, review the form for any errors before submitting it to the IRS.

Steps to complete the Pt 401 Instructions And Form

Completing the Pt 401 Instructions and Form requires a systematic approach:

- Gather relevant financial documents, including W-2s, 1099s, and receipts.

- Read the instructions thoroughly to understand each section of the form.

- Fill out personal information, such as name, address, and taxpayer identification number.

- Report income and deductions accurately based on your financial records.

- Double-check all entries for accuracy to minimize the risk of errors.

- Sign and date the form before submission.

Legal use of the Pt 401 Instructions And Form

The legal use of the Pt 401 Instructions and Form is governed by IRS regulations. It is essential for taxpayers to complete the form accurately and submit it by the designated deadlines to avoid penalties. The form serves as a formal declaration of income and deductions, making it a legally binding document. Failure to comply with the requirements can result in audits, fines, or other legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Pt 401 Instructions and Form are critical for compliance. Typically, the form must be submitted by April 15 of the tax year, although extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as the IRS may adjust them based on specific situations, such as natural disasters or public health emergencies.

Required Documents

To complete the Pt 401 Instructions and Form accurately, several documents are required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Bank statements and investment income documentation.

- Prior year tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The Pt 401 Instructions and Form can be submitted through various methods. Taxpayers can file online using IRS-approved e-filing software, which often provides guidance throughout the process. Alternatively, the form can be mailed to the appropriate IRS address, ensuring it is postmarked by the filing deadline. In-person submission is generally not available, but taxpayers can visit IRS offices for assistance if needed.

Quick guide on how to complete pt 401 instructions and form

Finish Pt 401 Instructions And Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Pt 401 Instructions And Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Pt 401 Instructions And Form with ease

- Find Pt 401 Instructions And Form and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries exactly the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Alter and eSign Pt 401 Instructions And Form and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 401 instructions and form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Pt 401 Instructions And Form and how can they benefit my business?

Pt 401 Instructions And Form provide essential guidelines for submitting your tax information efficiently. By understanding these instructions, businesses can ensure accurate filings and avoid unnecessary penalties. Using airSlate SignNow, you can streamline the signing process of these documents, improving overall compliance and efficiency.

-

How can I access the Pt 401 Instructions And Form using airSlate SignNow?

You can easily access the Pt 401 Instructions And Form through airSlate SignNow by uploading your document and inviting signers via email. Our platform simplifies the process, allowing you to manage signatures and documents all in one place. This ensures that you are well-prepared when filling out the Pt 401 forms.

-

What features does airSlate SignNow offer for managing Pt 401 Instructions And Form?

AirSlate SignNow offers features such as customizable templates, a user-friendly interface, and real-time document tracking for managing Pt 401 Instructions And Form. These tools help you create, send, and sign documents seamlessly. Additionally, you can integrate with other software to further enhance your workflow.

-

Is airSlate SignNow a cost-effective solution for handling Pt 401 Instructions And Form?

Yes, airSlate SignNow is designed to offer a cost-effective solution for handling Pt 401 Instructions And Form. With various pricing plans available, you can choose one that fits your business needs. The platform helps save both time and money by streamlining the document signing process.

-

Can I integrate airSlate SignNow with other applications for my Pt 401 Instructions And Form?

Absolutely! AirSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce, making it easy to manage your Pt 401 Instructions And Form efficiently. Integrations allow you to pull documents directly from your preferred tools and streamline your workflow.

-

What are the benefits of using airSlate SignNow for Pt 401 Instructions And Form?

Using airSlate SignNow for Pt 401 Instructions And Form streamlines the signing process, improves accuracy, and enhances compliance. You'll experience faster turnaround times and reduced paperwork, leading to an overall boost in productivity. Our platform also provides security features to safeguard your sensitive information.

-

How secure is airSlate SignNow when handling Pt 401 Instructions And Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure data storage to protect your Pt 401 Instructions And Form. This ensures that sensitive information remains confidential, giving you peace of mind while managing your documents.

Get more for Pt 401 Instructions And Form

- Cleveland community collegestart your journey form

- Form dependent student

- Release waiver assumption of risk and hold harmless form

- Oncologic neuroradiology fellowship application form

- Cross registration request form

- Fa form 21 terms of agreement west hills college

- Reduced course load rcl request form medical condition

- Njcu verification form

Find out other Pt 401 Instructions And Form

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online