Form RP 7141311Complaint on Tentative Special Franchise Full Tax Ny

What is the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny

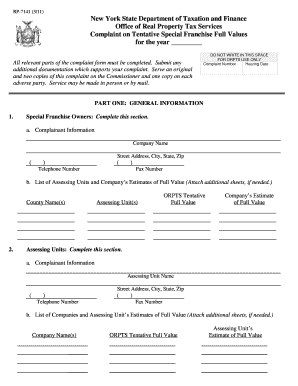

The Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny is a legal document used by taxpayers in New York to contest the tentative assessment of special franchise taxes. This form is particularly relevant for businesses that operate in New York and are subject to special franchise tax regulations. The form allows taxpayers to formally dispute the assessed value of their franchise, which can impact their tax liabilities. Understanding the purpose and implications of this form is essential for ensuring compliance with state tax laws.

How to use the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny

Using the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny involves several key steps. First, taxpayers must gather all relevant documentation that supports their claim against the tentative assessment. This may include financial statements, property valuations, and previous tax returns. Once the necessary information is compiled, the form must be completed accurately, providing detailed explanations for the dispute. After filling out the form, it should be submitted to the appropriate tax authority within the specified timeframe to ensure that the complaint is considered.

Steps to complete the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny

Completing the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny requires careful attention to detail. Here are the steps to follow:

- Review the instructions provided with the form to understand the requirements.

- Fill in your personal and business information, ensuring accuracy.

- Provide a detailed explanation of why you are contesting the assessment, including any supporting evidence.

- Sign and date the form to validate your submission.

- Submit the completed form to the appropriate tax authority by mail or electronically, as permitted.

Legal use of the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny

The legal use of the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny is governed by New York state tax laws. This form serves as a formal mechanism for taxpayers to challenge the state's assessment of their special franchise taxes. It is essential that the form is completed and submitted in accordance with the legal guidelines to ensure that the complaint is valid and can be reviewed by the tax authority. Failure to adhere to these legal requirements may result in the dismissal of the complaint.

Filing Deadlines / Important Dates

Filing deadlines for the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny are critical to ensure that your complaint is considered. Typically, the form must be filed within a specified period following the issuance of the tentative assessment. It is important to check the exact deadlines each year, as they may vary. Missing the deadline can result in the inability to contest the assessment, leading to potential financial repercussions.

Required Documents

When filing the Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny, certain documents are required to support your claim. These may include:

- Copies of the tentative assessment notice.

- Financial statements demonstrating your business's valuation.

- Any prior tax returns that may be relevant to your dispute.

- Documentation of any changes in business operations that may affect the assessment.

Form Submission Methods (Online / Mail / In-Person)

The Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny can typically be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Options may include:

- Online submission through the state tax authority's official website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form rp 7141311complaint on tentative special franchise full tax ny

Complete Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny with ease on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to draft, modify, and eSign your documents swiftly without any delays. Manage Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny effortlessly

- Find Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny and click Get Form to initiate.

- Make use of the tools we supply to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to preserve your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Alter and eSign Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rp 7141311complaint on tentative special franchise full tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny?

Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny is a specific document used for filing complaints regarding special franchise taxes. This form is essential for taxpayers who wish to contest assessments or other issues related to their special franchise tax obligations in New York. Understanding this form can help businesses ensure compliance and potentially reduce their tax liabilities.

-

How can airSlate SignNow help with Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny?

airSlate SignNow simplifies the process of preparing and eSigning Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny. Our platform offers an intuitive interface that allows users to complete the form accurately and efficiently while ensuring that all signatures are securely captured. This not only speeds up the process but also ensures compliance with New York State requirements.

-

What are the pricing options for using airSlate SignNow to manage Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny?

airSlate SignNow offers competitive pricing plans that cater to different business needs, allowing you to eSign and manage forms like Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny cost-effectively. Each plan includes essential features to streamline your document workflows and ensure compliance. You can choose a plan based on the number of users and document needs.

-

Are there any integrations available for managing Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny?

Yes, airSlate SignNow integrates with a variety of popular applications to enhance your workflow when dealing with Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny. Whether you're using document management systems or accounting software, our integrations make it easy to streamline your processes and ensure that your forms are managed efficiently.

-

What features does airSlate SignNow provide for Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny?

airSlate SignNow offers features such as customizable templates, in-person signing, and real-time notifications specifically designed for forms like Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny. Our platform ensures that the entire signing process is secure and compliant, making it easier for businesses to manage their tax-related documents effectively.

-

How secure is the data when using airSlate SignNow for Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny. We utilize advanced encryption and security protocols to protect your data, ensuring that your forms remain confidential and secure throughout the signing process.

-

Can airSlate SignNow accommodate multiple users for filing Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny?

Absolutely! airSlate SignNow allows multiple users to collaborate on filing Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny, making it easier for teams to work together on tax-related documents. You can easily manage access and permissions, ensuring that the right team members can contribute to the process efficiently.

Get more for Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny

- This confidential financial certification form must be completed and submitted along with supporting financial documents before

- Page 1 v5 verification worksheet 20162017 your 2016 2017 free application for federal student aid fafsa was selected for review form

- San juan college center for workforce development application for admission san juan college center for workforce development form

- Spokane community college radiologic technology application packet spokane community college radiologic technology application form

- Mclennan community colleges admissions amp registration checklist application and menigitis vaccination information mclennan

- Federal regulations require enterprise state community college to determine whether a student is maintaining satisfactory form

- The state of delaware maintains strict confidentiality and security of employee records in compliance with federal and state form

- Clark university health services graduate immunization record name date of birth student id cell phone email department form

Find out other Form RP 7141311Complaint On Tentative Special Franchise Full Tax Ny

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter