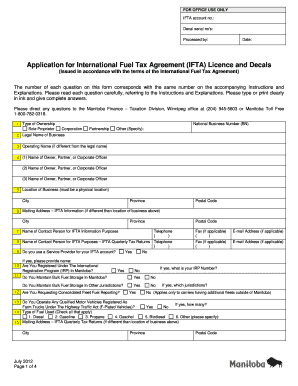

Ifta Manitoba Form

What is the Ifta Manitoba

The IFTA Manitoba refers to the International Fuel Tax Agreement for the province of Manitoba. This agreement simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. It allows carriers to file a single fuel tax return instead of separate returns for each jurisdiction, streamlining the process for businesses that operate across state lines. The IFTA is crucial for ensuring that fuel taxes are distributed fairly among the states and provinces involved.

How to use the Ifta Manitoba

Using the IFTA Manitoba involves several key steps. First, businesses must register for an IFTA account with the Manitoba government. Once registered, carriers can track their fuel purchases and mileage in each jurisdiction. At the end of each reporting period, typically quarterly, they must complete the IFTA return, detailing fuel consumption and mileage. This return is then submitted along with any owed taxes. Accurate record-keeping is essential to ensure compliance and avoid penalties.

Steps to complete the Ifta Manitoba

Completing the IFTA Manitoba form requires careful attention to detail. Here are the steps involved:

- Gather all necessary documentation, including fuel purchase receipts and mileage logs.

- Calculate total fuel usage and miles traveled in each jurisdiction.

- Complete the IFTA return form, ensuring all information is accurate.

- Submit the completed form by the deadline, along with any applicable taxes.

Maintaining organized records throughout the reporting period can simplify this process significantly.

Legal use of the Ifta Manitoba

The legal use of the IFTA Manitoba is governed by various regulations that ensure compliance with tax laws. Carriers must adhere to the guidelines set forth by the Manitoba government and the IFTA agreement. This includes accurate reporting of fuel consumption and mileage, as well as timely submissions of returns. Failure to comply with these regulations can result in penalties, including fines and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA Manitoba are critical for compliance. Typically, returns are due quarterly, with specific dates set by the Manitoba government. It is essential for carriers to be aware of these deadlines to avoid late fees. Keeping a calendar of important dates can help ensure timely submissions and maintain good standing with tax authorities.

Required Documents

To complete the IFTA Manitoba form, several documents are required. These include:

- Fuel purchase receipts from all jurisdictions.

- Mileage logs that detail the distance traveled in each jurisdiction.

- The completed IFTA return form.

Having these documents organized and readily available can streamline the filing process and ensure accuracy.

Quick guide on how to complete ifta manitoba

Complete Ifta Manitoba effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents quickly without any hindrances. Handle Ifta Manitoba on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and eSign Ifta Manitoba with ease

- Obtain Ifta Manitoba and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Verify all your information and click on the Done button to save your modifications.

- Select your delivery method for the form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ifta Manitoba while ensuring clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta manitoba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IFTA Manitoba filing process?

The IFTA Manitoba filing process involves collecting and reporting your fuel usage and miles driven in different jurisdictions. With airSlate SignNow, you can easily prepare and eSign your IFTA returns online, simplifying compliance. Our platform helps ensure that your documents are accurate and submitted on time, making the entire process more efficient.

-

How can airSlate SignNow help me manage IFTA in Manitoba?

airSlate SignNow offers a user-friendly interface to create, sign, and manage your IFTA documents. By using our platform, you can automate your filing, track submissions, and maintain organized records. This streamlined approach ensures that your IFTA Manitoba submissions are handled smoothly and accurately.

-

What features does airSlate SignNow provide for IFTA Manitoba filings?

airSlate SignNow provides several features specifically for IFTA Manitoba filings, including document templates, eSignature capabilities, and integration with accounting software. These tools are designed to help you save time and reduce errors in your reporting. Additionally, our platform offers easy collaboration options with your team or accountants.

-

What are the pricing options for using airSlate SignNow for IFTA Manitoba?

airSlate SignNow offers flexible pricing plans to suit different business needs when managing IFTA Manitoba. Pricing is based on features and the number of users, ensuring that you only pay for what you need. You can start with a free trial to explore the capabilities before committing to a plan.

-

Is airSlate SignNow compliant with IFTA Manitoba regulations?

Yes, airSlate SignNow is compliant with IFTA Manitoba regulations and adheres to the requirements for electronic document submissions. Our platform is designed to help businesses maintain compliance and streamline their filing processes. By using airSlate SignNow, you can confidently submit accurate and timely IFTA reports.

-

Can I integrate airSlate SignNow with my existing accounting software for IFTA Manitoba?

Absolutely! airSlate SignNow can integrate with various accounting software solutions to facilitate the seamless transfer of data for IFTA Manitoba filings. This integration helps reduce manual entry errors and improves efficiency in managing your documents. You can easily sync your data to ensure accurate IFTA reporting.

-

What are the benefits of using airSlate SignNow for IFTA Manitoba?

Using airSlate SignNow for IFTA Manitoba offers signNow benefits, including enhanced accuracy, time savings, and streamlined collaboration. The platform simplifies the creation and management of documents, reducing the hassle of traditional paperwork. Additionally, you can track your filing progress and receive notifications, ensuring you never miss a deadline.

Get more for Ifta Manitoba

Find out other Ifta Manitoba

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile